Dear Clients,

Hope each of you is doing well and enjoying your summer. As the S&P and QQQ have done very well in 1H24, the markets are very bifurcated, as the DIA is up just 3.5%, and many areas such as small and mid-cap are very challenged this year. An analyst (Sam Stovall) that I follow on a regular basis, noted that since WWII, all election years with positive Januarys were higher for the full year and gained 15.6% on average. The S&P has recorded 23 new highs, and in the 10 other years that recorded the most new S&P highs since WWII, the S&P has been up an average of 20.4%.

There are so many reasons that people can be bearish right now. The markets are at very high valuations as a whole (by the way believe it or not, valuations are a poor indicator for short-term movement), with P/Es now at over 21 for 2024 estimates (33% premium to average S&P forward PE over last 20 years). There is over $6 trillion in cash/cash like investments according to CNBC, so many have felt a better place to be than stocks right now. Inflation, has remained “sticky,” as many indicators have given mixed signals in 2024, with shelter has remained especially stubborn. And to top it off, many worry about both our election coming up in November, and the fact that 49% of the world is getting re-elected in the next year. With all these headwinds, it can test an investor’s mettle to stay in these markets. But these past two years, are again a notable example of why “timing the markets” is a game I rarely see done successfully. The reason, is the markets are always looking forward and the market narrative can have many variables.

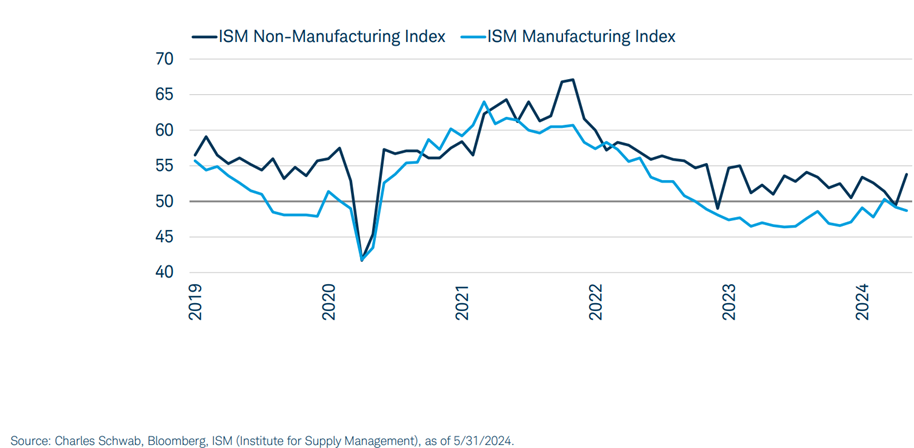

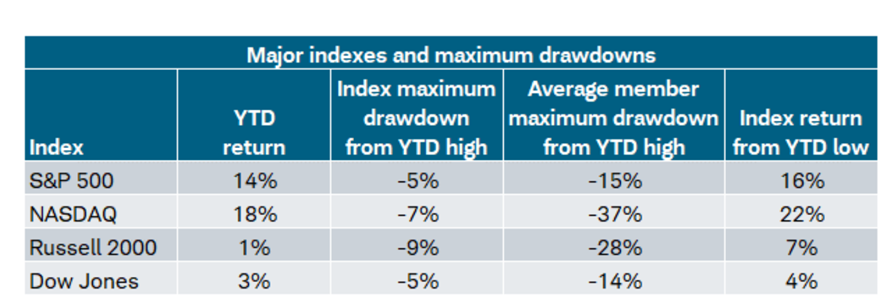

With that said, the S&P was up 4% in 2Q24, while the average stock was down 3%. This is because 90% of all the S&P returns have been from the top 10 stocks in 2024 and the markets are incredibly bifurcated. Additionally, according to CNBC, over ½ the analysts now have a YE projection that is below the current S&P average thru June. But again, while the markets seem to have gotten ahead of themselves in many ways, selling everything is often a regretful move, as past declines since WWII of 5-9.9% have fully recovered in 1.5 months, while corrections of 10-19.9% only took 4 months for full recovery, according to CFRA. As noted above, markets are always looking forward and this is something that seems to often be missed by analysts. Do you remember in early 2023, when 64% of all economists said we were going into a recession? I can’t tell you how many times I heard people say, “why wouldn’t someone, just stick their money in cash until all these issues blow over?” That would have cost my clients a lot of money, as 2023/24 have both been very strong years for my clients. Again, the moniker “don’t fight the Fed,” is driving the markets as we speak, in my opinion. That doesn’t mean the markets aren’t due for a breather, but getting in and out of the markets as a whole is a game “to hard to play”. There are also many reasons to stay the course in these markets, especially in certain parts of the markets. Services, has again reaccelerated… As you can depict from the graph below, the service sector has reaccelerated, as travel/cruises/eating out, have been where a good amount of $s is being spent.

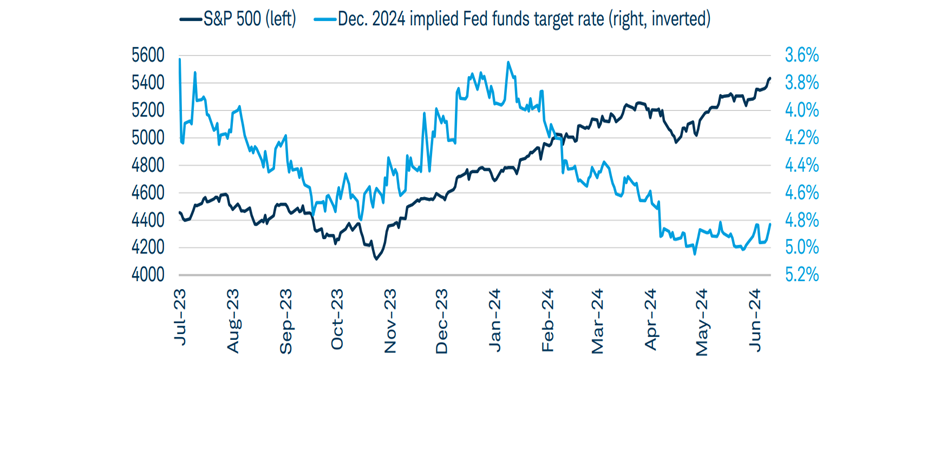

The Fed is less of a driver of stocks in 2024, as rates have gone up this year, but stocks have continued to increase in overall value, as projected Fed cuts keep investors optimistic. While these cuts haven’t happened yet, I have seen enough to make me feel the first rate cut is likely to come in September.

Source: Bloomberg

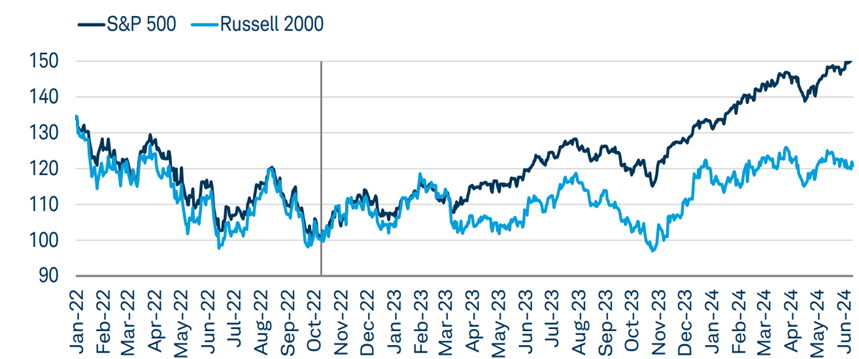

Everything went down in 2022, but since early 2023 large cap has destroyed small cap performance. As you can see from the chart below, small caps have gone nowhere for 18 months. Analysts/Experts, have been predicting a small cap rally for two years, but until I actually see rates come down more significantly, I just don’t want to step in front of this train. Strong balance sheets, just matter too much right now in my opinion, as there are many areas of weakness like commercial real estate, consumer discretionary, and many retail areas.

Source: Bloomberg

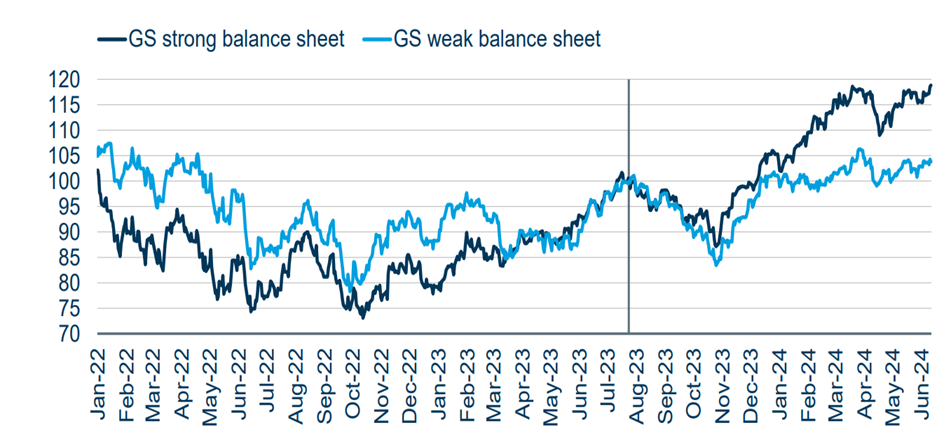

Financial strength has become much more important as we have moved through the year in 2024, as strong balance sheets have been rewarded, as the economy has begun to show some weakness. In fact, strong balance sheets have been a key reason (besides earnings) why I also like the big banks, energy, and certain healthcare.

Source: Goldman Sachs

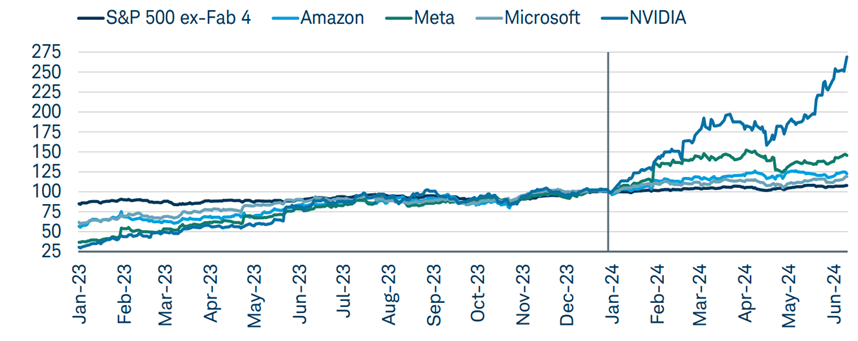

This year it seems like growth along with great balance sheets have driven the “big boys,” as the Magnificent 7 of 2023 became the Fabulous 4 of 2024.

Source: CNBC

As I wrote above, I feel like there has been a rolling recession through many sectors, as depicted below for the average stock.

Source: Bloomberg/Schwab

Just think about what has happened to companies who haven’t done well the past quarter or two. Industrials have suffered. Companies like Starbucks, Walgreens, Dollar General, and Nike, have been the latest stocks to get pummeled for coming up short. I feel like the low-end consumer has suffered, as well as any brand that is not showing real value. I am seeing many customers looking for brand, value, and ease of acquisition, and refusing to settle for anything less. This is much different than past few years.

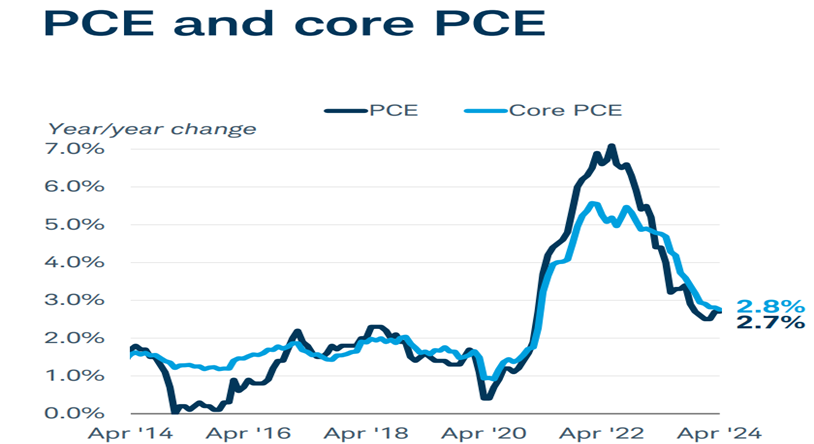

Another interesting trend as of late, is yields are coming down at a decent rate while looking past the Fed, but this last mile has proven to be very sticky. This is mainly because shelter has been slow to come down, though the report we just received last week, looks very promising.

It finally seems like inflation is easing, as the last two readings have headed back in the right direction. This is why I think the Fed will ease at least once if not twice, before year end.

Source: CNBC

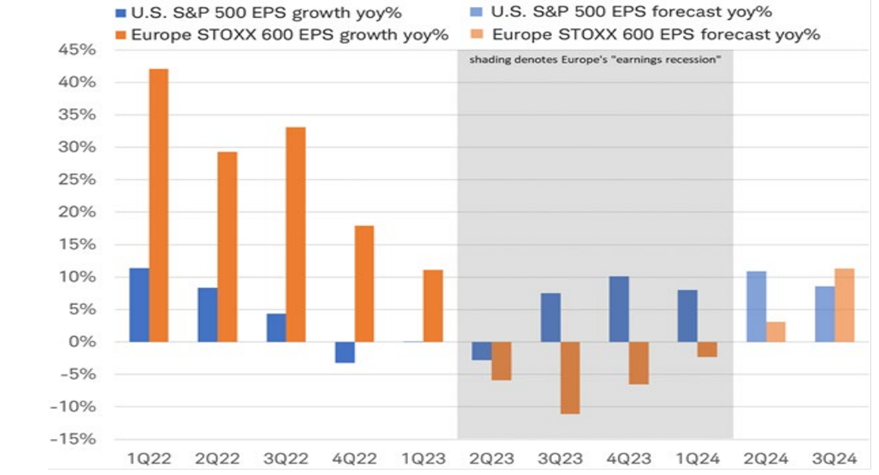

Earnings growth in the U.S. versus the rest of the world has been very strong the past year, though the top 10 stocks in the S&P, have provided all of the growth, according to CNBC.

Source: Fox News

In fact, large cap earnings were incredible in 1Q24, and in my opinion made the technology move in 1H24 totally justifiable and a reason to be very optimistic about tech going forward.

I have shown you in the past, charts that depict where the return differences of the S&P are neglible for Republican or Democrat presidents. It is that time again, where I need to remind so many, that even if the election is incredibly polarizing, the Fed or economy is often more important than who is President. The next chart depicts how the markets don’t have a lot of variation even with majority across congress, which we currently don’t have.

I think it is much more important to stay with your long term strategy for retirement planning, investing, tax planning and risk planning, versus trying to time the markets. Remember, the entire market returns typically come in 5 full days of the year.

So, you will continue to see me do several things to protect clients where possible. This might include covered calls, especially on stocks that have run considerably. This may include buffered ETFs, which give you total downside protection, but also cap your gains. This may be through enhanced income funds, which use a lot of strategies to get enhanced income. This will include individual corporate bonds, that are guaranteed a 7.5-8% YTM with 1-6 year maturities, as long as the company stays solvent. There are so many more ways to protect clients, hedge bets, and stay in the game with rates so much higher than we saw for 13 years. I do think at these current valuations, now is not the time to be too aggressive, but as I have discussed with many of you, there are many trends that have occurred that make a down year very unlikely. So, get ready for more volatility, as geopolitics and our own politics are bound to cause issues in the coming months, but just know volatility is part of the game after these kinds of runs.

Financial/Legislative Thoughts

While I always write that the Presidential party in office typically doesn’t make a big difference in market returns, this election is different in that it does have some other tax/estate ramifications that will be significant. Here are some things to think of in the coming years that this election will have an effect on:

- Will congress remain split (which is often a good thing)? Currently, 51-49 margin for Senate Democrats (includes 4 independents); 218-213 for the Republicans in the House.

- Major Funding Bill: Congress expected to pass short-term extension of government funding from Oct. 1 until after the election. This is critical.

- 2017 tax cuts are set to expire at the end of 2025. This will include the estate exemption being cut in half, tax rates going up, and some exemptions going away. The tax rate cuts will likely be kept if a Republican is elected and expire if a Democrat elected.

- Both parties expected to include tax issues beyond just those expiring provisions.

- No clarity on how this will play out until after the election.

- Whomever is elected, will likely decide who will have supreme court judge majority, by end of term.

I hope each of you has a wonderful 4th and we all remember to thank those who fought for our freedom. Have a good week.

Best Regards,

Hunter Hardy

Sorry, comments are closed for this post.