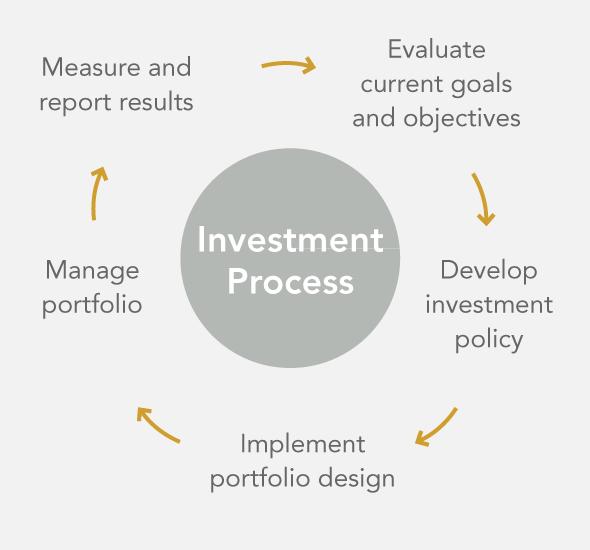

Investment Process

Goal: Construct portfolio to provide return objectives while minimizing risks

We work to provide our clients with these key benefits:

- Reduce the amount of time to manage assets

- Select investments most likely to help achieve your institution’s objectives

- Accommodate risk tolerance level and any unique constraints

- Control investment expenses

- Effectively manage tax liability if applicable

- Stay abreast of new investment developments and products

- Update your investment strategy as appropriate

- Reduce unnecessary investment risks

InvestmentHunter Wealth Services will provide money management for a client after a thorough review of a client’s goals, risk profile, and financial understanding. Our philosophy is primary that of a long- term, buy and hold strategy in a balanced well-diversified portfolio.

- Provide wealth preservation, wealth growth, wealth stewardship, and wealth administration

- There are many benefits for using an independent investment advisor

- Manage asset classes which include stocks, bonds, REITs, MLPs, precious metals, and mutual funds

- Provide advice based on estate and tax information

- Comprehensive Approach

- Fees based on assets under management (AUM), so clients never have to worry about hidden costs