Dear Clients,

Hard to believe we are closing out of 2021 and moving into 2022. Many things have changed in the markets and a lot of them will change business forever in my opinion. First, I don’t think business travel will likely ever get back to where it was before the pandemic. I also feel like “working from home”, will be at least partially implemented at most firms, as we have all learned how to use technology better when communicating with others. I also believe delivery of goods, is something that will continue to expand as so many of us continue to look for ways to save time.

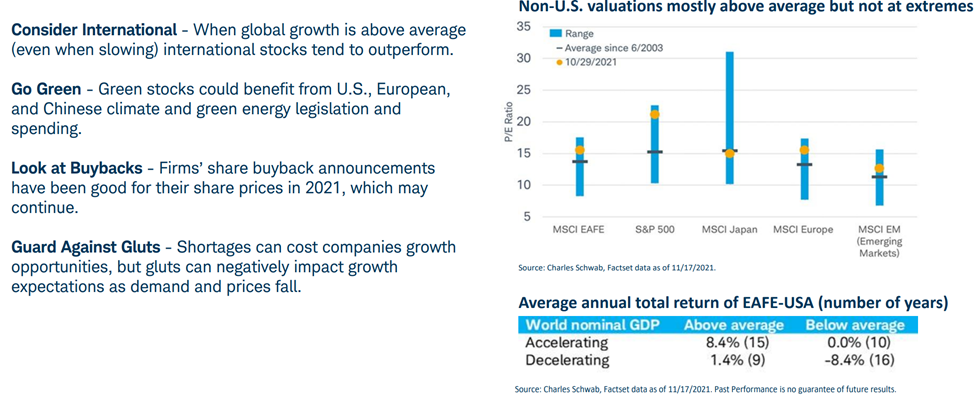

There have been many changes the past couple of years and I will continue to watch trends closely, as we move into more normalcy in 2022. I think the coming years will definitely be more challenging than the past few years of excellent returns, especially as rates normalize. I think the first half of the year will be especially tough and think we will have a correction at some point in the first half. I think the stock markets will end up over the course of the entire year as we get more clarity, but I think it will be a single-digit gain in the overall markets. But while I think 2022 will be more challenging than the past three years, there are always ways to make money and I don’t think this year will be any different. I think picking investments that have pricing power and can do well in an inflationary environment will be critical to success. I believe more international and alternative investments will make sense in 2022.

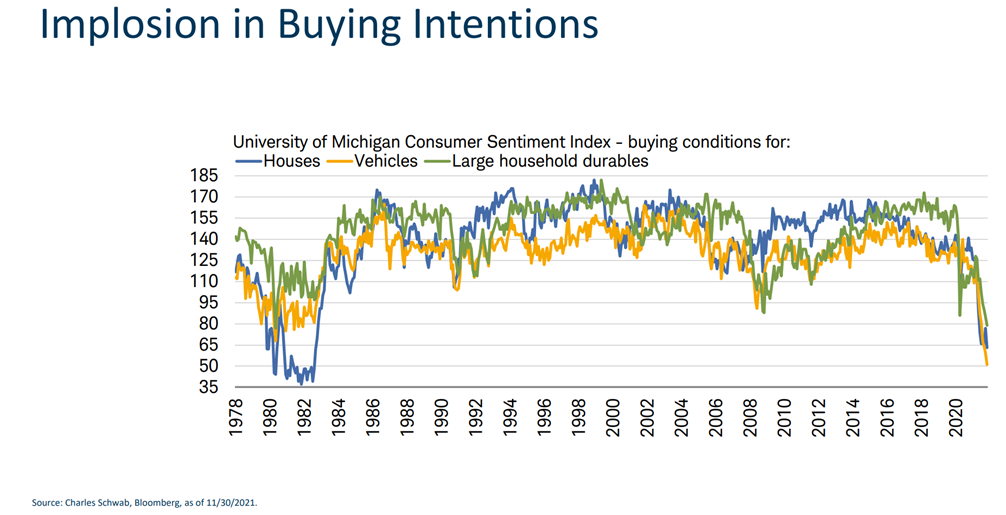

So, let’s talk about some of the latest trends and potential expectations for the coming year. First, we have the highest savings in multiple decades, as people have not spent with all the economic uncertainty over the past couple of years, especially for larger purchases.

I think spending will bounce back vigorously, though Covid will likely continue to temper results. But I do think you will see spending pick up significantly as we move into the Spring.

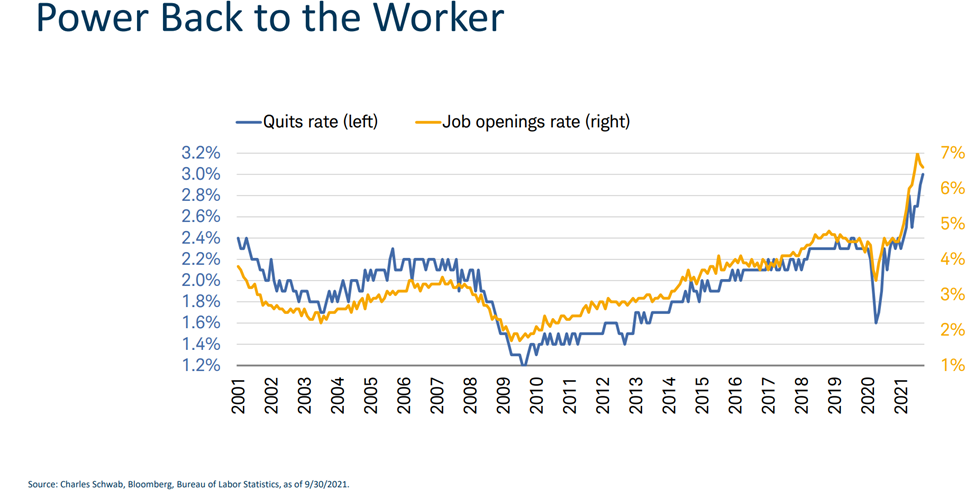

I haven’t seen labor with this much power in decades. According to Department of Labor, there are now more job openings then there are people to fill them. Some of the labor shortage is because 2.4 million people retired early because of covid, according to CNBC. I think this will lead to additional labor inflation and continue to give leverage to the worker, for at least the next couple of years.

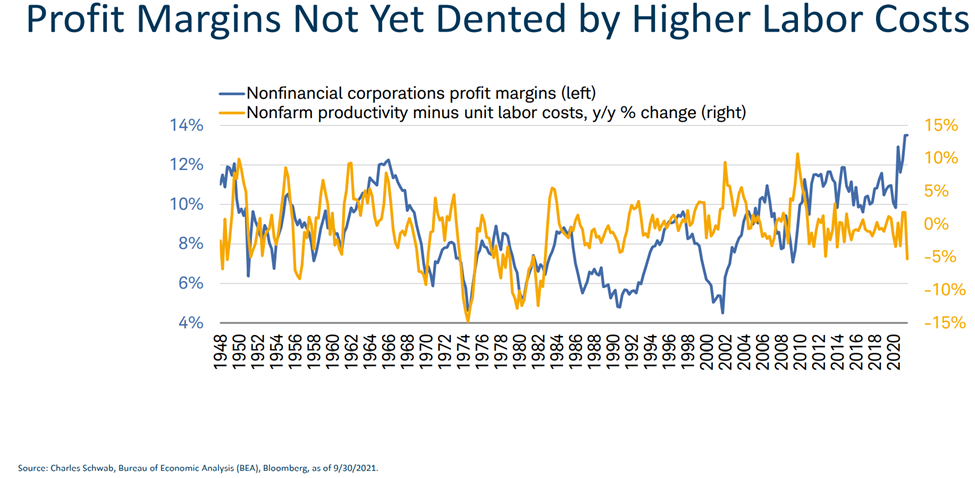

While labor costs have risen significantly, overall profit margins have continued to be very strong. So many companies have come out of the pandemic as strong as ever and are passing the increased costs on to end users. Companies with this pricing power, is where one should hide in 2022. Financials and semi-conductors are examples of pricing power.

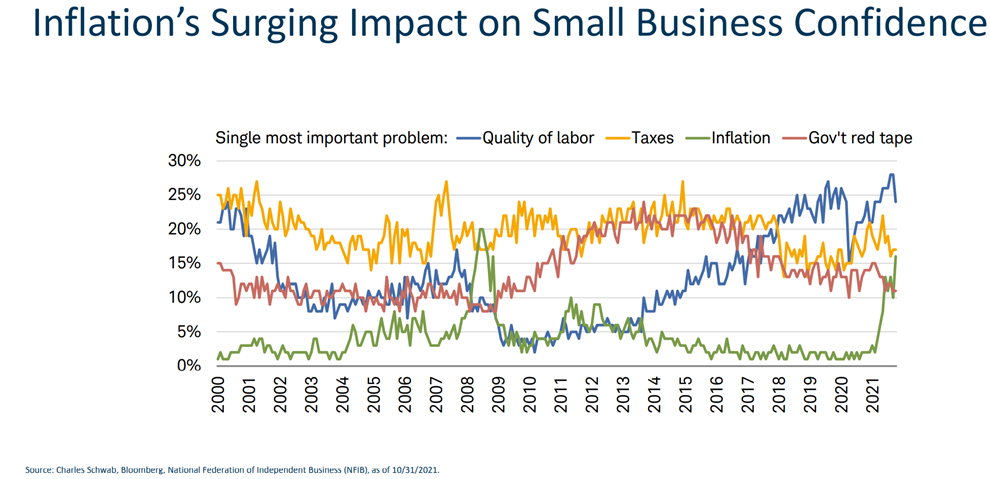

While many companies have shown they have strong pricing power, that has not been the case in smaller companies in general, especially in the service industry. As depicted in the chart below, labor and inflation are becoming the biggest concerns for many smaller businesses, and I don’t see that changing at all in 2022.

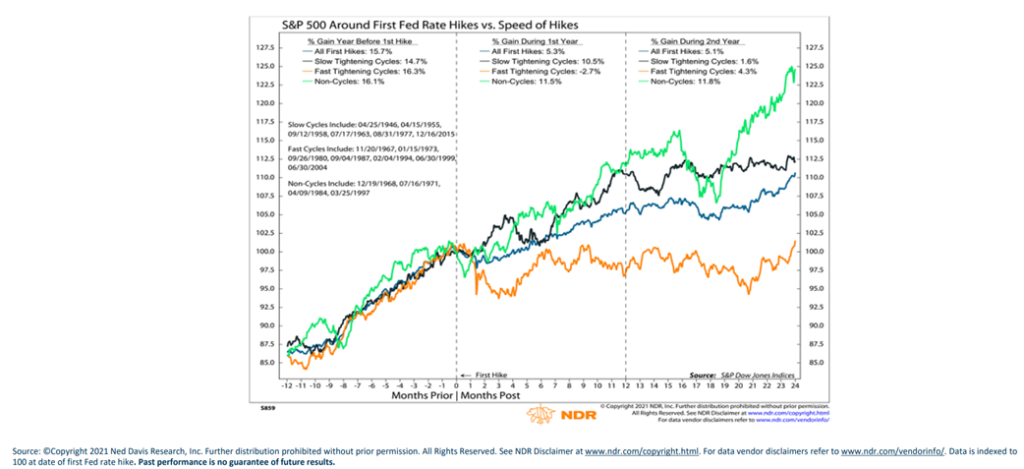

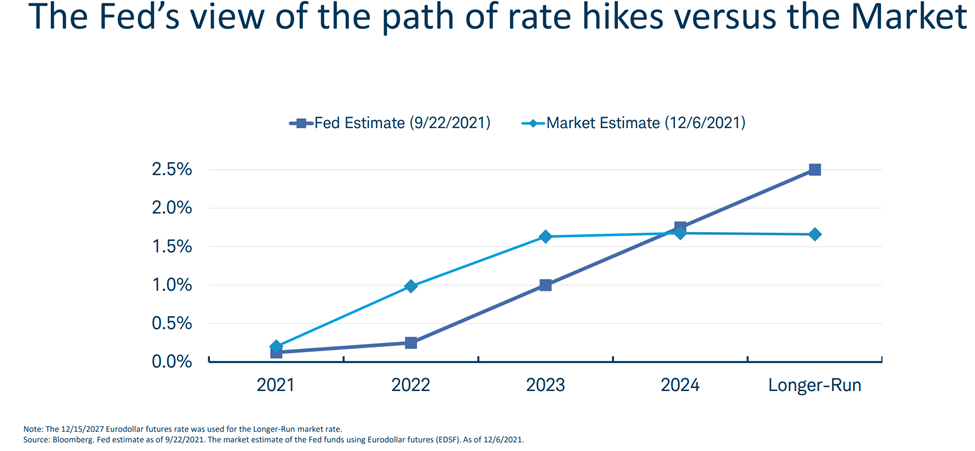

I often get asked “since we have significant inflation and the Fed is going to start raising rates, isn’t that bad for stocks?” I always reply, “it depends how quickly the Fed has to move.” I do think after the significant runs the past few years, we will see many markets that are challenged in 1H22. The markets know the Fed is coming, markets are very fully priced, and inflation is going to continue to be navigated. The Fed has to stay on top of inflation without moving too quickly. The markets will watch this very closely and this will likely cause more volatility in 2022. This will definitely cause me to make some changes as we enter 2022.

While I think we will have stubborn inflation in labor and energy prices, I think many inflation areas have already peaked, as I am already seeing some relief due to the supply chain becoming healthier. I also feel like the amount of baby boomers that chose early retirement, coupled with the benefits of technology, will help resolve inflation in many areas of the market over time. I do think by the end of 2022 the inflationary rate will have subsided to around the 2.5% level, but that is a way down the road.

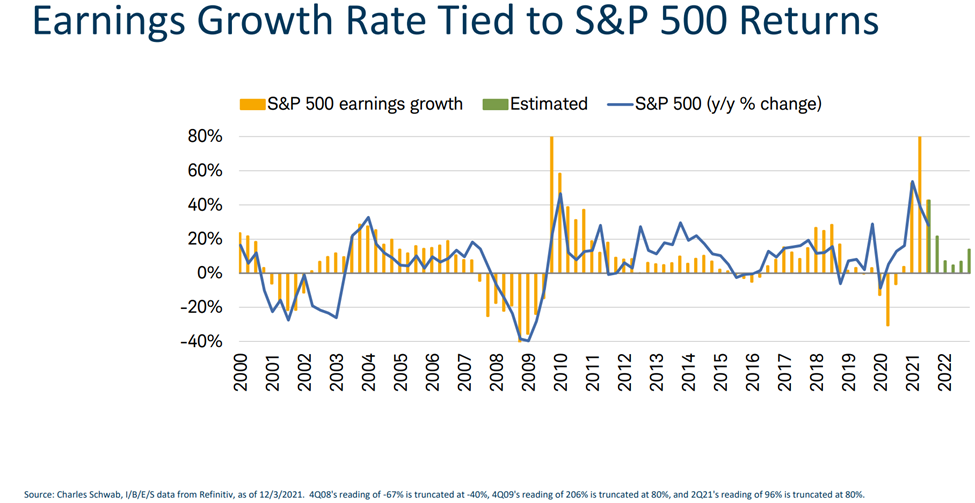

One reason why I feel like we will have a strong second half of the year and end the year in the black, is earnings continue to look very strong. I think we will have S&P earnings of about $250/share and if the multiple decreases due to rates rising a little, I think a 20 P/E multiple will be in order. That would get us to around 5,000 for the year, which is about a 5% increase from here.

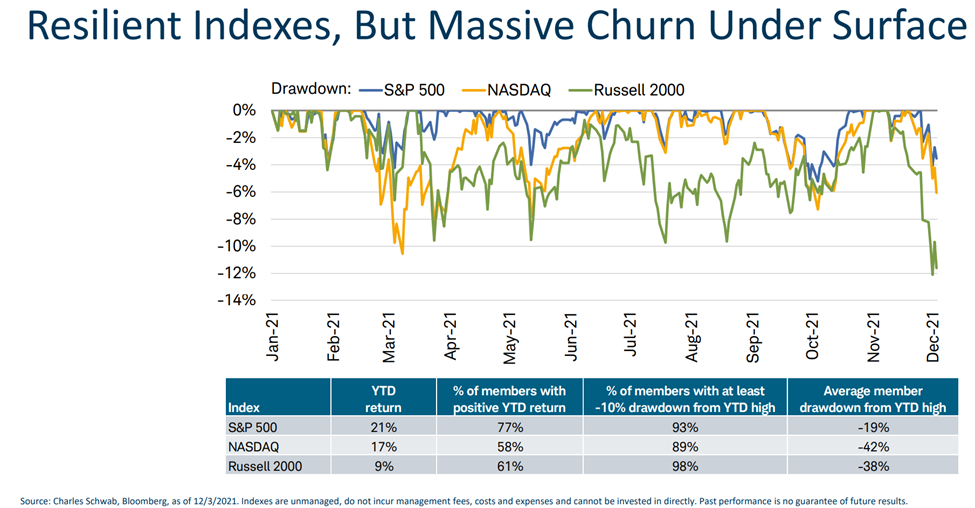

One trend I have seen this year, has been the “unique churn” going on below the actual indexes. For one, companies that are trading off a multiple of price, have for the most part gotten hammered (yes, that’s a technical stock term…) this year. I believe this will continue in 2022, as I think earnings power will become even more important as we move through the year. Especially, after we get through January, which is typically a very good month for smaller, uber-growth type of companies. But as depicted below much of the Russell 2000 companies (smaller companies) and the Nasdaq (predominately technology), have had some serious corrections in 2021. So while we have had a very good year on the whole (if you have been invested the entire year), much of that is because much of the fortress technology companies (AAPL, MSFT, GOOGL, NVDA, AMD), energy, and financials have done very well. But under the surface has been a very different issue for many investors.

My strategy is to look for sectors/asset classes to invest in, that do well when yields rise. I continue to think that will be in financials and many commodity type of investments like energy and metals/mining in 2022. I also believe, the same fortress balance sheet technology will do well, and I really like areas such as semi-conductors (even after incredible returns in 2022) that have much more demand than available supply. Actively managing technology will be very important, as rising rates can have significant short-term effects on technology.

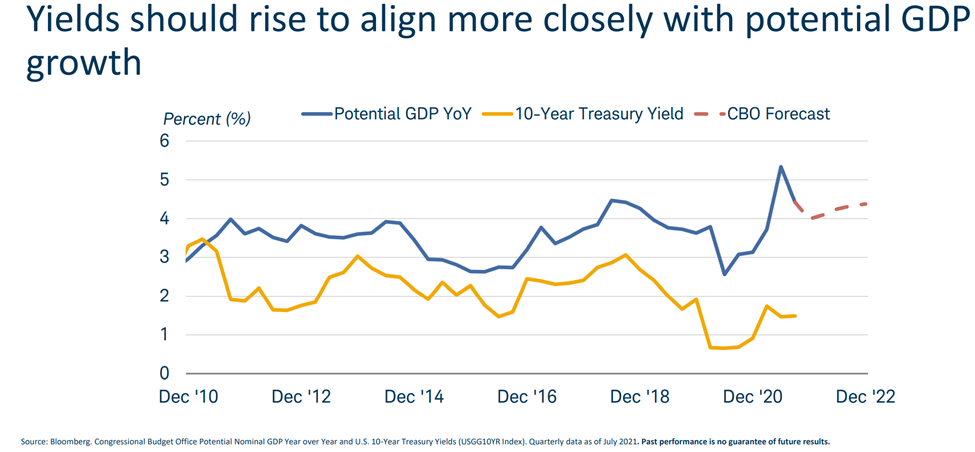

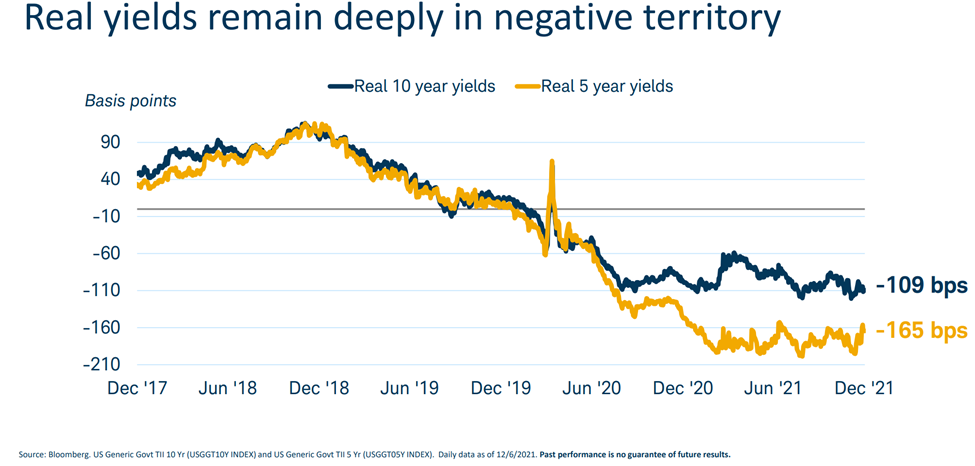

Another dynamic that will make cash and fixed income investments extremely challenging, is one has to get higher yield than is typically currently available, just to stay up with inflation. While I believe real yields will improve some in 2022, I think they will stay negative for the entire year. This will make things especially challenging for retirees, especially those who get too conservative, as fixed income will again be a difficult place to make money in 2022.

While the markets continue to believe the Fed will have to raise rates faster than forecasted, I believe the Fed will be able to move a little slower than expected, as Covid, normalizing supply chain, and technology, will likely keep rates from running away.

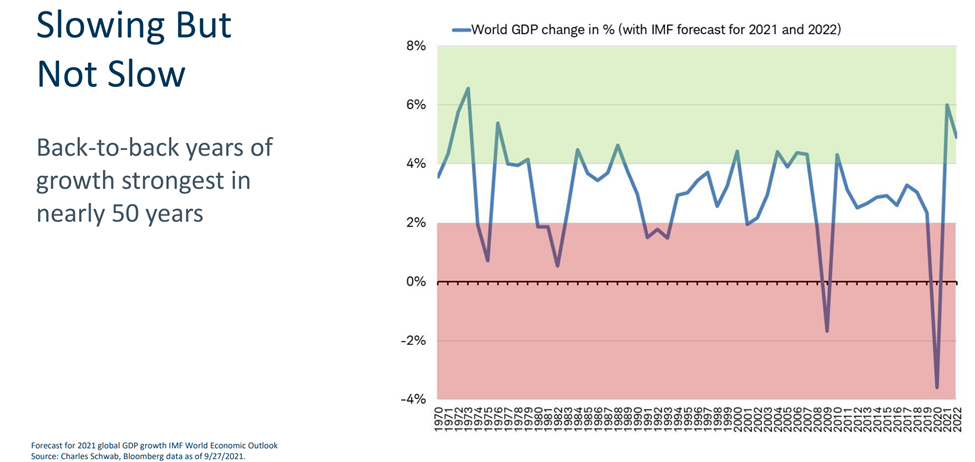

I believe picking the correct sector/asset classes will be especially important in 2022. I also feel like alternatives and international diversification will become more important in 2022. As I have discussed with many of you, international and U.S. investing tend to trade off, with multiple years of favor. The past decade has definitely favored the U.S., but that was not the case from 2000-2010, nor from 1980-1989. According to MSNBC, International stocks are now discounted 28% to the U.S., which is significant as the average is closer to 15%. With GDP picking up around the world, I do think many countries in the rest of the world, will do much better in 2022 then seen in recent years, especially with values represented by much lower multiples. As depicted below world GDP growth should be strong this year.

There you have my overall view of a much more challenging 2022, especially in the first half of the year. You will see me taking some profits in many areas in January and February, as I look to create more cash early in the year, to better be ready to take advantage of any volatility. Additionally, many taxable accounts have very significant long-term gains and by waiting until 2022 to execute, any taxes due will not become so until at least April of 2023.

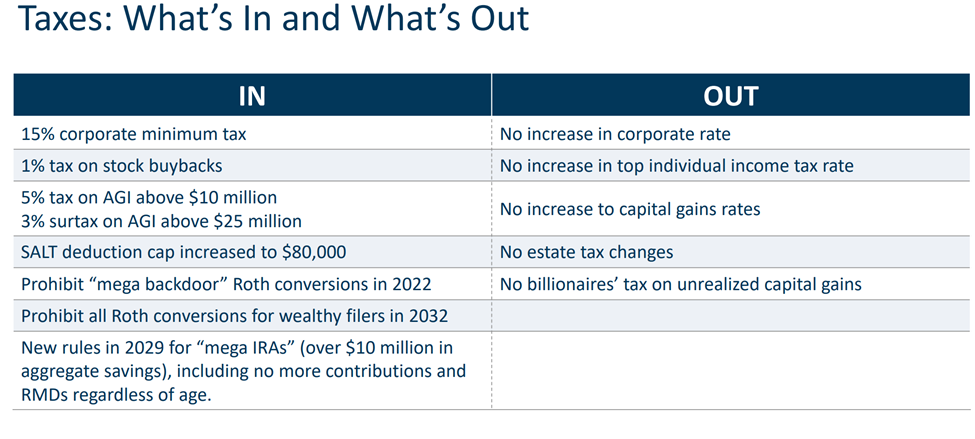

Speaking of taxes, let’s spend a little time on that. As is so often the case, investors that overreact to potential tax changes often wish they hadn’t. I listed what was likely to pass or not pass below, and what’s not going to pass is especially relevant, as much of what is “Out” was expected to be “In”, just a few months ago.

In fact, interesting that there is not likely going to be any corporate tax rate increase, cap gain increase, or individual rate increase. All of these were being projected to pass a very short time ago. And everyone was talking about the “ridiculous” potential tax on unrealized capital gains, which would have been funny just to watch them try to implement and manage. It just usually doesn’t make sense to make many moves until one sees tax legislature being debated on the congressional floor. I mean, “how many times have we heard this plan change in the past couple of months?” And if the SALT deduction goes up significantly from $10K on taxes, many people will again be able to itemize deductions, especially in years when one “doubles down on paying property taxes. One more time, the Backdoor Roth escaped termination, so I will continue to use that discipline with many of my clients.

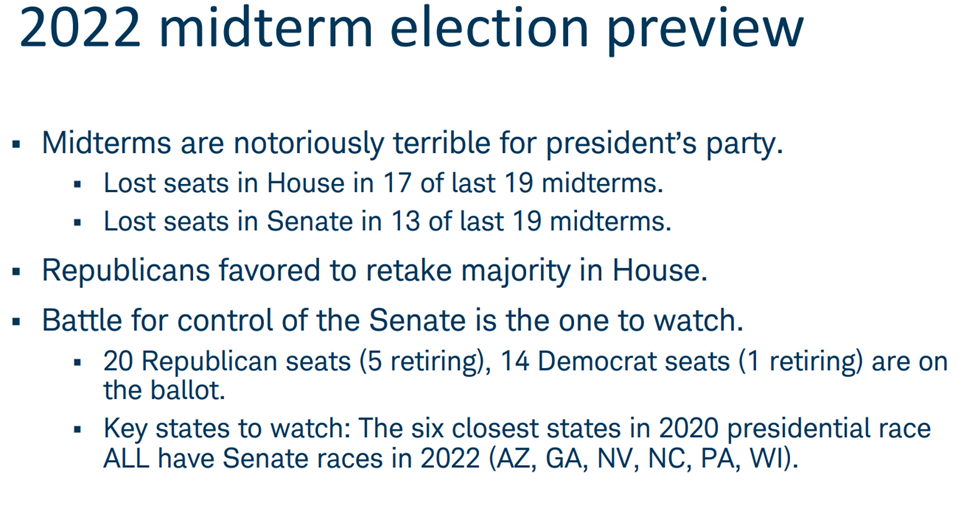

When you couple the fact that the midterm will likely change control of congress further, significant tax legislature is looking less likely until at least 2025. Midterms are typically bad for the president’s party, and the markets like split governments, so this will be interesting to watch in the next year also.

I hope each of you had a Merry Christmas, have been able to get in some good family/friend time, and enjoy the New Year! It has been a very strong few years, and this one ought to be more interesting with many cross winds to say the least. Look forward to talking with each of you soon.

Happy New Year,

Hunter Hardy

Hardy Investment, Inc. dba InvestmentHunter Wealth Services, is a Registered Investment Advisor. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussion herein.

Sorry, comments are closed for this post.