Dear Clients,

President Trump’s double whammy of threats against Apple (25% tariffs on imports) and potential 50% tariffs on European imports was an unexpected blast to global markets, that ended the week. These latest news stories accompanied an already challenging “beautiful bill” (really is named that!) that congress just got through the house. This new news hit the markets at the same time as an announcement that no foreign students can now go to Harvard. Opening more fronts on the trade war was exactly what traders hoping for a quiet end to a pre-holiday weekend did not need, and it clearly caught most off guard. I’m sure the plans of many in the US to try to leave work early, were dashed. It’s not clear what prompted these statements, but they are emblematic of the type of volatility that we should always be prepared for and seems to hit the markets every few days this year.

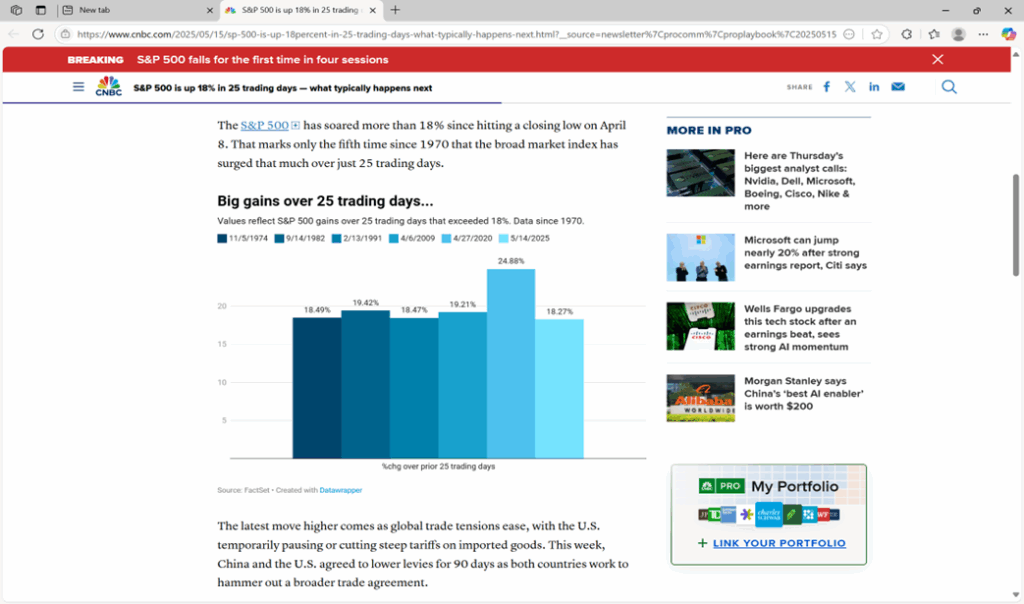

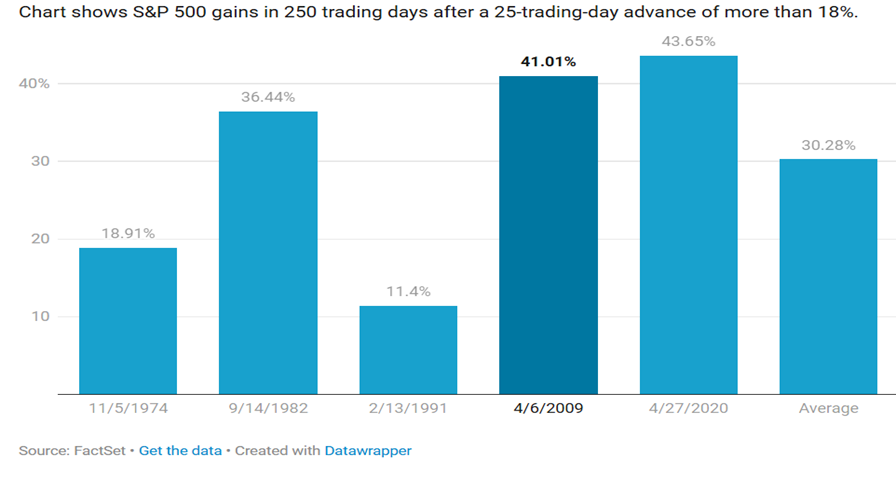

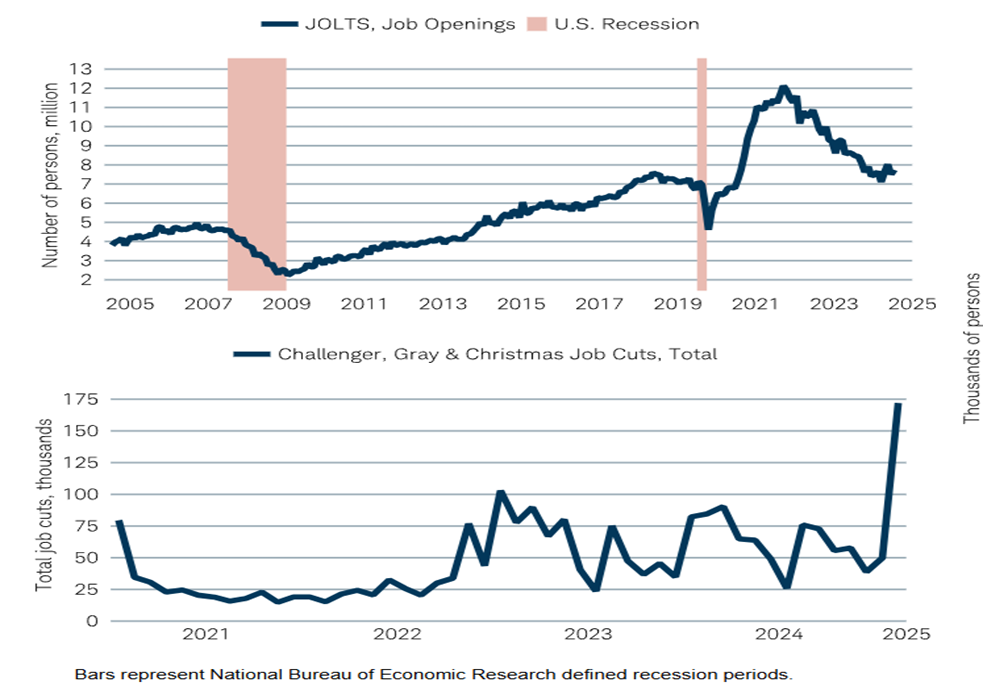

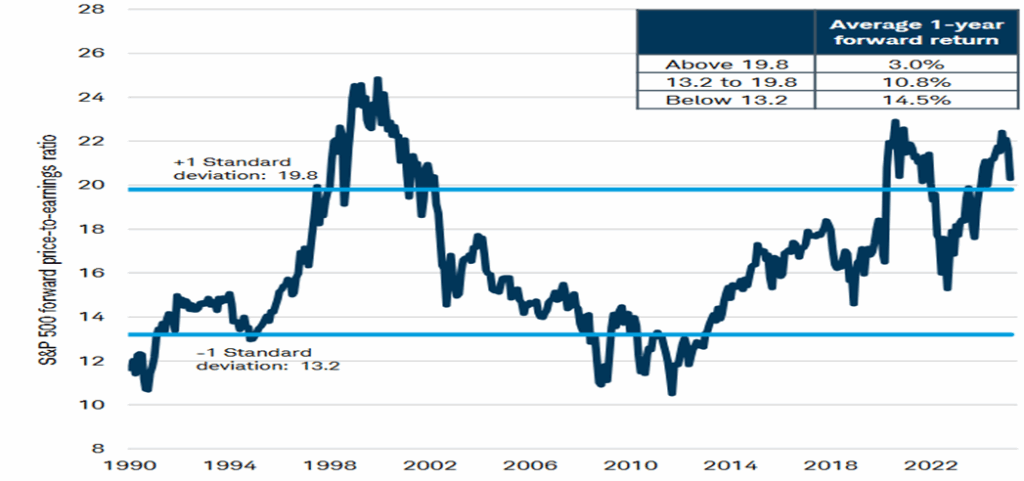

With that said, I still don’t like the current risk/reward for the stock markets. When I consider all the uncertainty and trends on the overall economy/markets, I feel it’s time for caution. I look at slowing growth (just look at the GDP for last quarter), slowing earnings growth (Earnings growth has gone from 10.5% growth at the beginning of the year to about 8.4% through the latest earnings season), and valuations at a 21.5 P/E. And that P/E is on earnings that I think are inflated by about 6-8% for 2025, I don’t think there are a lot of good places to put new money in the stock market. With that said, I do like assets like Buffer Fund ETFs, stocks/covered calls, enhanced income funds, and bonds with 2-5 years in duration/bond ladders in a time where you can still find good returns with much less risk. I am also keeping a very close eye on rates, as almost all the good returns of the year are coming when the 10-year treasury falls to under 4.5% (90% of positive returns have been when this rate is less than 4.5% according to Sam Stovall on CNBC). I am also getting great yields on covered calls and really like these as part of my strategy this year. With that said, you might ask me, why are you not even further out of stock market, if you don’t like the current risk/reward? Good question. But I have to be respectful of what will happen if congress provides more clarity on the above… Less taxes, less regulations, fairer trade (though tariffs are like taxes), and more IPOs coming to the markets. Additionally, the momentum has been going back and forth and it can be brutal to get on the wrong side of momentum. Just consider the chart below and what typically happens after runs like we just saw:

I use AI in my analysis regularly and I have been using ChatGPT, Perplexity, and Grok in my analysis, especially during challenging times. I always check the reference, and according to Carson Investment Research when the markets have had a correction of 10% within a month (which we just saw in April) the S&P was higher in 3 and 6 months 100% of the time since 1950. Data like below, depicts one more time that emotions have no place in money management. Additionally, the average gain six months later was 14.7%, so I can’t ignore the momentum, even if I don’t like the risk/reward. Though it has led me to play much more “defense” in the short-term with many of the assets I listed above, this defensive posture has protected some of the outsized gains investors have had the past few years. But though I feel like we will continue to be challenged over the next quarter or two, after runs like we just saw, markets almost always have a strong leg before long as illustrated in the chart below:

So, let me move back to congress before I continue with the markets, as never before has congress had the kind of effect on the markets I am seeing right now, in my opinion.

President Donald Trump completed the first 100 days of his second presidency at the end of April and, well, it’s been a LOT. A record 143 executive orders have been signed. The markets suffered the worst first 100 days of any president’s term since 1974 before rebounding in early May. Economic growth was negative in the first quarter. Border crossings are way down. Tariffs are way up. What’s going on from a policy perspective in Washington has had a more direct impact on the markets than at any other time in decades.

Amid higher market volatility and huge swings in the market, it’s been a head-spinning time for investors (and advisors!) trying to make sense of it all. The key question for investors and advisors is how much of everything happening in the nation’s capital will significantly impact the markets over the long run.

The president’s sweeping tariff plan includes tariffs on imports from Canada and Mexico, as well as new tariffs on steel, aluminum, cars, and car parts. Tariffs on imports from China hit 145% before the two countries reached a temporary truce in early May that saw those reduced to 30% for 90 days. But it is the universal 10% tariff on all imports, implemented on April 5, that may have the broadest impact. That provision alone brings the effective U.S. tariff rate to its highest point in nearly a century. The White House’s plan for even higher “reciprocal” tariffs on about 90 countries would increase the impact further, but the president paused those for 90 days, until early July, to give an opportunity for country-by-country trade deals to be negotiated.

While the White House has engaged in a blizzard of activity, Congress has been strikingly quiet. But now the focus is turning to Capitol Hill as it takes on its first major legislative challenge of 2025: a massive bill of tax cuts and spending cuts that forms the heart of the Republicans’ policy agenda. Republicans plan to use “budget reconciliation,” a parliamentary process that allows budget bills to be considered under expedited rules. Crucially, the process allows a final budget package to be approved with just a simple majority in both the House and Senate—obviating the need for a 60-vote supermajority in the Senate to overcome a filibuster.

Both the House and the Senate have completed the first big step: passing the “budget resolution,” a framework that sets broad targets for $4.5 trillion in tax cuts and as much as $2 trillion in spending cuts. But now comes the difficult part. The two chambers will have to reach agreement on a detailed package that spells out the specifics of every spending cut and every tax provision. The House of Representatives just took the first crack at doing just that and was able to get a win with a razor thin majority of 215-214.

On the tax side of things, the House legislation extends all of the 2017 tax cuts that are slated to expire at the end of 2025, including the lower individual income tax rates and the higher standard deduction, among dozens of other provisions. The estate tax exemption amount would increase to $15 million per person in 2026. There has been some talk of raising the top income tax rate for wealthy individuals, but that was not included in the House bill.

The Bill faces an even tougher road in the Senate, where further changes are all but certain. Getting a final bill through both chambers by August 1 would be a significant accomplishment—but that is not a sure thing, though the goal of the President.

Expect tariffs to dominate the economic discussion for the next several months. The president is attempting to fundamentally reshape the U.S. economy, hoping to encourage companies to manufacture more products domestically. Economists are skeptical that this will be the outcome. What’s clear at the outset, however, is that markets are rattled, diplomatic relations are strained, the dollar’s value has declined (which I believe has been overdone), consumer confidence has tumbled, and companies are finding it difficult to plan. The risk of a recession has risen markedly. The president remains committed to his plan, but he’ll likely need a series of major trade deals in the coming weeks to convey that his plan is working, as one pact with the friendly UK, has not created any momentum in the negotiations thus far. Meanwhile, expect the White House to keep a close eye on the markets and the economic data as we head into the summer—and to change course if needed, as when the bond/stock markets cratered the first time this year the President deferred major tariffs for 90 days. When it happened a second time, the President changed course and said he would keep Fed Governor Powell on through the end of his term. So, they are obviously watching the markets and Secretary of Treasury Bessent, has become a critical mouthpiece for President Trump.

The S&P 500 currently has a forward price-to-earnings ratio of about 21.5, according to FactSet, which is roughly where the market was trading in late 2024 before President Donald Trump’s tariff rollout. But again, I think the E in Price/Earnings is overstated and we are actually at an even higher P/E rate based on that assumption.

Over the past couple of weeks, Chair Powell made some interesting comments regarding the Federal Reserve’s approach to monetary policy. He said the FOMC needs to reconsider the key elements of its dual mandate regarding inflation and employment, given the possibility that supply shocks and price increases may become more frequent. Powell’s remarks suggest a potential for tolerating higher inflation as long as the jobs market remains strong. Traders have pushed out the odds of the next interest rate cut to September with only one additional cut expected by year-end as recession fears have eased. However, the Moody’s downgrade of the U.S. credit rating last weekend adds another risk factor to consider, as long-term Treasury yields are on the rise. Turning to the upcoming week, the economic calendar is light with the global flash PMI readings.

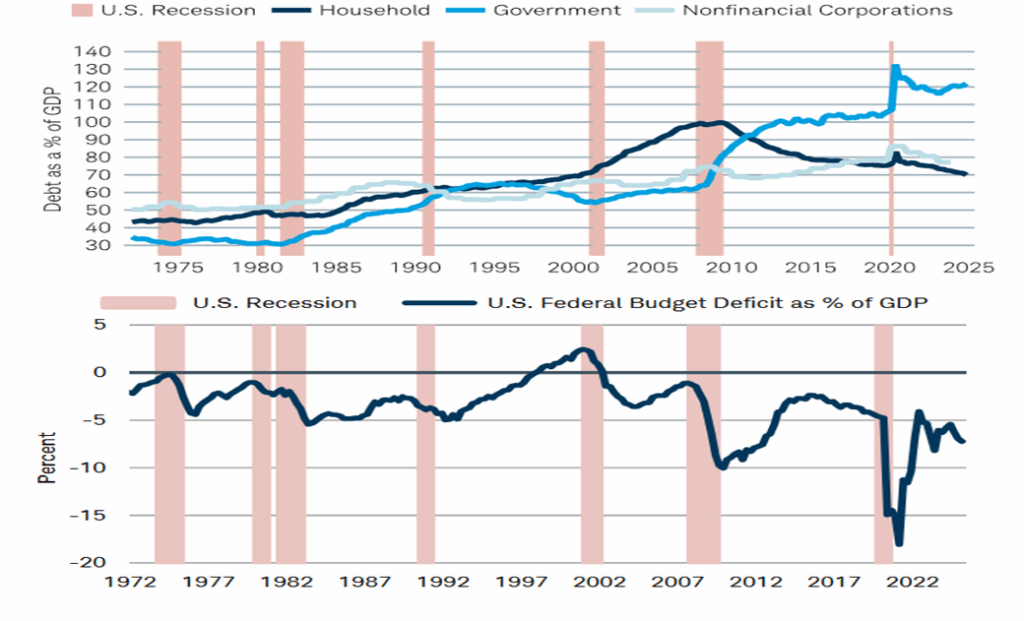

But as I have watched the markets move incredibly fast both ways this year, there is nothing that has continued to drive markets more over the past few years, than interest rates. If the “bond vigilantes” continue to drive the market (which I believe will be the case for multiple months/quarters to come), the debt/deficit plans of congress will remain incredibly important to the markets. And NOW the markets are watching the budget very closely, as they have finally said “enough” on debt/deficits.

As I noted earlier, interest rates matter a lot, especially to growth stocks, as when one discounts cash flows in valuing companies, interest rates can have a huge impact on what valuation makes sense. You can see from the chart below, a significant change occurs in the stock markets when rates have moved above 4.5% in the past four years.

Bond markets around the world have been a bit shaky, particularly for long-duration paper (the TLT is down a whopping 10% since December, which rarely ever happens so suddenly) and the last thing the markets wanted, was a piece of legislation that risks creating larger budget deficits in the world’s largest economy. Remember, a stock’s current price is supposed to reflect the present value of its future earnings and/or cash flows. The higher the interest rate, the lower the present value of those flows. Many think that highflying tech stocks would be immune from such concerns, but that’s just not the case, as stocks with higher P/E multiples can in fact be more susceptible to higher rates. Which is why I am watching rates so closely.

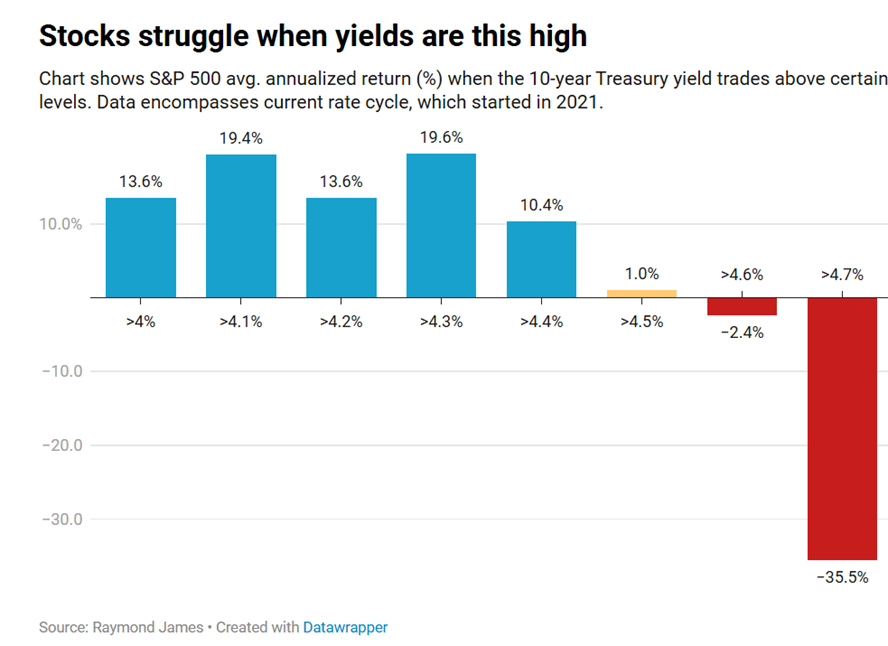

Let’s move away from congress and rates and talk about other aspects of the markets/economy. As I wrote in my opening paragraphs, I am seeing slowing growth in multiple ways, and I know the Fed is watching the jobs data very closely. As depicted below, that data has shown some cracks, though not an alarming slowdown thus far. It has been more of a “low hiring”, “low firing” job environment when you take out government jobs lost.

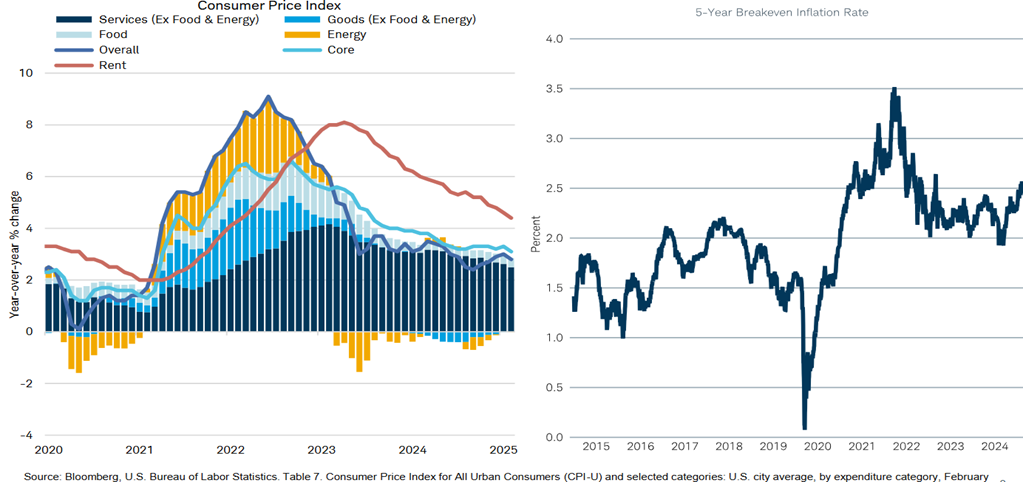

And though the tariffs could reignite some short-term inflation issues, I just think the slowing economy will keep a lid on inflation and think the current slowing trends we are seeing will continue, though there will likely be a short-term tariff blip.

I mean look at the various categories. Even rent/shelter (which makes up a significant part of CPI), is coming down pretty quickly now. And think about things such as groceries and prices at the pump, and the trend is definitely down, which could lead to another rate cut or two this year, which the markets would love as the Fed Funds rate is well above the real rate of inflation. The current rates are causing concerns in the housing and auto industries, as well as the overall debt/deficit of the country.

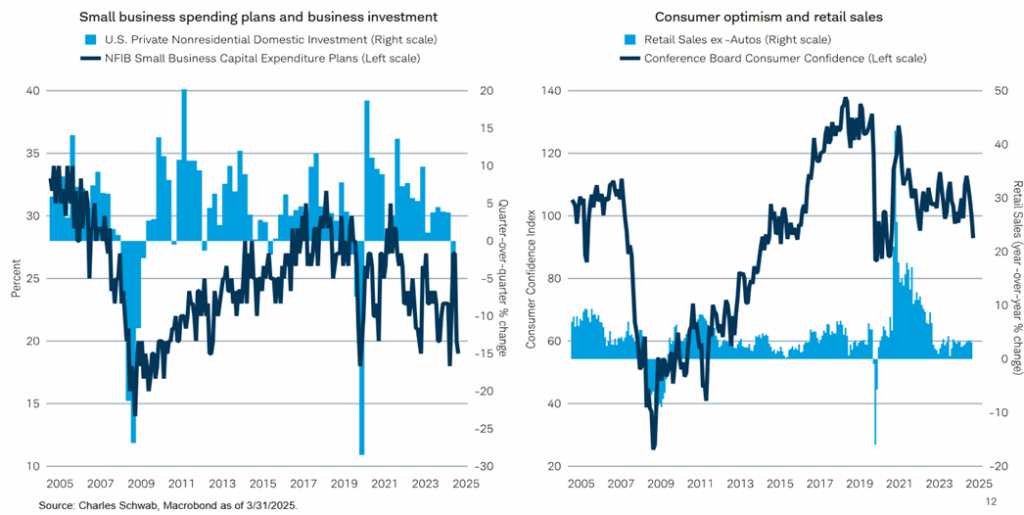

Another reason I think we will continue to see a slowing economy, is uncertainty leads to a lower consumer/business confidence level, which leads to less investing/spending, which can lead to this virtuous circle, until we get more clarity.

Look, I actually am very glad there is so much emphasis being placed on the debt/deficit finally. I mean, what company could get away with this kind of debt/negative cash flow for decades? As Warren Buffett has often said, “just tell congress they don’t get paid until they get a balanced budget and it will be balanced in a couple of hours!” That is so true… But with the debt/deficit at the current levels, trying to get them under control without pushing us into a recession will be an incredibly hard job. This has to get done, along with getting our entitlements Trusts such as Social Security and Medicare/Medicaid funded.

The bottom line, is playing defense makes sense in my opinion this year, as though the markets will move up in my opinion when we get more clarity on these many topics such as tariffs. Current valuations depict an environment where it doesn’t make sense to get more aggressive until we get more clarity and the P/E comes in some and we have a better risk/reward.

Financial Planning

Now is the time to be intentional when thinking about your Life Plan/Retirement Map. Are you comfortable with your risk tolerance? Are you contributing to your plans enough? Do you understand your budget? Take the time to ensure you understand all the elements of your personal Plan to ensure your success. Remember, the stock market has a 20% correction every 4.5 years on average, so this correction was normal. In fact, most people can’t believe the S&P 500 YTD is only down 1.3% and the Nasdaq is down just 3.4%, in a year that feels much worse at times because of all the market headlines. But these corrections are good for markets and a good reminder that while the markets go up 79% of the time according to Fox Business News, growth is not always in a straight line.

I know this is a long newsletter, but there is a lot I wanted to communicate this month. I feel good about the country and many areas of growth such as AI/power. There are challenging market/financial issues to work through, and I am cognizant there will be some pain getting through them. But the other side looks very bright with some great opportunities. I hope each of you have a great rest of your day and Memorial Day weekend.

Warmest Regards,

Hunter Hardy CFP®

InvestmentHunter Wealth Services