Dear Clients, I hope each of you had a great summer and you are having a good start to your Fall. The markets have definitely evolved of the past few months and quarters, as we have seen markets that were rewarding the “Magnificent Seven” almost exclusively in 2023, that have evolved into markets that are now also including certain financials, industrials, and parts of technology in 2024. In both years, cash/cash like investments are a significant investment option for many, as we now have an unbelievable $6.5 trillion in cash-like investments according to First Trust. With the exciting returns we have had, that doesn’t mean there hasn’t been issues for many investors. In 2023, the other 493 companies had earnings growth of -5%, while the Magnificent Seven had earnings growth of 33%! Additionally, last year the DIA returns were a fraction of the S&P 500 ROI, because the S&P is capital weighted and the biggest 10 stocks drove that performance. That is why so many investors did not do well in their 401Ks, when they had too much of their investments in the DIA or small caps. In 2024, while technology has continued to grow at a rapid pace (though slowing down to around 20% according to CNBC), the other 493 stocks are supposed to grow at low double-digit rates, hence we are seeing a catchup in some areas. With that said, there has been significant damage in many individual stocks, as the average drawdown for every Nasdaq stock through September was 44%, even though the overall index had not seen a drawdown of over 13%. It is hard to even get one’s mind around the fact that the average Nasdaq stock was down 44% at some point this year. So there has been pain in many areas, even though the overall S&P 500 has done very well.

So today, I am going to show you a lot of trends that have kept me positive and why it makes sense to stay in equities this year, even with valuations at this current level, and the various crosswinds the markets have in their face. Let’s analyze things further…

The opinions have been so different in these markets, that I never answer the question, “what do you think the markets will do in the coming year?” I always respond, it depends which market or parts of the markets you are talking about, because there are so many markets underneath “the market”. While I think the overall markets are fully to overpriced, there are still many places and reasons to be invested in many markets. And even in the overall market, I believe it is at least hard not to be “reluctantly invested” right now. I will give you my reasoning, as we continue through the typically tumultuous investing time of the year, which continues through October.

There are a lot of reasons for people to stay on the sidelines, with valuations, geopolitics, a slowing economy, and our own “crazy election” later this year, causing plenty of angst. But the thing that is most important (in my opinion) is valuations and believe it or not valuations are not a good short-term indicator for the markets. Though they are an excellent indicator for the long-term. With that said, there are some things on the positive side, that just make it too hard not be at least an “uncomfortably invested bull”, at least for now. “The Fed”, earnings, credit spreads, and cash all make it uncomfortable to get too much on the sideline.

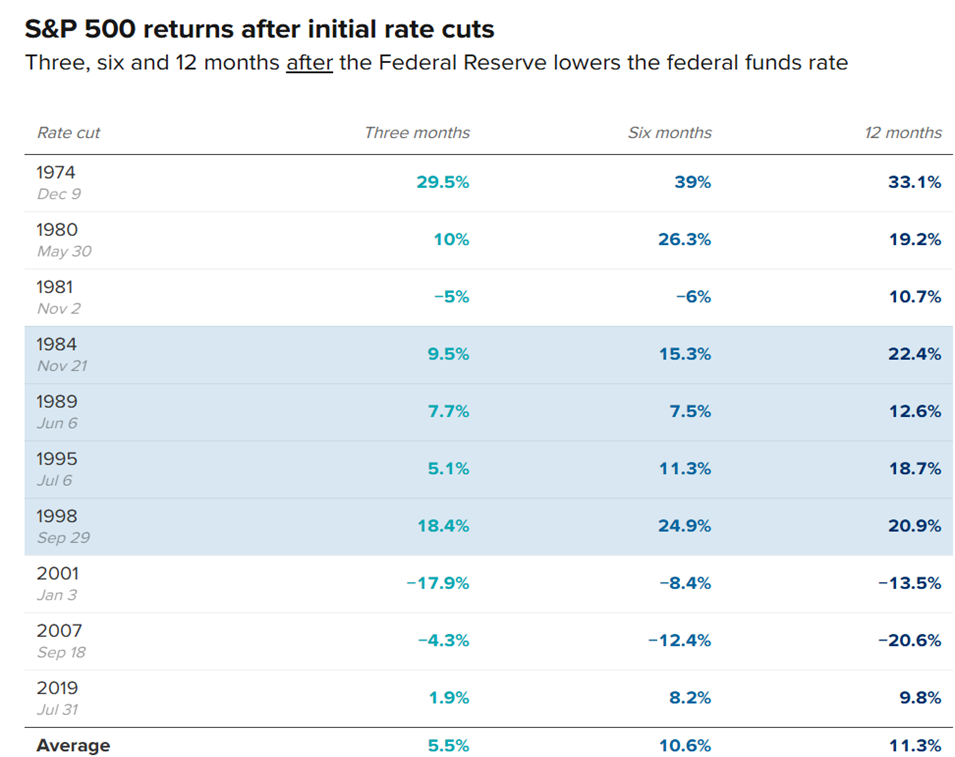

The Federal Reserve cut interest rates for the first time in four years recently. Let’s take a look at how stocks performed at the start of prior easing cycles. How it will perform from here depends largely on the economy, historical data shows.

In total, across all cycles, the S&P 500′s performance in the aftermath of the first cut was largely positive but with some big misses, though only when the economy turned down. Overall, the broader index was higher 70% of the time three and six months out, and 80% of the time one year later, according to Canaccord Genuity, which reviewed the last 10 easing cycles going back to 1970.

The S&P 500 averaged a 5.5% gain in the first three months after an initial cut, 10.6% six months later and 11.3% one year out.

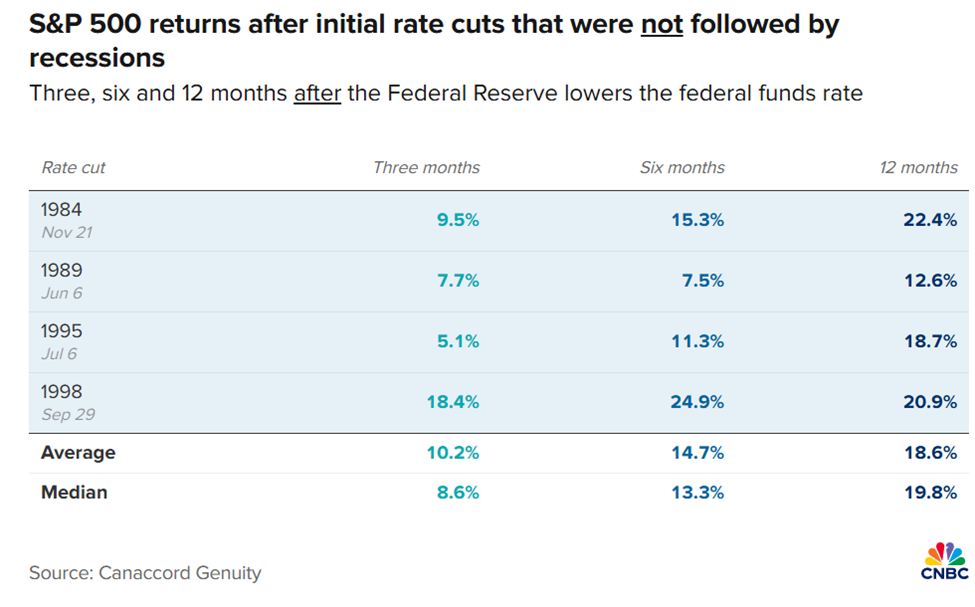

But exclude the times when a recession followed and compute only using the soft-landing scenarios — which is the consensus this time — and the performance gets even better.

A recessionary scenario was defined by Canaccord as one in which the economy was already in a downturn or entered one within 12 months of the first cut.

In the years when the S&P 500 experienced no recession during or soon after the first reduction — such as in 1984, 1989, 1995 and 1998 — the benchmark was higher 100% of the time three, six and 12 months later. That is data that is pretty hard to ignore!

Check this out… when we did not have a hard landing or recession (which I believe will be the case for at least a few more quarters), the returns have been unbelievable as depicted below.

On average, the broader index jumped 10.2% three months later, 14.7% six months out and 18.6% one year afterward. Pretty impressive. But again, it all depends upon whether a recession is around the corner, as according to Bank of America, we are only up 20% of the time after the first rate cut if a recession happens within 6 months of the first rate cut. Again, I just don’t see that happening and I believe the economic data as of late backs me up.

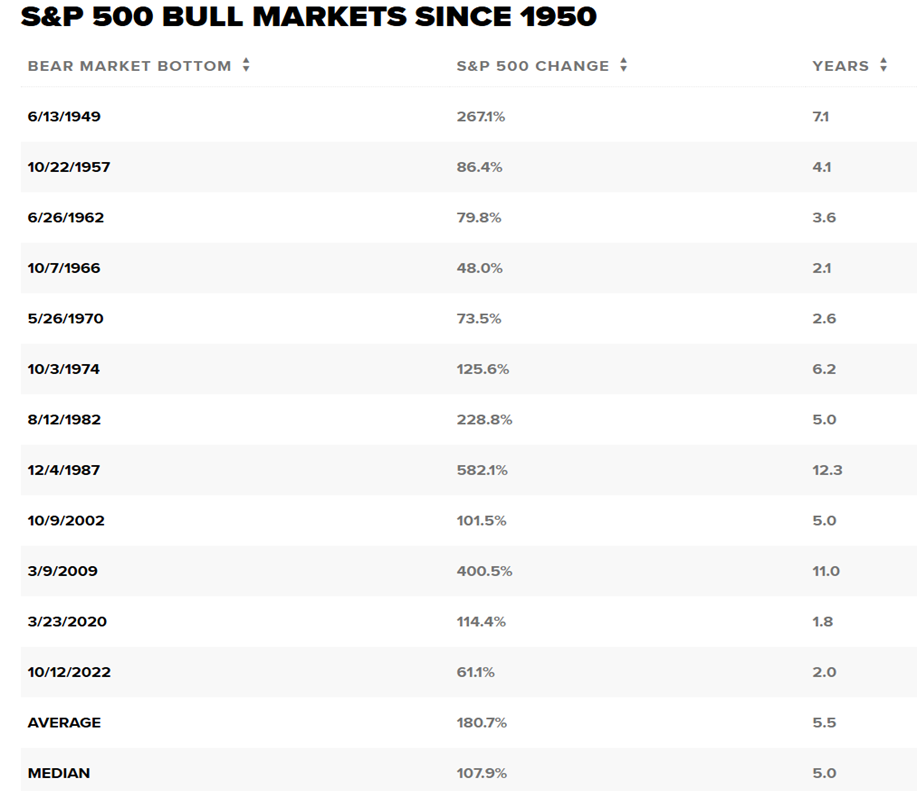

And when you look at typical scenarios from a historic bull market perspective, data shows that the existing bull market is still just the second youngest of the 12 since 1950. How many people have you heard say, “isn’t this bull market a little long in the tooth?” The data shows that this is just not the case at all…

Although many might think this bull market has gone too far and is getting old, if you look back at history, bull markets last more than five years on average, making this one at two years actually very young.

Even at these valuations, if you add the strong revenue growth — on top of earnings growth — the upwards driver at the moment, the look ahead continues to look pretty strong, which is what the markets do.

And that doesn’t mean that we won’t have many corrections along the way, as represented by the latest one last August just two months ago… The S&P sold off over 8% and the Nasdaq about 12%, as recession fears were again at a short-term high. With that said, the markets once again scared out the “weak hands” as the narrative just didn’t change much and the markets quickly bounced back in two week’s time. One more time, where news has been short-lived and the weak hands got pushed out of the markets.

I do think that many investors are less optimistic, especially since this year is an election year and it still seems to be a coin toss as to which candidate could win the U.S. presidency. Komal Sri-Kumar, president of Sri-Kumar Global Strategies, believes that the bull market could have legs for another three to six months, maximum, so there are many investors/analysts on both sides of the fence.

Whoever takes office is going to face an immense problem with the total debt of the country, and neither candidate has a solution to it. This is very concerning to me. My expectation is that the bond market is essentially tolerant of this situation until election time, but once the new president takes office, you’re going to have the bonds again questioning whether the deficit is sustainable. I see the longer-term yields holding much firmer than short-term duration, and this could leak over into equity markets.

So, I am going to spend a little more time in this newsletter talking politics, since this is such an important political year.

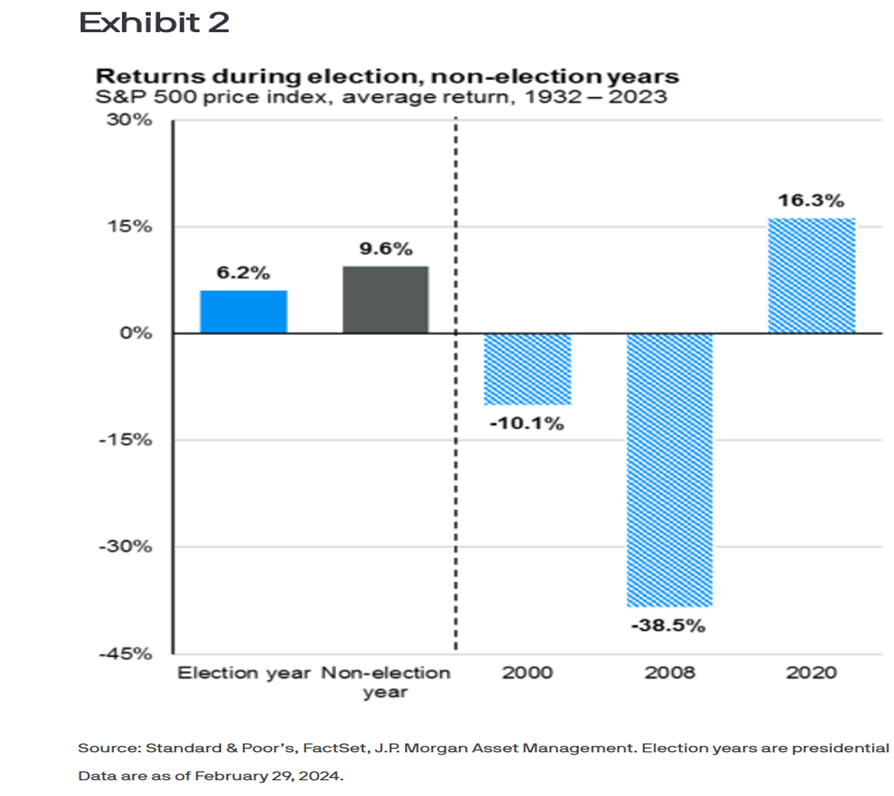

Congressional Update I know politics are on your minds as I get questions on this every Review right now. I understand why this is on many of your minds. But as I have written in the past, whichever party holds on to the Presidency has had little effect on how the markets have done over the last century. In fact, if you take out the dramatic years like 2000 and 2008, the chart below shows little difference in ROI, regardless of who is in office, or whether it is an election year or not. As depicted below, while non-election years have shown better market returns, 2000 and 2008 are where all the difference in returns came into play.

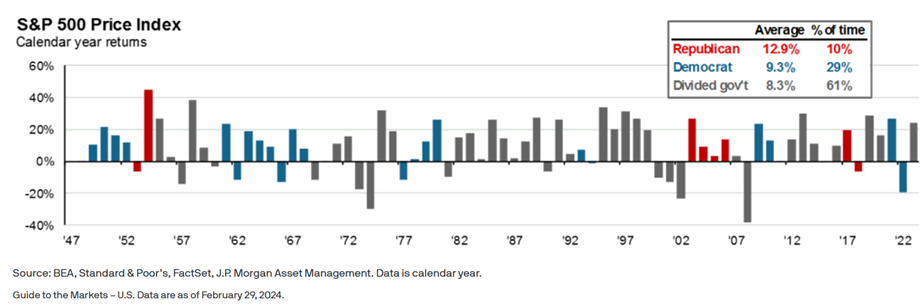

And as depicted below, while Republican congresses have done slightly better than Democratic congresses since the 40s, though congress has been divided the majority of the time and returns just haven’t been that different.

Republicans remain a strong favorite to capture the majority in the Senate. Democrats (including the four independent senators who caucus with the Democrats) have a narrow 51–49 majority, so Republicans need to flip just two seats in November to win the majority. There are 23 Democrat-held seats on the ballot this year, and just 11 Republican-held seats. Republicans are all but guaranteed to win the open seat in ruby-red West Virginia, where moderate Democrat-turned-Independent Senator Joe Manchin is retiring. And Democrats have tough seats to defend in Arizona, Michigan, Montana, Nevada, Pennsylvania, and Wisconsin. Republicans are likely to come out with a slim majority, though there is no sure thing in politics. Democrats, on the other hand, are optimistic about flipping the House of Representatives. Republicans hold just a four-seat majority, and Harris’s entry into the presidential race appears to be benefitting down-ballot candidates in close races. I think Democrats are a slight favorite to win the House, but it is far from a slam dunk. If Republicans win the Senate and Democrats capture the House, it would be the first time in history that the two chambers flipped in opposite directions in the same election. But who ever said this election was going to go along the historic norms?

November’s outcome will be critical in clarifying the path forward in 2025 for a key policy issue: taxes. This is what I will be watching more than anything in congress in the next 14 months after the election. All the 2017 tax cuts, including lower individual income tax rates, the higher standard deduction, and the larger amount of assets that can be inherited without triggering the estate tax, are set to expire at the end of 2025. That means a titanic battle is shaping up next year on what to do about those expiring provisions. And both parties are thinking about what other tax issues could be included in a large bill. In recent weeks, for example, both presidential candidates have endorsed ending the taxation of tip income. Trump has indicated support for eliminating taxes on Social Security benefits and overtime pay, while Harris has proposed new tax incentives for first-time homebuyers and small businesses. Won’t anyone just please focus on our deficits, social security, and Medicare???

The taxation of wealthier individuals is likely to be one of the central points of debate during the campaign. Vice President Harris has endorsed most of President Biden’s tax plan, which includes allowing the top individual income tax rate to return to 39.6%. But Harris recently proposed a capital gains rate much lower than Biden’s, calling for a top rate of 28%, plus a 5% Net Investment Income Tax, for households earning more than $1 million. The plan also includes a controversial proposal to tax unrealized gains for individuals with net assets over $100 million. But if there is a divided Congress next year, few of these proposals have any chance of happening. Even with a majority congress, I have a hard time believing any of the unrealized gains tax scenarios becoming law, for many reasons I won’t get into today. Expect a lot of back-and-forth this fall about next year’s tax debate, but until we know who will be occupying the White House and which party controls the House and Senate next year, it’s impossible to predict how the complicated issue will play out.

Democrats are clearly re-energized by the switch from Biden to Harris, as the Harris campaign has seen an explosion of fundraising and strong movement in the polls since she entered the race. But the race remains close and is likely to remain that way right through Election Day on November 5. Seven battleground states—Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin—hold the key to the outcome. Polls in early September showed all seven in the “toss-up” category, so expect the campaigns to focus their energy, time, and advertising on these key states.

But while much of the attention will be on the presidential race, the battles for control of the Senate and the House of Representatives are perhaps even more important to the markets. That’s because while presidential candidates can and do make a wide array of policy promises on the campaign trail, it is ultimately Congress that has to turn those ideas into laws.

This just in:

The latest inflation report came in slightly hotter than expected, knocking stock prices lower. But there are some encouraging signs within it.

The consumer price index rose by 0.2% in September on a month-over-month basis and 2.4% from the year-earlier period. Economists polled by Dow Jones had forecast expected a 0.1% gain month over month and 2.3% increase year over year. Core CPI, which strips out food and energy, also was more than expected. I am sure that some investors are worried the report means the Federal Reserve may not be able to cut rates further.

But the odds of a quarter-point Fed rate cut in November actually rose after the report came out. Per the CME Group’s FedWatch tool, the fed funds futures market indicated a 94% probability of a quarter-point rate cut next month. That’s up from about 75%. The chances of the Fed holding rates at current levels lowered to about 5% from 24%.

CPI Inflation data was slightly on the hotter side, with commodity prices (outside) energy rising more than expected. The good news is that shelter inflation is pulling back and that’s going to pull inflation lower. The big picture is inflation continues to pull lower, albeit with some bumps along the way. I believe the labor market “remains in the driving seat for the Fed and next month’s payrolls release will be an important data point in determining the pace and extent of Fed easing.

Investors received fresh labor market data Thursday as well, with initial jobless claims jumping by 33,000 to 258,000. That’s the highest claims level since August 2023 and should signal to the Fed that it needs to stay the course with rate cuts, in my opinion and that there will be another cut of 25 points next month.

So back to the markets…

While I have mentioned that I am an “uncomfortable bull” and it is getting increasingly challenging to find exciting investment opportunities, they are out there. I continue to find new sectors such as financials, defense, and parts of healthcare that continue to make sense. And there are still parts of technology that make total sense to continue to ride. Additionally, I like many aspects of fixed income and am using hedge bets on buffer ETFs, enhanced income ETFs, and corporates, and covered calls, to keep investors in the game, mitigate risk, and take interest rate risk out of the picture. The past couple of years, have been a great time to take advantage of new types of investments that take advantage of higher rates/volatility.

I look forward to talking to each of you in 4Q as we ensure tax efficiency.

Warmest Regards,

Hunter Hardy CFP®

InvestmentHunter Wealth Services

Sorry, comments are closed for this post.