Dear Clients, January 22, 2024

Hope you all are doing well and are well rested after the holidays. I know some of you are in very cold areas, and hope you get some relief soon, as forecasted. The beginning of the year started off very slow and has since recovered and the S&P has made new highs for the first time in two years. Which means we have basically had flat markets for two years since January, 2022, at least in the stock markets.

With that said, so many have come into the year very bullish, and I do not think now is a time to be aggressive. In fact I think now is the time to be more conservative than normal, especially when looking at the markets as a whole. Remember the start of 2023? The analysts were never more offsides, as everyone was down on technology and over 60% of the economists were predicting a recession in 2024. Again, when too many people “get on one side of the boat, one should always be leery of joining that crowd”!

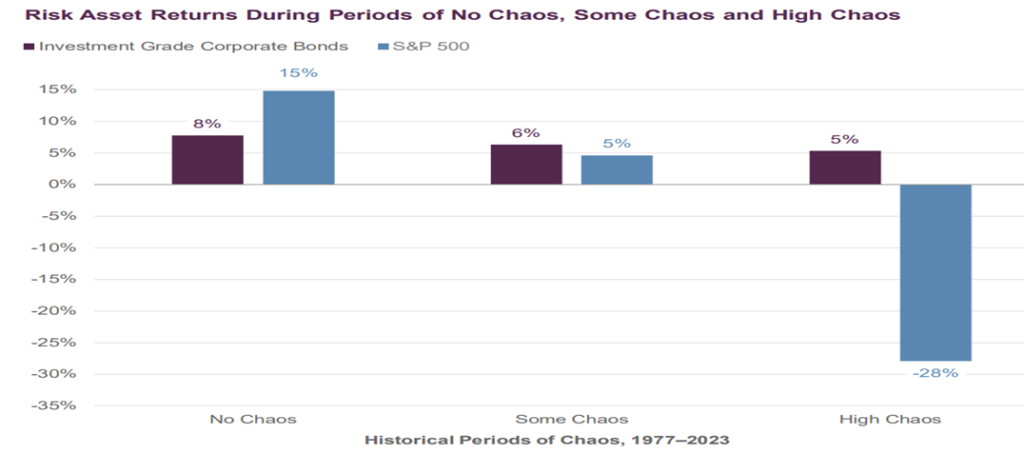

I also feel like the risk/reward of the overall markets do not favor the equity markets, while giving some real opportunities in the bond, buffer, and preferred income markets. Think about what positioning and expectations are coming into this year. First, you have the SPY/DIA at a 2024 expected P/E multiple of about 20, based on earnings expectations of $242 for the S&P. Second, you have earnings growth expectations of 12% in 2024, in a time when the cost of capital has been increased significantly, quantitative tightening is occurring (and misunderstood), Geopolitics issues are as contentious as ever, and breadth outside of the top 10 players has been relatively subdued. On the other side, there are many opportunities in income type plays, that I think will remain good opportunities in 2024. But if

you are ahead in your Life Plan, be careful not to get overly optimistic, as most markets are due to slow some in my opinion and risk/reward has changed a lot the past couple of months after this runup.

These markets are also oversold in the short-term, as depicted by the S&P 500, the DIA, and the bond markets (RSI at the bottom is the technical indicator to look at to determine short-term overbought or sold current trend).

As depicted above, even the fixed income markets are starting to cool some, after a huge move the last two months of the year.

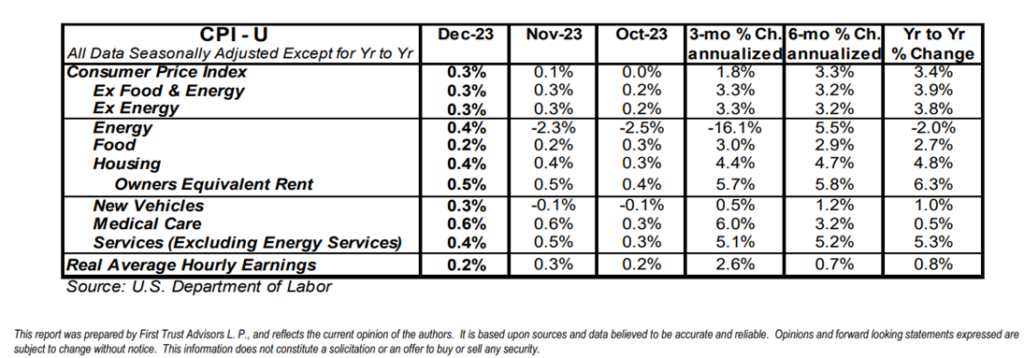

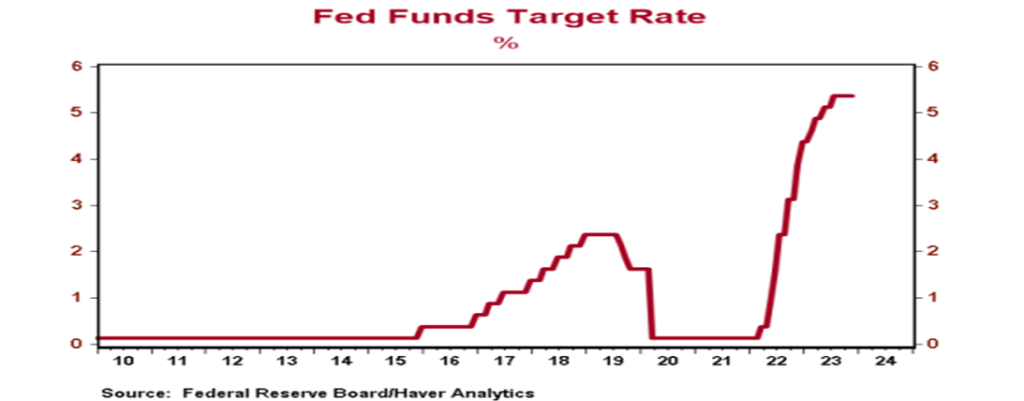

The good news about cooling markets, is everything I am looking at on the inflation side of the ledger is moving down and taking the pressure off the Fed. Now don’t get me wrong, I think the markets have been “offsides” here for many months, as I can’t imagine six rate decreases, even with inflation slowing as much as it has. Just a month ago, according to CNBC, there was over a 70% chance of March rate decrease, which I just don’t agree with. I believe the first decrease will likely be May or later, though I really like what we are seeing on inflation as CPI has moved from over 9% to the mid 3% level.

I do believe in the “higher rates for longer” narrative, but do not believe this will have much of a negative effect on the markets. In fact, I think the consumer will continue to hold up pretty well, which will give the Fed the ability to “pause” on not moving too quickly. We have all heard how Fed Powell does not want to be remembered as the Arthur Burns of his time, and he will likely continue to ensure inflation does not reignite by moving rates down too quickly. But with the rates where they are, I feel this will give the markets plenty of room to reduce rates and further stimulate the fixed income markets.

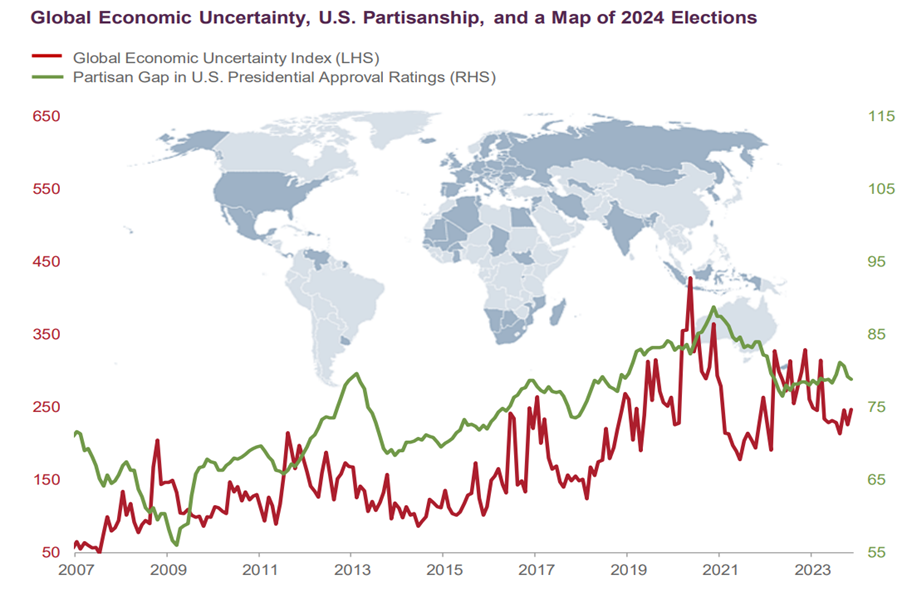

I guess the thing that gives me as much pause as anything, is all the uncertainty in the global markets and the geopolitics we are all living through. I heard from Guggenheim this weekend that 50% of the countries across the world will have elections in 2024, so there will be a lot of moving parts across the world… Already heightened geopolitical risks are set to intensify, given the ambiguity surrounding the profile of political leadership and their economic agendas. In the United States, the presidential election will be contentious as the country has never been more polarized. President Biden faces unfavorable conditions including the highest disapproval rating for a president going into an election year since 1980 and heightened recession risks. Uncertainty is compounded by former President Trump’s legal challenges that will ramp up during campaign season. And certainly events abroad will add to the volatility, with ongoing conflicts in Ukraine/Russia, tensions with China likely to ramp up with Taiwanese elections, the Israel/Hamas/Houthi conflict, and new hotspots undoubtedly emerging.

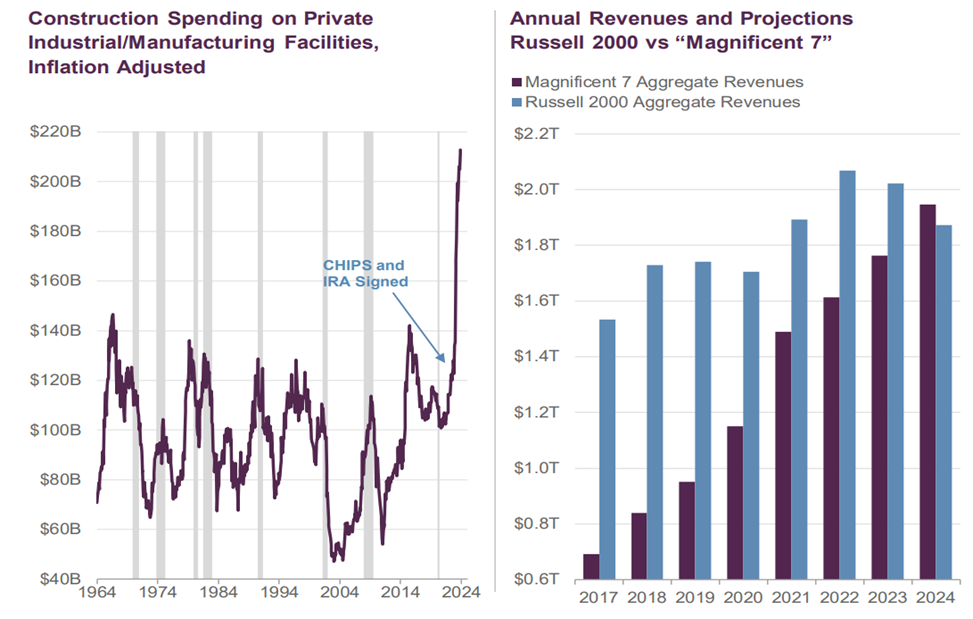

Clients, often ask me “do you think we are going to have another year where the earnings are so bifurcated, where so few drive the markets”? I do think the markets will be much less bifurcated this year, as 40% of all stock companies have been down two straight years, according to CNBC. That just rarely happens and I do think a reversion to the mean makes some sense at this point in time and bode well for small caps if we do not have a recession.

With that said, I think Artificial Intelligence, Cloud, and Security, make not owning at least some of the “big boys”, a foolish move for anyone in that position. Looking for GARP (Growth at a Reasonable Price) from market leaders makes sense. Further AI progress will lead the tech sector to siphon more revenues from other industries and drive an increasingly technology driven world. Looking at the amount of money being spent on technology and the revenue growth of the Magnificent 7, just further depicts a trend which shows why we all must include some of the Magnificent 7 components.

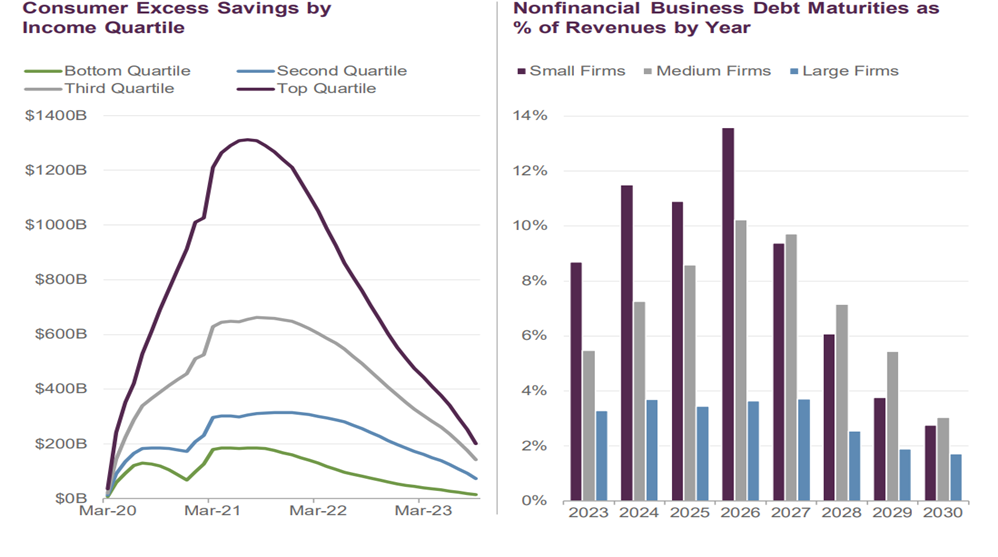

When you shift to the consumer, they have remained very strong as we move into 2024, though excess savings have been drawn down dramatically, as people continue to “get out and about” as services continue to be where $s are being spent. But the amount of government money that was rushed into the economy was not spent for a year until after covid peaked, and has been drawn down ever since. And as for companies, higher debt rates will also add to a slowdown in overall spending in my opinion.

I think one challenge for the economy that so many analysts missed, is that money supply typically has a significant effect on the economy and “just like it was wind at our backs the past few years”, it is “wind in our face right now”, for many years to come. As inflation progress continues, participants will turn to deflation indicators. Money supply is one such indicator. Money supply contracted by 4 percent in 2023. Contractions in the money supply are rare and have historically been followed by some degree of deflation, even if short-lived. At a minimum reduced M2 will enter the market discourse and could incite brief periods of volatility.

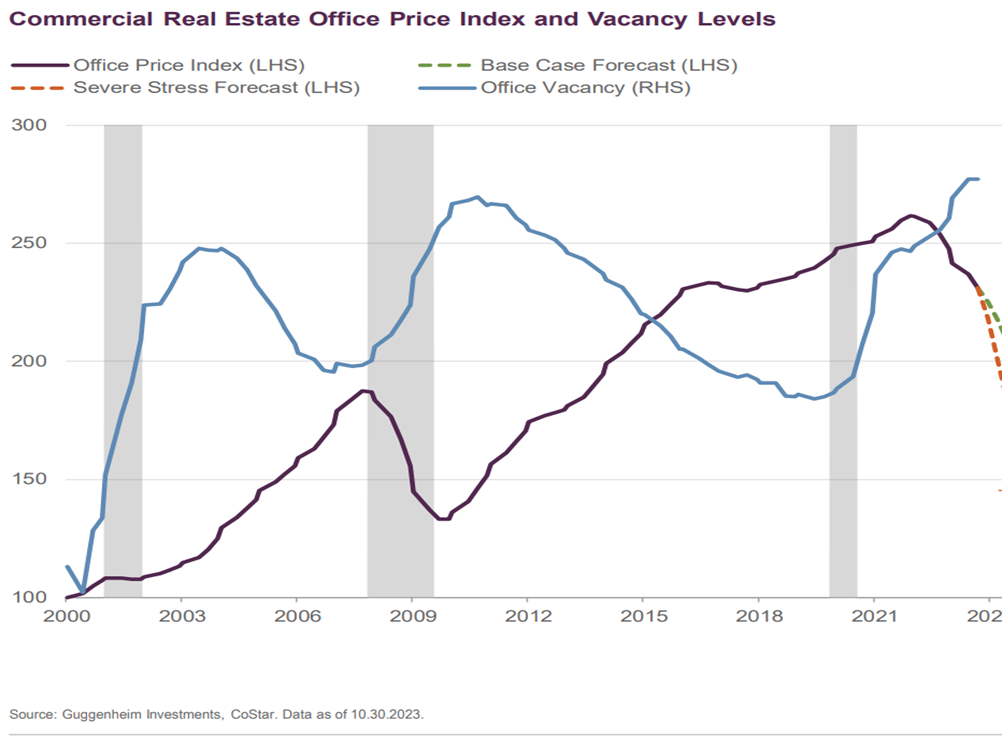

Leading economic indicators (LEI) have been down 21 months in a row, and this rarely happens unless the economy is about to realize some serious slowing. So again, I don’t know how one can say, “deflation will continue to happen”, without also saying, “growth will slow”, even with a resilient consumer. And as a slowdown comes into play, I don’t see how commercial real estate won’t be a place that gets hit especially hard. In a recent discussion I had with a Guggenheim executive, she was very concerned with what she thought the commercial real estate market could see in the coming months/years. While I am not near as negative as her, I do agree that trends for many areas such as office space will continue to worsen, especially in areas such as NY or San Francisco, which have already seen significant price drops and increased vacancies.

So, while the markets typically do well in years of presidential elections, especially with an incumbent in office, there are many crosswinds that will make this more of a fixed income year in my opinion. While markets are setup to continue to do fine if inflation/interest rates comes down, the many factors I noted above will make me cautious for at least the first half of the year, on equities, especially with the amount of risk currently in the markets.

With that said there are many places to make money and you have seen me invest actively in buffered ETFs, GARP type sectors, and fixed income. Higher rates help in many investment areas, and give investors the opportunity to get REAL yields again after a decade and a half of not having that alternative.

Lastly, I again encourage each client to plan conservatively on your Life Plans from here, as valuations at these levels should give one pause, or at least to not get too aggressive with strategies going forward.

Financial Planning for Charitable Giving

For this newsletter, I wanted to ensure that when giving to charities each of you considered two key strategies to make your money going further. First, in taxable accounts, you should always consider giving appreciated investments, so to lower your unrealized gains and taxes over time. Second, in retirement accounts, one can give Charitable Qualified Distributions to fulfill RMDs (Required Minimum Distributions) requirements. Another great strategy to both “give back” to worthwhile endeavors and also reduce taxes over time.

Have a great week!

Hunter Hardy CFP®

InvestmentHunter Wealth Services

Independent Advisor Since 2008

Hardy Investment, Inc. dba InvestmentHunter Wealth Services, is a Registered Investment Advisor. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussion herein.

Sorry, comments are closed for this post.