Dear Clients,

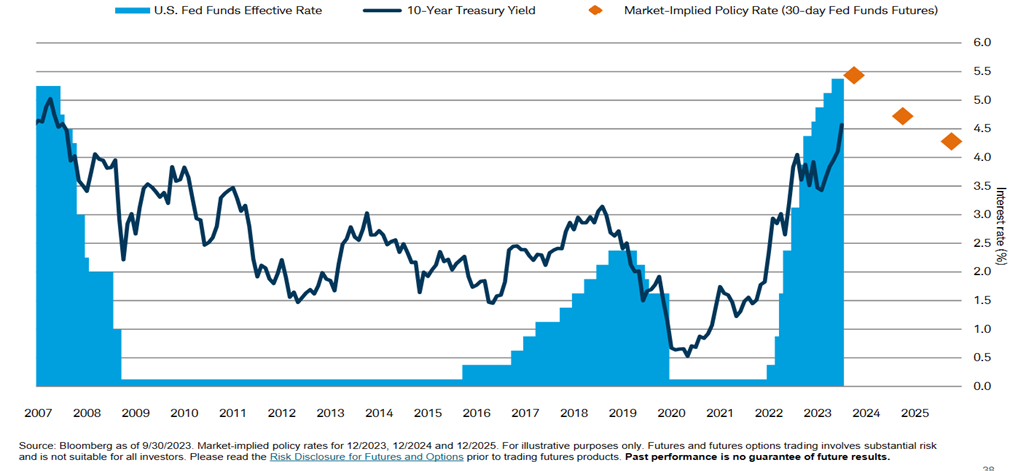

What a volatile 3+ months it has been. After a terrible 3-month period for stocks, fixed income, and preferred’s, all three market areas bounced back for the best week of the year, last week. The markets continue to show investors how quickly they can move, and how they can move in a way that “always puts pressure on weak holders”. But what this move does also, is gives you the ability to reanalyze risk tolerance and ensuring you really are where you think you are or want to be… Because there are also times (like the past three months and the majority of last year), when “hedges” such as fixed income also don’t work, as rising rates can wreak havoc on many asset classes. Though I believe we have hit our terminal rate for the year.

The markets have certainly changed, in that TINA (There Is No Alternative) is no longer the case, like it was, until a couple of years ago. In fact, I am constantly looking at different asset classes, like fixed income, buffered ETFs, income funds using covered calls, preferred’s, and other alternative classes. The question always is, “is the additional potential ROI over say a one-year treasury, worth the risk?” If it is, how much of these conservative type of investments should go in one’s accounts based on risk tolerance? I mean for clients with a really strong net worth, why would you take on too much risk right now? It is not worth the risk unless the reward warrants it. This is when I get into what the equity risk premium are versus other investments. Customizing assets to one’s risk tolerance is especially important right now, as nobody should be “very far out over their skis, when valuations are at this level”. With that said, there are some very interesting investments right now, because rates are giving us the opportunity to enjoy some great yielding investments, and some stock sectors have already gone through a bear market, sentiment is low, and many sectors are trading at compelling valuations, even if the stock market if richly valued overall.

I just wrote, there are many areas in the stock market that have already gone through major corrections. When you look at the S&P 500, I have never seen a more bifurcated market. The magnificent 7 have done extremely well, while the rest of the stocks are flat or down slightly on average. And utilities, real estate, manufacturing, and small caps have all gone through bear market like corrections during the year.

With that said, it is pretty surprising to me, that the economy has not had more of a slowdown. When I talk with certain small businesses, the feedback I receive is more negative than I get from the overall market narrative. I think that is because, a lot of the businesses are product driven, or a lot of the businesses are finding it challenging to have much pricing power… When you couple this with higher employee and capital costs, a slowdown in profit growth definitely seems to be gaining momentum, as a lot of future earnings revisions are coming down. And there are a lot of reasons for this, so let’s look at the data closer.

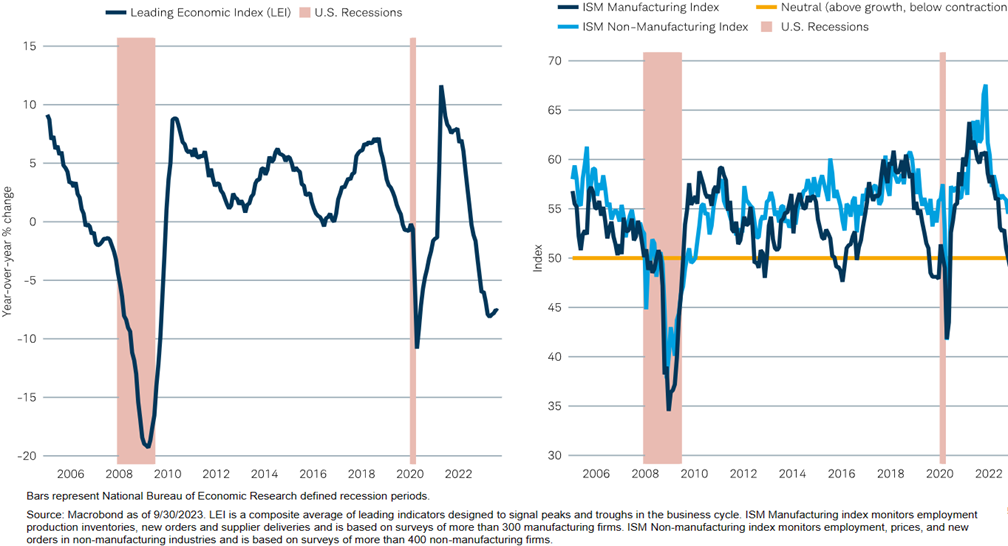

Below, key graphs depict a slower economy based on the 10 leading indicators, and especially the ISM Manufacturing Index, which typically are indicators of a recession to come. But based on history, we would already be in a recession, especially when you couple with the inverted curve. So why has the economy stayed so resilient and continued to grow at a very healthy rate of 1.1% 1Q23, 2.1% 2Q23, and 4.9% 3Q23? We will analyze this further.

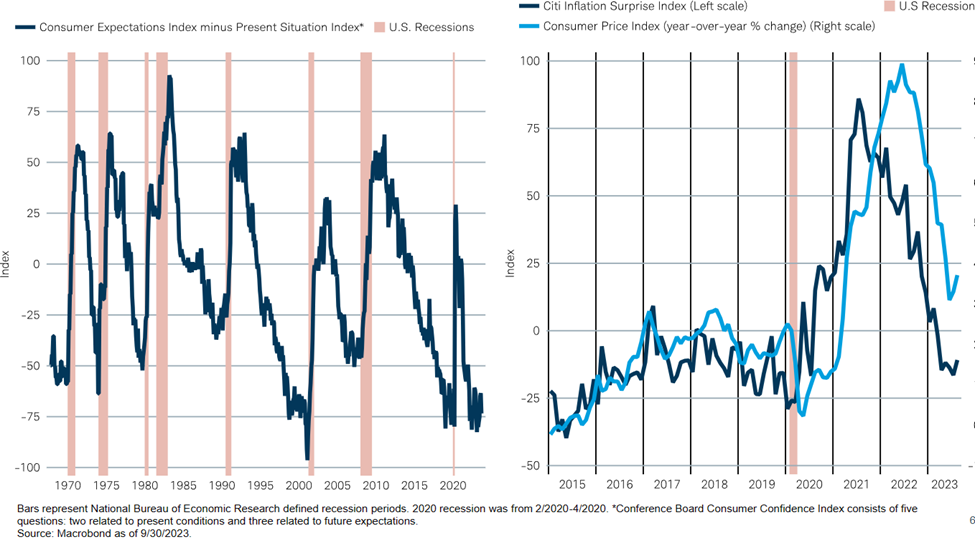

One element, that has made the stock markets even more interesting to me, is the consumer sentiment has been so negative according to the National Bureau of Economic Research. And I have felt this, as client sentiment has been fairly negative, with all the cross currents affecting the markets.

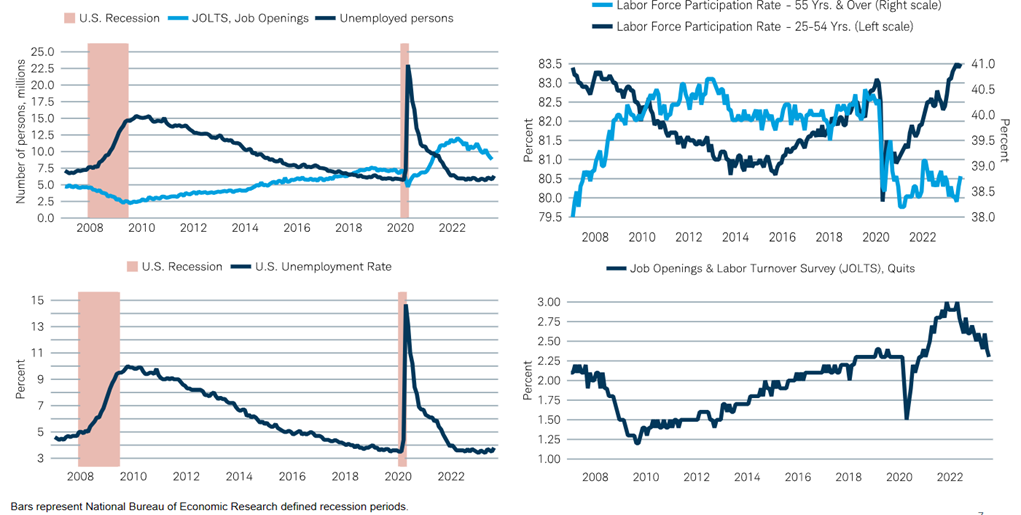

I mean, I think about the headwinds that the economy/markets are facing right now. Geopolitics, much higher interest rates, cost of capital, slowing economy, U.S. politics (almost humorous how divided at times!), and rich valuations, provide serious challenges for these markets. And the amazing thing is the labor market has really been strong, even with these challenges. I mean, it is hard to fathom a recession in the next couple of quarters, unless labor trends really make a change to where unemployment is at least at a 5% level, versus our current 3.9% level. According to CNBC, the lowest rate of unemployment at the start of recession was 4.7% in 2001 and 2007, but has normally been much higher. With that said, there have been many more job cut announcements as of late. So, if there is a recession, I think it is likely to be a rather quick and shallow one, unless the markets are hit with an unknown.

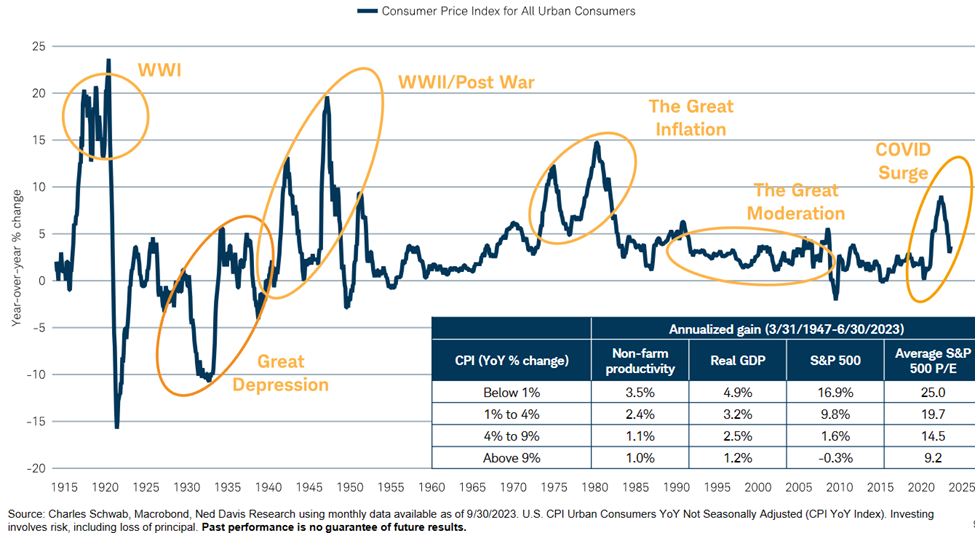

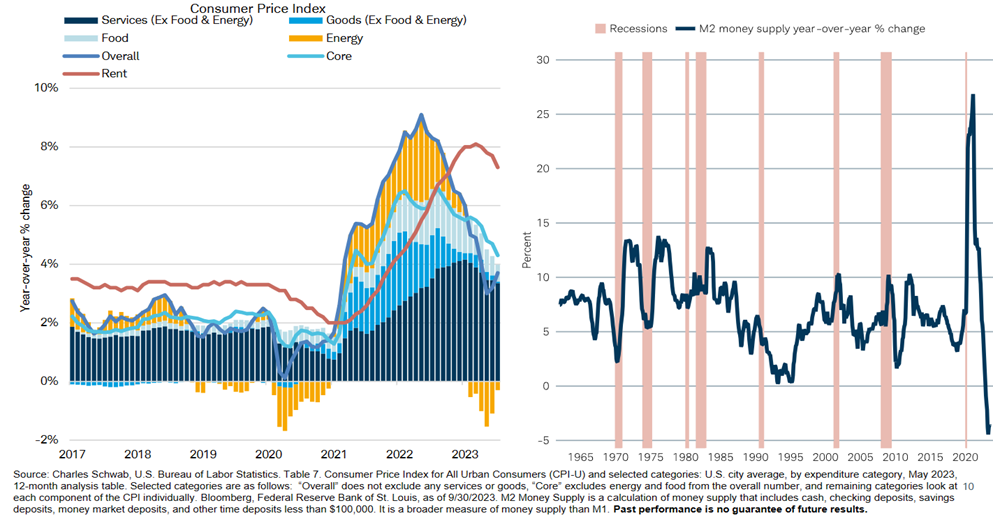

Another reason I am not overly bearish, as I just referenced, there has been a lot of damage already done in many sectors, as at times it has felt like a rolling recession. We now have a much lower CPI of 3.7% according to the government. With that said, keeping below 4% will be critical for markets, as depicted by the graph below, if CPI history plays out like it has in the past.

I still see the four key risks as higher interest rates, inflation, valuations, and geopolitics. But I am seeing inflation go down in almost all areas, and M2 supply has shrunk significantly as depicted below.

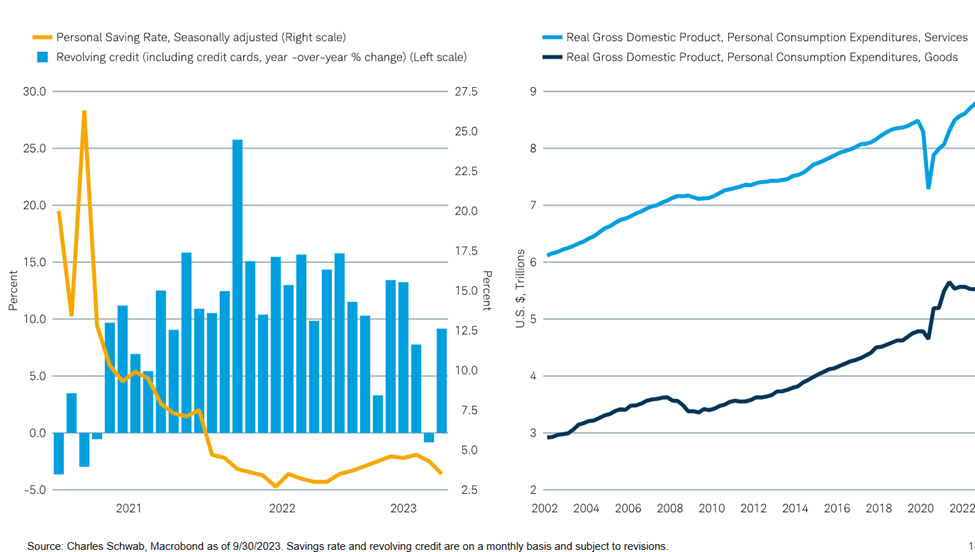

And as the M2 supply has shrunk, so have savings, as people are out and still spending on services.

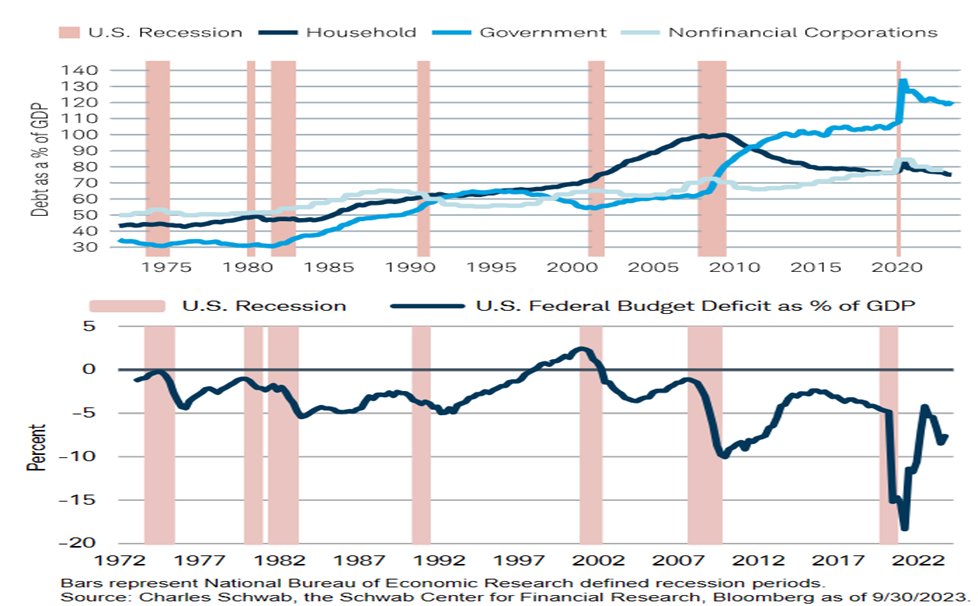

And below the surface, we all know that the federal government is out of control on both the budget deficit and their balance sheet. This must be rectified, or this really will affect the markets at some point.

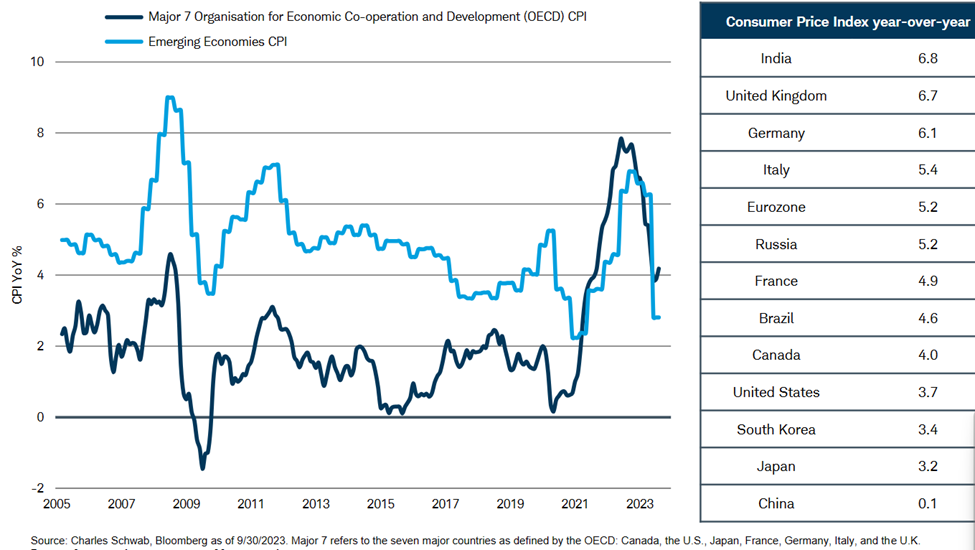

Even though I am neutral to underweight stocks, I do like “our neighborhood” better than others, as inflation has come down rapidly and we all know that rate cuts have “long and variable lags”. These will continue to work their way through the market. Many countries still have a lot of work ahead of them.

I don’t put a lot of faith in the “dot plot” as the Fed has been “so incredibly wrong” in predicting where rates are going. Nobody thought we would go to where we went last year or this year on interest rates, because of Fed forecasts. The main thing we should take from this though, is the Fed Funds rate is going to likely stay higher for longer, which means it will likely be very similar to the equity risk premium for at least another year. This is the main reason, I feel like there are other investments that make more sense than most naked equities.

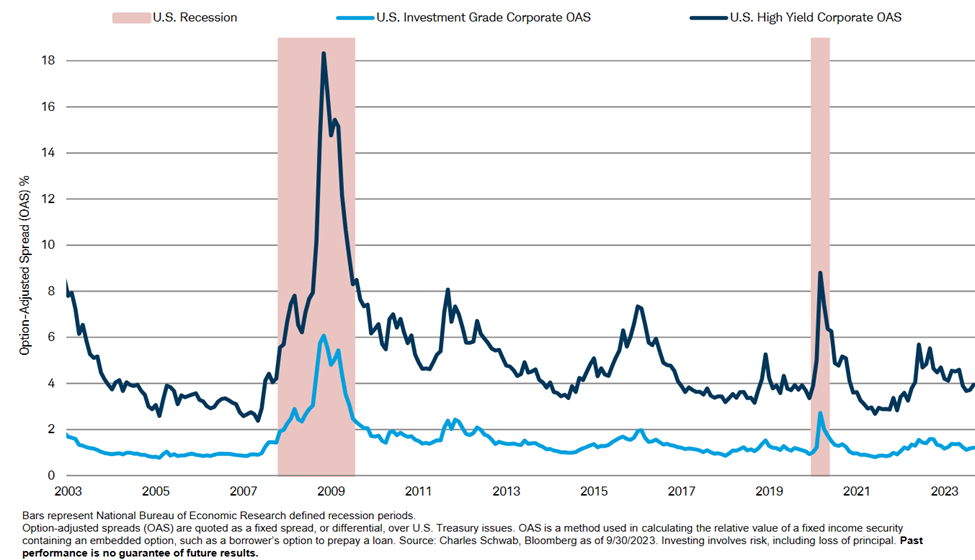

But again, even if I feel like there are many other investments that make sense, I still don’t feel like a “hard recession” is in the cards. I follow many things such as high-yield, the rate inversion, LEI, PMI trends, bond spreads, growth trends, but nothing is more important than option spreads. You can see from below how incredibly wide these get as we start to move through a recession and this hasn’t even gotten close to happening yet.

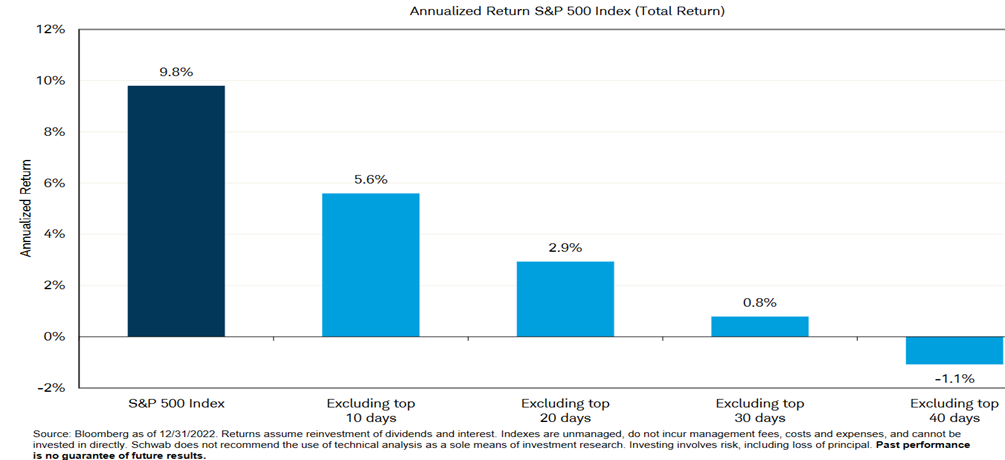

So, you might ask “Hunter, if you are still neutral to underweight on stocks, then why have you not reduced your exposure even more”? As I wrote earlier, a lot of damage has been done in the value areas. On many equity plays I use hedges such as covered calls or buffered ETFs, and Nov/Dec are two of the strongest four months of the year. If you just miss a few days, it can really do havoc to your portfolio.

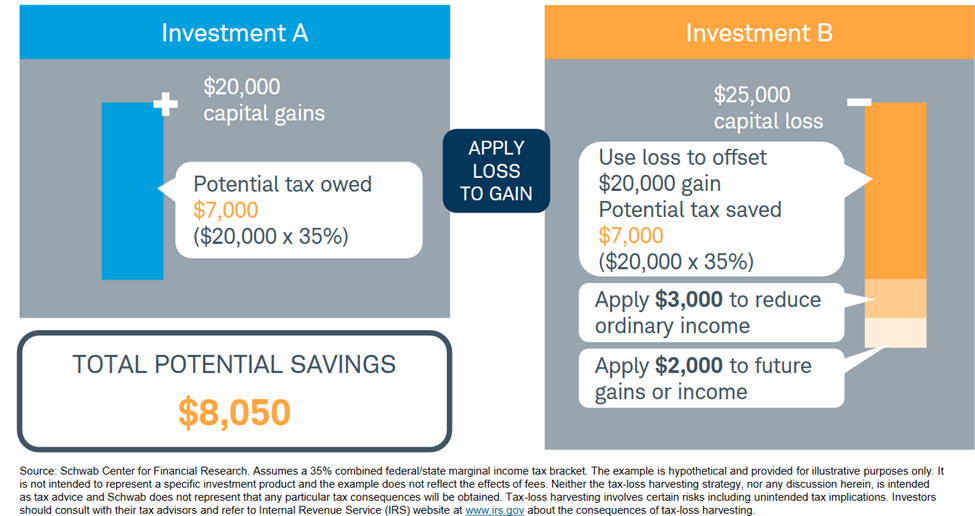

I also want to remind you that this is the time of year when I will try to harvest losses where it makes sense, to bring down overall taxable gains. It really can have a significant impact, so I will likely be more active than normal.

So again, I want you to take away a couple of things from this month’s newsletter. Think about your risk tolerance and do the work with me to ensure you are comfortable with your risk tolerance, if you feel uncomfortable. With these types of volatile markets, this is the perfect time to do so, as we just went through a storm. Second, realize that even if I am not bullish on stocks currently, that doesn’t mean there aren’t many ways to make good money. As I discussed earlier, 2-5 year corporate bonds I am comfortable with are often paying 8% annual returns and you are guaranteed 100% of bond capital back if the firm doesn’t go bankrupt before maturity date. We can make 7-10% in income funds that use covered calls like I do to create yield. I have recently put many of you in buffered ETFs where you can’t lose money if the market goes down 15% or less over the course of a year, but your gains are also capped at 15-16% (not a bad trade in these markets). I won’t go through all the different investment strategies, but there are now many ways to make money, with much higher rates to work with. A guaranteed 5% rate from a treasury or income fund isn’t a bad Risk/ROI in itself, depending on your current situation. Just remember, now is the time to have a customized risk tolerance in place.

Financial Planning:

I have spent a lot of time with many of you on Medicare Plans A, B, and D, and also discussed alternatives like Medicare Advantage Plans and Supplemental Plans. Take the time when your time comes to analyze and make the right choices for yourself on Medicare and Social Security. These decisions affect you for the rest of your life.

Enjoy the cooler weather and have a great rest of your week.

Warmest Regards,

Hunter Hardy CFP®

Sorry, comments are closed for this post.