Dear Clients,

The second quarter was an incredibly challenging quarter and things haven’t settled down until the past couple of weeks. I don’t ever remember a market quite as confused as this one, as there are often significant reversals in hours and certainly reversals it seems every few days. With that said, I believe now is still the time to be defensive, even though earnings have held tough thus far through about 15% of S&P earnings season.

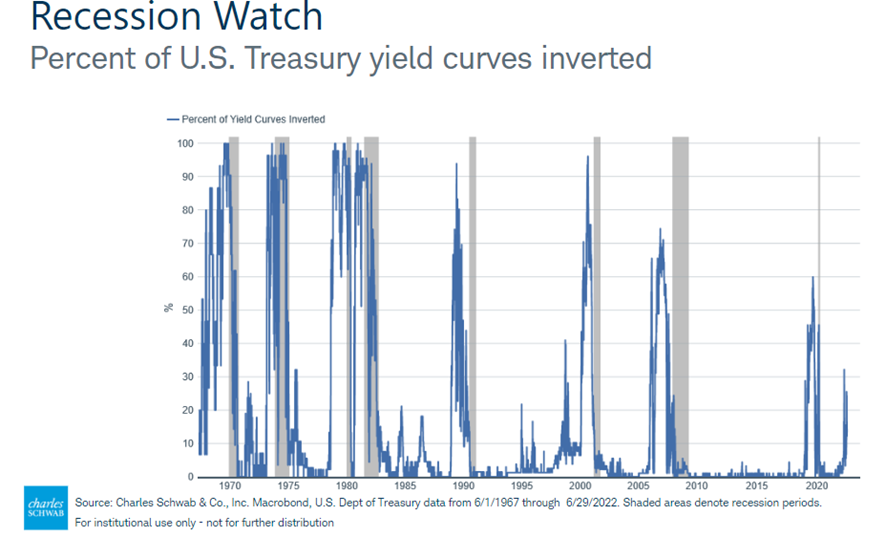

The reason I still remain cautious for now, is I think we still have to get more clarity for the markets to become more predictable. First, I believe earnings will have to come down, at least to where we show very little growth in 2022 (earnings still show 10% growth for both 2022 and 2023). I believe this will continue to come down as analysts are typically late in catching up with earnings revisions downward in a slowdown or recession. Second, I just don’t see how the Fed can back off until they see a serious reduction in inflation. While many experts talk about inflation already peaking (and I do agree that June was the peak), there is still so much work that has to be done to tame inflation. The biggest two issues I see, is shelter makes up about 30% of core CPI and it takes a while to get shelter prices down, as home sales affect rentals/leases and I haven’t seen almost any affect in pricing yet, though housing is definitely slowing. Second, transportation makes up a big part of CPI and I think energy prices will take time to get down to a level the Fed believes is necessary (Fed says they have to get the CPI down to around 2%). With the war going on in Russia, I also think food inflation could remain stubborn around the world. So, while I am seeing inflation rollover in many commodities in a big way (Source: MFS since highs, copper down 34%, wood down 38%, steel down 37%, gas down 36 consecutive days) we still have a long way to go. The Fed Chairman has said there may be some pain here, as Powell doesn’t want there to be any chance of having a stagflation environment which many of us went through from 1978 through 1982. We saw at least 7% inflation for 48 months (Source: Bureau of Labor Statistics) during that timeframe! Now I don’t see anything like that happening this go around, but I do think the Fed is going to be very determined to ensure inflation is tamed. Because of this, I just don’t see how the Fed can contain inflation without pushing us into a mild recession, or at least two quarters of contraction and significant increases in unemployment. With that said, I think much of this is priced in the markets. Additionally, the inverted price curves, the doubling of energy prices, and dollar strength like this are all typically precursors to at least a mild recession. And while the average recession typically results in a drop of around 30.5% on the S&P (according to CNBC which would take the S&P to about 3380), mild recessions typically have a drop of about 25%, so a retest of the lows could very well be tested. Again, the key will also be what the real earnings turn out to be. So, it is my opinion that we will have at least one more swoosh down (likely in 3Q or early 4Q) and now is still not the time to try and be a hero, though there are some areas that look very interesting and “I have dipped my toe in the water in a couple of them”. Let’s take a look at some additional information backing my narrative:

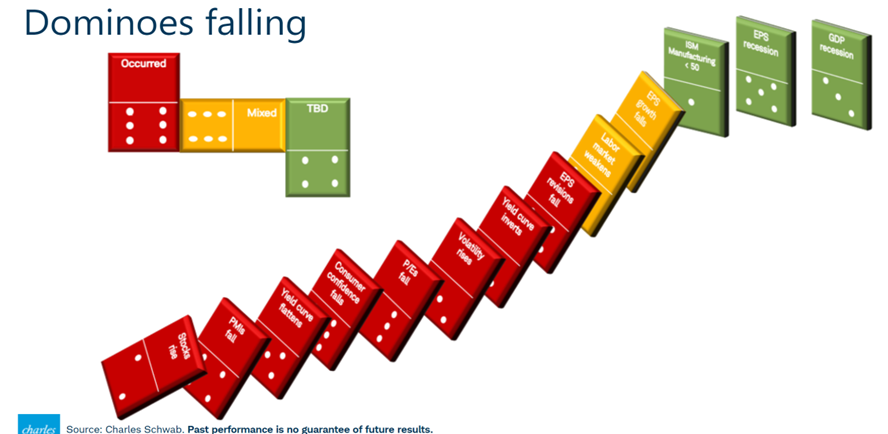

The chart above show how negative feedback loops (which we are currently in), typically affect other areas and usually affect key areas such as earnings growth and manufacturing.

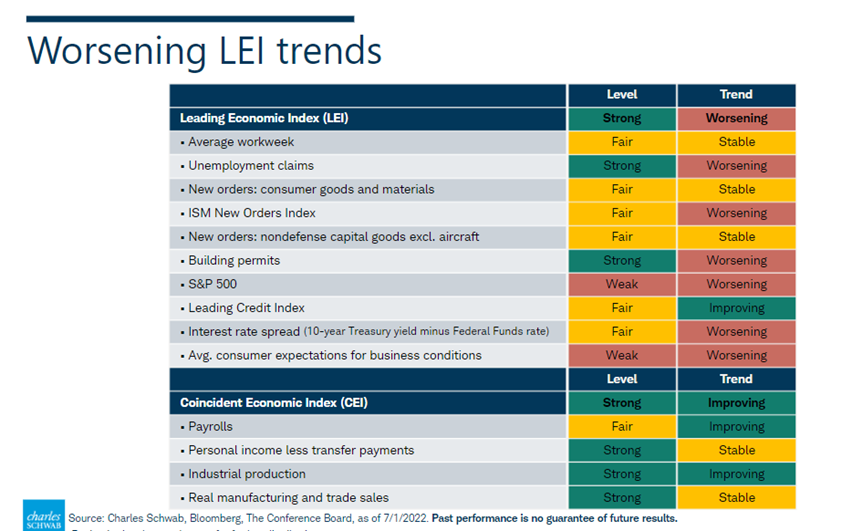

While many trends such as employment remain very strong, I am starting to see a lot of companies reduce hiring and many have started layoffs. Until the Fed pivots, I think some of these trends will ultimately rollover and cause additional slowing.

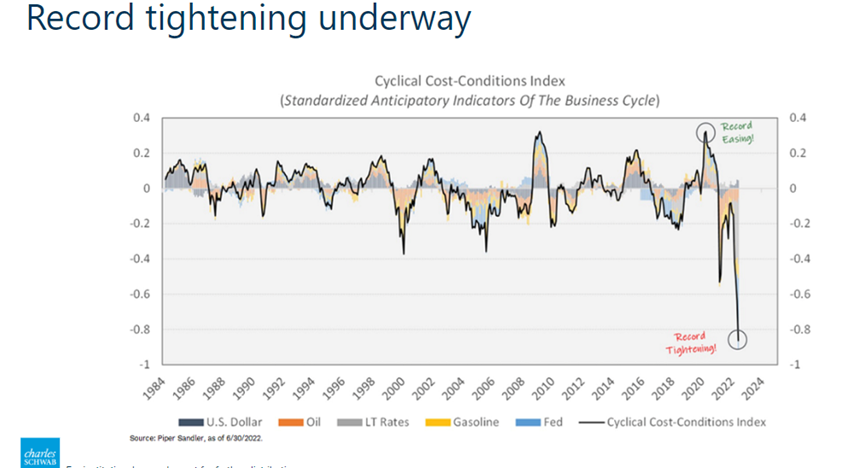

I think one thing that many analysts don’t have a total grasp of yet, is how this Fed tightening is going to affect the market. I mean, we haven’t had tightening in 40 years, so while M2 increased 42% the past couple of years, we are now going through liquidity tightening that has never seen before, in addition to rising rates.

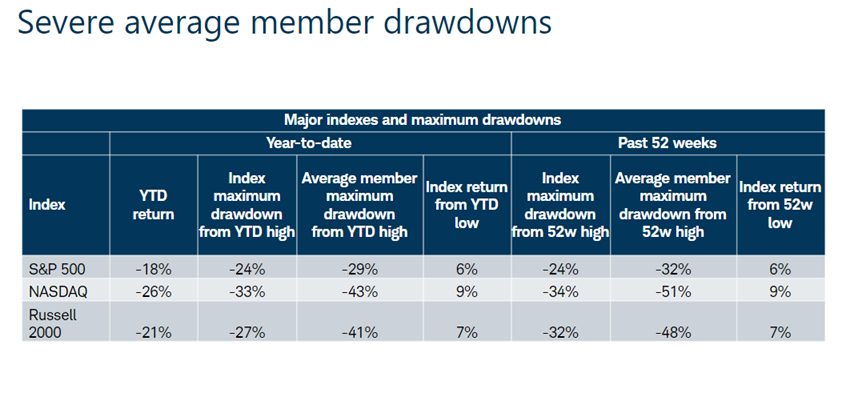

Even with much of the trending still down, a lot of the work on the markets has already been done, which is why one doesn’t need to be as negative on the markets in my opinion. As you can see from below, though we have had a rebound as of late, the drawdowns for the year are still significant.

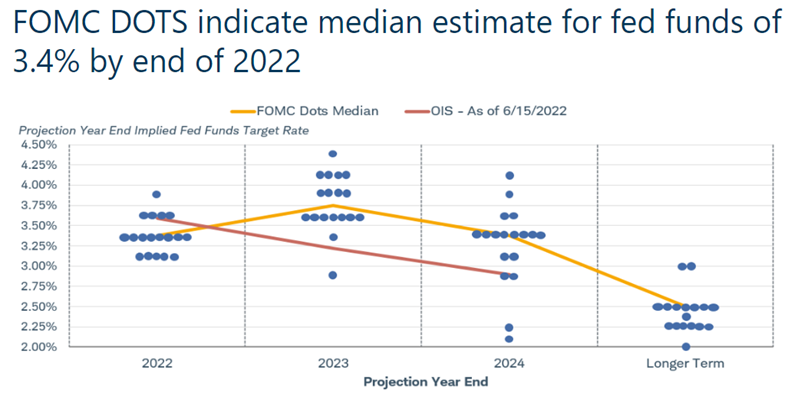

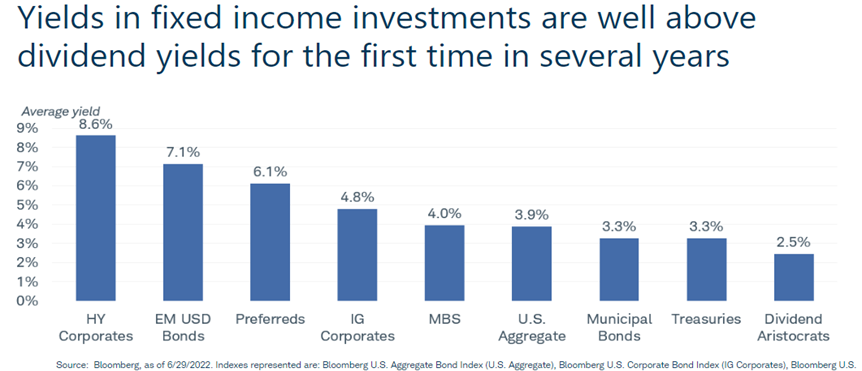

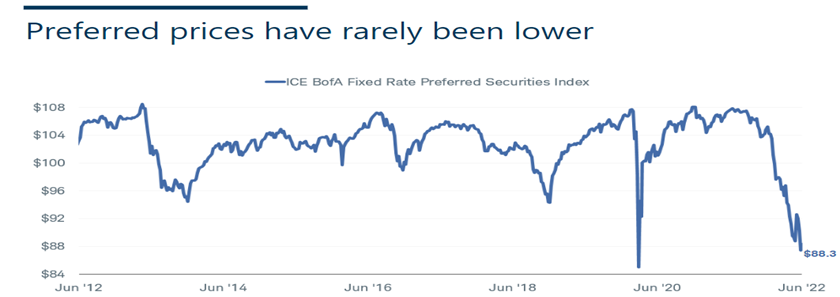

And though the Fed Funds rate has a way to go, the markets and the Dot Plot have finally gotten more in sync. For the entire year, the markets have been screaming that the Fed has to catch up, and that rate increases will have to be much higher than originally thought. This is the main reason fixed income has had the worst years in its history with bonds down on average 12% in 1H22 and 30-Year treasuries down 24% (Source Barron’s)! Because the markets finally believe the Fed has caught up with the projections, I now feel like it is okay to again start investing in fixed income (at least investment grade). Same goes for preferred income. But as you can see from below, the markets now expect Fed Funds to go to 3.4% by end of year and 3.8% by next late spring.

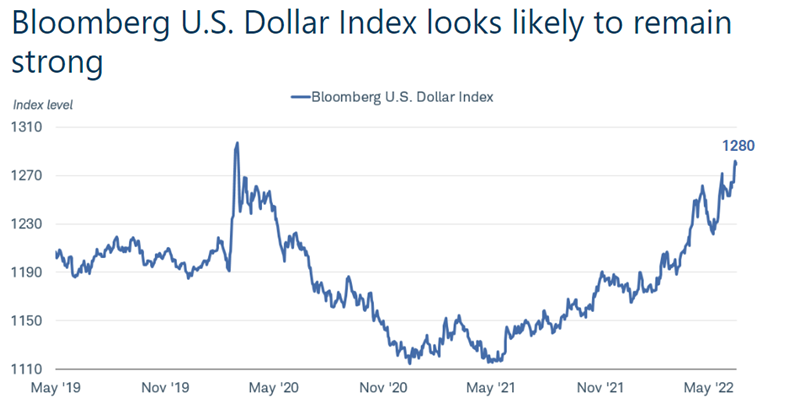

Another area of concern for international companies, is an incredibly strong dollar. This will make it very challenging for U.S. companies to do well in other countries, especially when you see the $ strength at this level. While I think this trend will likely slow, I do think the strong dollar will remain ($ now in parity with the Euro!) fairly strong as the rest of the world looks pretty weak.

This is just one more component that will weigh on earnings for many of the international companies, as nobody saw this kind of $ strength coming. Since the S&P is market cap weighted, the companies that are especially affected by the strong $ (Like Apple, Microsoft, IBM, Starbucks, etc.), will have an outsized effect to on the S&P.

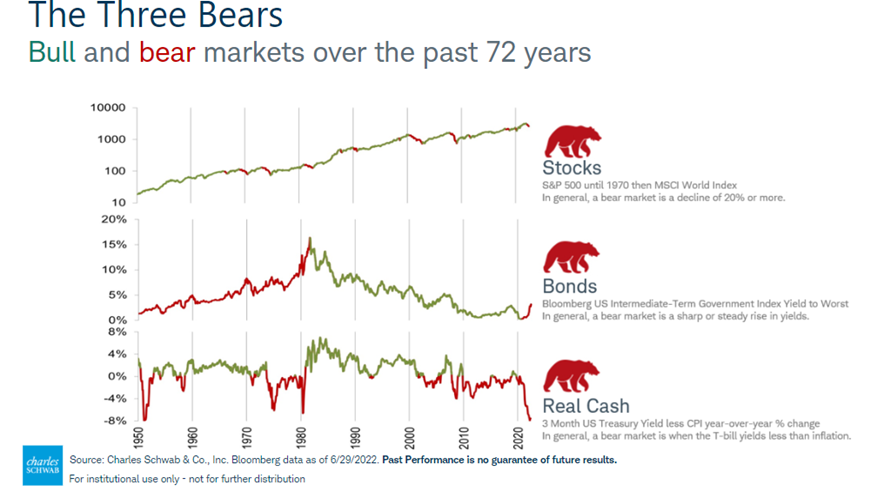

What has made these markets so different and challenging this year, is there hasn’t really been a place to hide when you look at asset classes. Even in 2000, 2008, and 2020, treasuries, precious metals and investment grade fixed income were excellent hedges to the stock markets. This year for the first time in 40 years, Fed Fund rates rising all the way from 0 to 3.4% (and 3.8% next year) and Fed tightening has basically made all asset classes trade off. Stocks, bonds, precious metals, REITs, bitcoin, and even cash have all suffered. As you can see from the chart below this just doesn’t happen almost ever and has wreaked havoc on risk tolerance comfort zones.

And the biggest recession indicator watched by analysts has turned very bearish as of late, as over 30% of all interest rate curves were recently inverted.

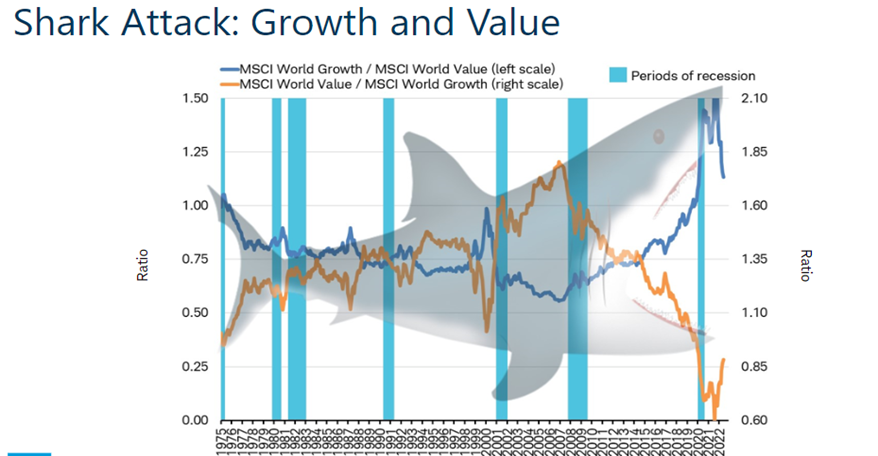

Other changes in the markets until recently, has been value working over growth after a long period of growth outperforming value. I am pretty split in most of my accounts, but growth technology has certainly struggled this year, until recently. Growth at a reasonble value (GARP), has been where I got a lot of my alpha versus the markets the past few years, so this has been a big change.

As I wrote earlier, for the first time in quite some time, I think it is now okay to go back into many fixed income areas as the markets have already moved on the yield side.

I am really starting to add in areas such as variable bank loans, investment grade + bonds, and looking closely at preferred income areas again. Though the preferred income options have a long duration, they also pay much more income yield and can provide some income buffer in challenging markets like these.

So, there are a lot of moving parts, but I think we still have at least 2-3 more months of work, even after the positive price action of the past couple of weeks. First, we have to get more clarity on earnings, as I believe S&P earnings will be reduced to around $225-$230, instead of the current level of $250/share. This will decide the short-term movement in markets in my opinion. But even if earnings go well, I think the Fed will likely come even harder to get inflation tamed. I believe regardless of what happens in earnings, we will have to wait for the Fed to pivot to at least neutral position, before we get what I consider a real bullish signal. I believe that will take some real changes in inflation data. I just believe that the Fed will likely go too far, as it is so hard to get rid of inflation that has become this embedded. Housing and energy have to roll over a good amount before I feel the Fed will become neutral. And I do worry that the Fed will have a very difficult time not moving us into a recession, as their will have to be an interest rate shock to tame inflation to the point of anywhere close to 2%. I just hope the Fed is able to be very balanced, as I do think the “jaw boning” is having a REAL effect, and things will continue to slow and if they overshoot too much a deeper recession would definitely come into play.

I do feel we will hit a bottom this year (likely late this quarter), as we have a lot of things that are starting to give me some confidence for 4Q22. First the markets look 6-9 months ahead and inflation definitely will turn down over the coming months in my opinion, as the Fed likely hikes another 75 points in July and September and continues to tighten $90 billion/month every month. Additionally, credit card and used auto debt is increasing at a rapid pace, which will also slow things down and reduce inflation. Again, one just hopes this doesn’t push us into a longer recession…

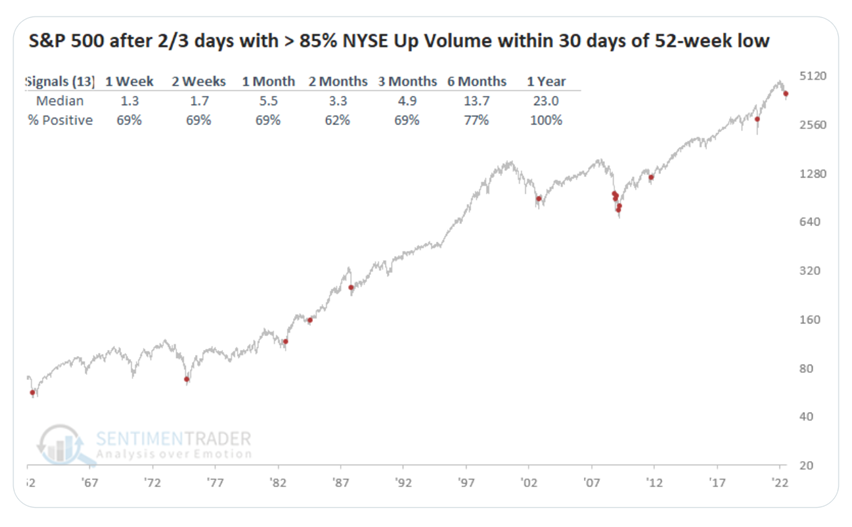

I am much more active during challenging markets, and also follow a lot more technical patterns closely. Over the last 90 years when the S&P has been down at least 15% in the first half of year, the market has been up all six times in the second half of the year (Source: Fox Business). I saw another chart recently that was also very interesting, as it again depicted that since we just had 2 out of 3 days with up volume of 85% or more, the odds are very good that we will be up a year from now.. When this phenomenon happens the market has been up 13/13 times one year later over the last 60 years from market bottoms. And even in great recession of 2008/09 and the 2000/01 the tech bubble, markets were not down for even a two-year period. So, history shows that bear markets don’t typically last even two years unless one goes all the way back to depression times.

Source: Jason Goepfert; Sentiment Trader

So while this latest bear market rally has felt good and earnings haven’t been as bad as many thought (at least so far), I don’t think we are in the clear yet. Therefore, I am continuing to hedge my bets where possible with covered calls, certain fixed income/bank variable loans, and more money funds/cash.

Both earnings reports and the Fed will be in the middle of all the news next week and we will continue to get more clarity. As Always, I will continue to be in the game, just more defensive than normal. I also think sectors such as big tech, financials, and energy will outperform, while consumers continue to be challenged in the coming months. But I will always watch the data and move accordingly if things continue to change.

Hope all of you are enjoying your summer and staying cool. Have a great weekend and hope to talk to you soon.

Best Regards,

Hunter Hardy CFP®

InvestmentHunter Wealth Services

Independent Advisor Since 2008

Sorry, comments are closed for this post.