Dear Clients,

What a brutal month September has been! With that said, this is not unique, in that September is historically the worst month of the year. But, the fact that the S&P is down 8% in September and down 23% for the year, depicts how challenging the markets have been this year. And if you look at markets such as Nasdaq or Russell 2000, those markets are down 31% and 26% respectively. What makes this year even more unique, is the fact that no asset classes have been up (including fixed income, precious metals, REITs, mortgages, Bitcoin). In fact, fixed income is down about 13.5% on average, with longer duration treasuries now down about 30% this year (this will go down as worst year in the history of bond markets). The good news (which I will get to toward the end of this newsletter), is I believe rates have more than normalized, and are likely providing a very viable option to securities. We no longer have to use TINA (There is no alternative), as I believe there will be many opportunities in fixed income going forward.

What really changed the sentiment of the markets as of late, was the Fed meeting announcements which occurred on Tuesday and Wednesday. It was even a more “hawkish Fed”, if that is even possible. It is amazing to me, how wrong the Fed has been for over a year, and how all forecasts have been SO wrong, even when you just consider a year’s timeframe. I think a lot of people thought the Fed would have to pivot, but nobody thought it would change their stance to this level. Just remember a year ago, the Fed was talking about maybe one 25 basis point increase for 2022 and a year end Fed Funds rate of .375%. They are now projecting a 4.375% Fed Funds rate by year end and have had three meetings in a row, with 75-point rate hike announcements. Absolutely unprecedented since the Volker years in the early 80s. This definitely spooked the markets further this week, as the Fed came into the September meeting with “guns a blazing” and “how/when/why”, all becoming more aggressive than previously thought.

What we all saw Wednesday afternoon was a dynamic shift in both projected aggressiveness and shortened length of hikes, which will dramatically affect earnings, which I now estimate will come in around $220-225/S&P by year-end, down from the current level of $241/S&P share. Here was a recap of the Fed announcements.

September FOMC Meeting Highlights

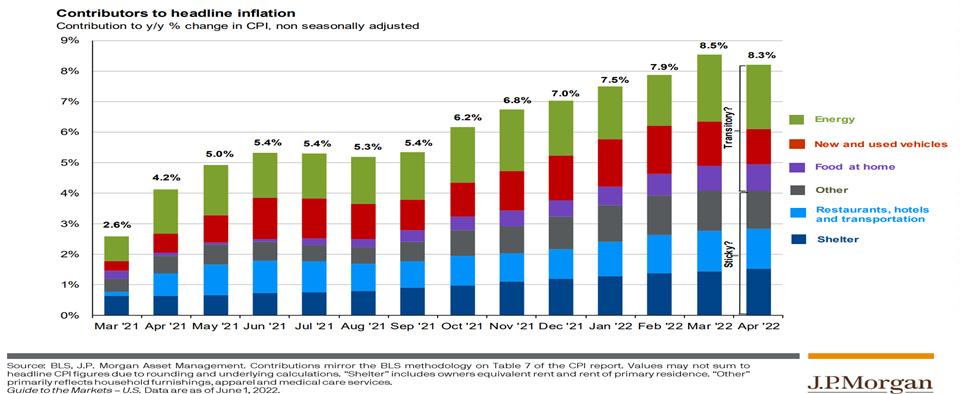

- The US Federal Reserve (Fed) raised its target Federal Fund rate by 75 basis points (bps) for a third straight meeting, resulting in a target range of 3.00 – 3.25% as of Wednesday. The 75 bp move was largely expected coming into the meeting, based on Fed Fund Futures. With overnight borrowing costs now being raised by 300 basis points since March, this has been a very aggressive response by the Fed to recent higher than anticipated U.S. Consumer Price Index (CPI) data. Which is very ironic, considering the Fed’s famous “transitory inflation” remarks multiple times late last year and early this year. Now, I feel like the Fed has gone from way to dovish to way to hawkish, and I feel like they will have to back off some, or very likely face the possibility of putting us into a recession sooner rather than later.

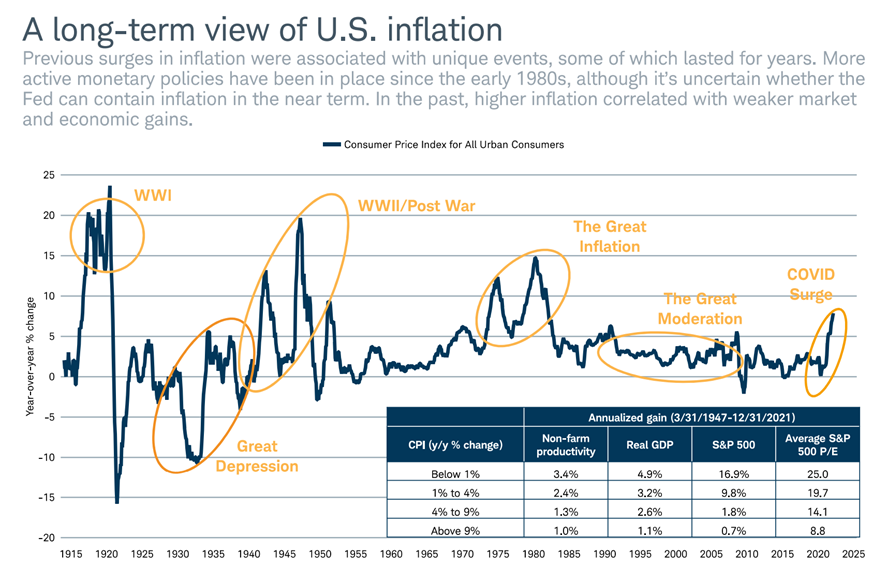

- Based on the so-called “Dot Plot,” Fed officials expect their target to reach 4.25% – 4.50% by the end of the year, peaking at a range of 4.50% – 4.75% next year (by April), up from the previous 3.75% level projected at the June meeting. This spooked the markets and drove the latest selloff this week. My personal opinion is the terminal rate will end up being slightly lower than the projected 4.6% rate, likely in the 4.1-4.4% level. The reason for this perspective as I am seeing inflation slowing everywhere, and in many places falling off a cliff. Housing, just had the biggest slowdown on record, for timeframe from June through August according to CNBC. Energy prices have been down for almost 100 days in a row. Steel, wood, plastics, copper, all falling more than 30% from highs. Ship containers, now seeing rates cut in ½, to a level before Covid started, according to Fox Business. So, the real question for the coming months, is where will we get inflation to in 2023? My view is we will get down to 3-4% next year, which should bode well for the overall markets if history is followed. If markets can get inflation down to under 4% next year, the P/E should again level out in the 17-19 range, as long as we don’t move into a longer lasting recession.

So, while labor and shelter will remain sticky for a little while in my opinion, those are areas which always take time before policy has any effect. Policy has always had a hard time effecting labor/shelter, as those trends are very difficult to reverse quickly. So, I just feel like the rate of increase will be slowed somewhat next year, as the rate hikes work through the economy, which typically takes 6-9 months.

- While Chairman Powell unsurprisingly reiterated his focus on doing whatever is required to contain inflation, he did highlight the potentially positive trends. There are, at least, tentative signs that labor market pressure is easing, along with some other indicators of inflationary economic activity. However, he also indicated that the path towards their inflation target may include both a weaker housing market and higher unemployment.

- However, overall economic activity has remained resilient (which is okay in my opinion as it takes many months for hikes to work through the economy), suggesting that large parts of the economy may not be particularly rate sensitive, creating a dilemma for the Fed as to how to soften price pressures in these areas. Importantly, Powell avoided being overly prescriptive with regard to future policy, highlighting that they remain highly data dependent and will adapt policy as they receive more information. I hope this is really the case, as I still feel like the Fed is not looking at future trends enough. It just appears at times that academic data from the past, trumps macro-economic data trends of the future. But I will try not to get into my personal perspective too much, and hope that all data is analyzed for future decisions.

- The other issue for many international companies, is the US dollar continues to strengthen, even as the rest of the world increases rates also. The $ has basically gone parabolic as depicted below, which can put a drag on earnings elsewhere around the globe.

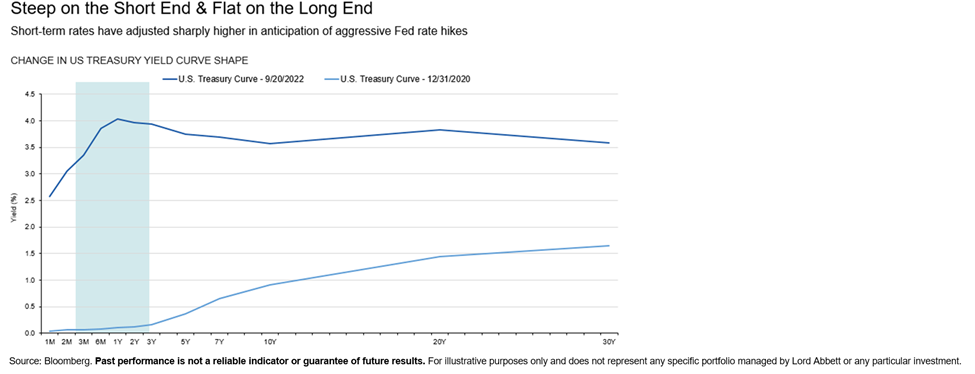

- One-year US Treasury yields have risen above 4.2% while 10-year Treasury yields have remained stubbornly around 3.6%, leading to a further inversion of the yield curve. It should be noted that initial reactions to recent Fed meetings have often reversed themselves in the days following the meeting, as the market continues to digest new data.

- While aggressive Fed actions has resulted in sharply higher yields in the short end of the curve, market pricing suggests that inflation will moderate relatively soon, as illustrated in the 5 year / 5 year forward inflation swap. However, I believe there is a risk that inflation may persist stubbornly on shelter (makes up 30% CPI) and labor, and that investors are not currently being properly compensated for that risk in longer dated US Treasury yields. Given the shape of the yield curve and the uncertain outlook for inflation, I believe most investors would want to reduce the duration of their high-quality bond allocations and take advantage of elevated yields on the short end. At least for now…

Even though these yields are now outdated since they are 3 days old, the current higher short-term yields offer an attractive entry point for investors, and an opportunity for income with lower volatility and less rate sensitivity than intermediate core bonds.

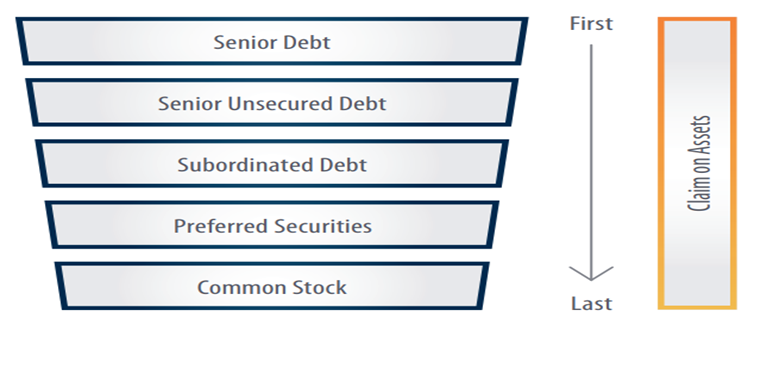

The Good News: With that said, I am finding some incredibly discounted bonds with just 3-5 years until maturity, with annual returns of 7-12%, just by getting back to PAR by maturity date. When cash flows of these companies are strong, and there is little chance of bankruptcy for investment grade bond holders (4% during distressed timeframes) are basically guaranteed PAR and will be rewarded for waiting just a short period of time. Bonds are higher in the hierarchy of asset claims, so even during bankruptcy one gets the majority of principal back with bonds, which is not the case with equities. I haven’t seen these types of opportunities in fixed income over the past 13 years and will be taking advantage of this in the weeks and months ahead…

The Fed has to get the projected Fed Funds rate down to the inflation level, before markets typically rally. I think this is likely to happen very soon.

In the last six bear market recessions, the markets typically rally within weeks or months (1970 was the only time it took months; source: CNBC), of peak inflation, which I believe is definitely behind us. This is why I believe there is a good chance for a rally in the last couple of months of this year in equity markets, especially since November/December are typically two of the best months of the year.

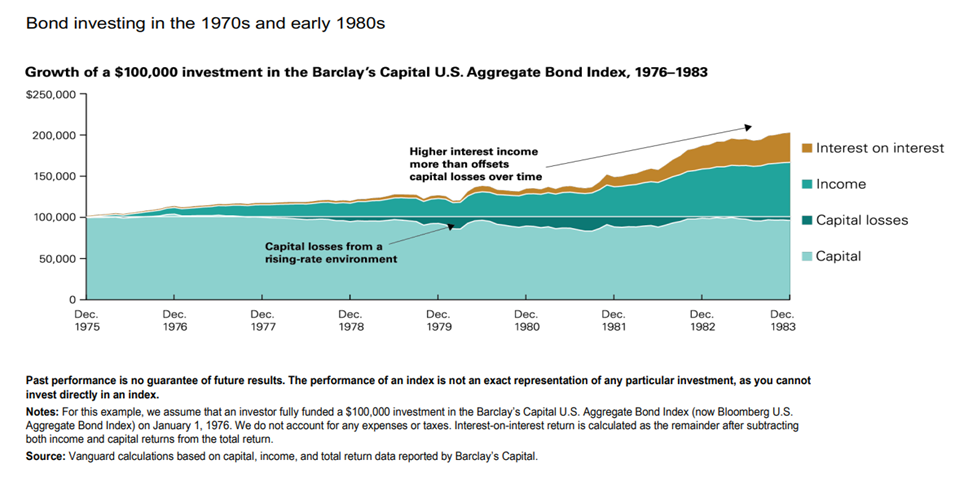

I believe fixed income will play a bigger role than it has over the past decade as I noted above, there are many excellent prospects. So even though rates have risen and could continue to rise (though I do not think that will happen much further), the “power of compounding” effect of additional income will likely make this a good time to get heavier in this game, even if rates do rise somewhat.

While I believe that inflation will come down to about 4.5-5% by year end, as I wrote earlier, shelter will still likely make up 30% of overall inflation and will be the very sticky part of inflation that it takes many quarters to get down. That is always the case with shelter. Additionally, labor costs are not something that are reversed quickly. Contributors to headline CPI are depicted below:

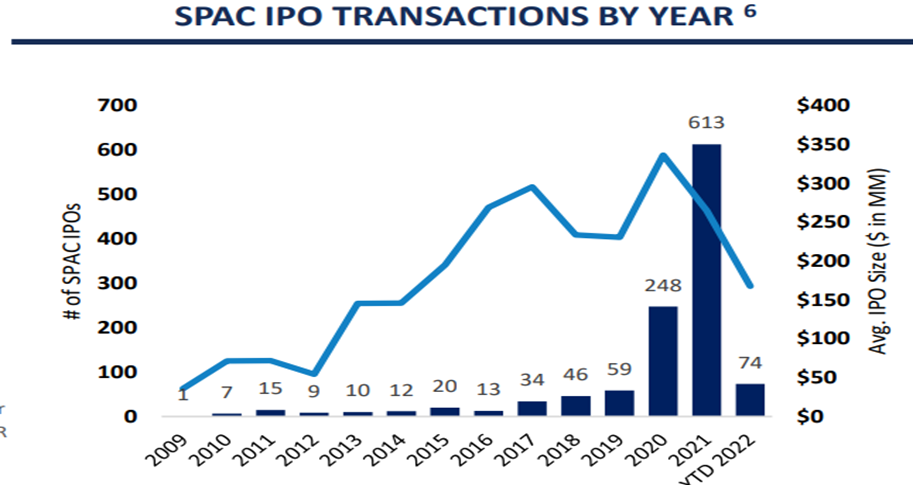

In fact, everything seems to be slowing down the past few months. As depicted below, the SPAC market has basically dried up and gone away, after a “blockbuster” year in 2021. This really does seem to have affected all risk assets, as bitcoin, Cathie Wood’s ARKK, and the majority of small growth have all been cut in half this year. And other areas such as commodities (even precious metals which used to be an inflation hedge), have seriously corrected.

I also feel like many people will feel less wealthy, as the average person uses 10% of home equity for discretionary spending (such as trips and remodeling), and equity will very likely be lost in the housing sector as home sales and refinancing dry up. In fact, re-financing mortgages has gone from 67% of all mortgages, to less than 25% of all mortgages according to Redfin. I mean, why would anyone refinance right now?

Higher mortgage rates usually push homeowners to repair and remodel existing homes rather than buy another home. According to data published by Truist, there are roughly 128 million existing houses in the U.S., with about 5 million turning over in a typical year. Higher rates should slow turnover in existing homes. Furthermore, approximately 37% of homes in the U.S. are owned outright, having no mortgage (according to Truist), and 90% of existing mortgages are fixed, which could insulate existing homeowners from higher mortgage rates.

So, what is the bottom line?

As I wrote in my last newsletter, I believed we would retest the June lows, and we were literally right on top of the 3666 closing low level of June 16th yesterday. We closed just slightly above that level, but I believe the markets will selloff further before finding a year low, in the coming weeks. The markets have done a lot of work repricing things, though I still believe two things have to happen, for us to reach a bottom. I still think we need a little more clarity on what REAL actual earnings estimates will end up being. As I wrote earlier, I believe the S&P earnings will be reduced to around the $220-225 level, from the current level of $241/share. If one puts a multiple of 15-16 on that, I think we are close to putting in this year’s lows, though they will likely be another 5-8% lower in my opinion, as markets always overshoot.

I think next year will be cloudy until we get more clarity on inflation and whether the Fed will also take a small pivot to also focusing on a potential recession. The markets must feel like the terminal rate of 4.6% is actually the high, or markets will be repriced further.

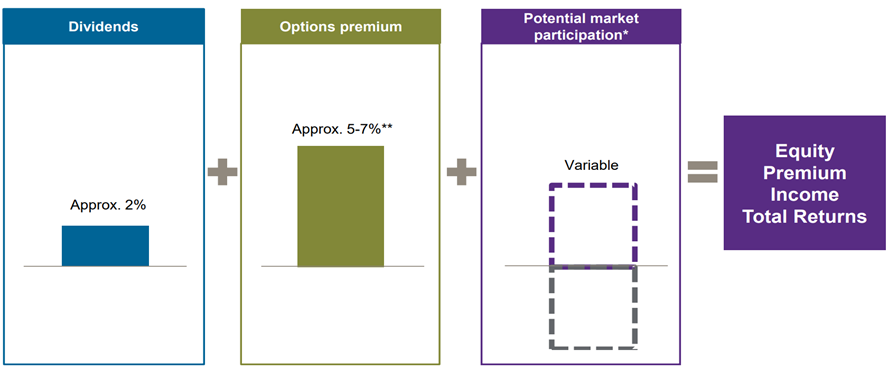

As I wrote above, I see many opportunities in various areas of fixed income, which should give a hedge for the first time in three years. Additionally, I feel like having an income buffer for the downside is very important with equities. There are multiple ways to do this. First, dividends matter a lot, and there are a lot of energy/healthcare plays with annual dividends of 3-9%. I am also finding that covered calls are providing significant income premiums and keep one in the game as we try to buffer the volatility. Just average dividends and options = 8% extra in one year, and I am getting much higher premiums in technology and energy on options which will result in overall income typically in the 11-15% range. I will continue to use this strategy as I have the past 5 months.

Additionally, I think many energy, technology, and financial companies are setup for a strong end of the year and 2023. But I do believe caution is still very appropriate for now.

Take energy for instance as one example of having secular momentum. Energy, makes up 4% of the overall S&P, but had 9% of the profits this year thus far (Source: Fortune). 3 of the 5 companies I own have paid special dividends averaging about 5% extra/annually. They literally don’t know what to do with all their profits. Additionally, energy companies have had record profits, while the SPR has been drawn down to the lowest level since 1984 (Source: CNBC). Additionally, China has been in a lockdown, hurricane season has just begun, and Russa will use natural gas as a weapon against Europe as we enter the winter. Any hiccup with any of these would push a tight supply to a level that would have a significant impact on pricing in my opinion. And while I have heard that demand in energy will likely slow significantly if we enter a recession, demand for energy rarely slows much (only 9 times in over 50 years; Source CNN). I know Friday was brutal for this sector, but markets are just good at overreacting and getting investors to let fear drive short-term decisions. If everything doesn’t go just right with the issues above, I again think we could see real price appreciation, though that is needed for strong returns. I could put together a very strong thesis for technology or healthcare, but I won’t in this newsletter.

Key indicators I am also watching very closely are the 2-year yield and $ strength going forward, as both have been key indicators to the market for the past several months…

While I am still not bullish yet, I do not believe now is the time to get too conservative. I like the fact that pessimism is at one of the highest levels since 1987. Over 61% of those surveyed by AAII are bearish right now, which is much higher than the 30% average. This is actually a good indicator for the markets and has always resulted in higher overall markets one year later when at these negative levels (9.5% increase in overall S&P average the last five times there has been this kind of pessimism according to AAII). Additionally, Friday was a 10/1 losing day, which had the real effect of a liquidation day, which I believe the markets are close to giving us a real opportunity. This is with the caveat that the pain is not over yet…

Lastly, we must not forget as I wrote above, that not only is November/December seasonally a strong time for the markets, but this is especially so, after a mid-term. Getting some clarity on the political front, is always a positive for markets.

Financial Planning Discipline

In this newsletter I wanted to remind clients why the overall Life Planning picture is SO important. Let me give you an investment/tax discipline that can have an effect on both Social Security and Medicare premium payments for the rest of your life. This can be important as a single filer and even more important when filing jointly? So why would this be?

So later in life, each of us pays taxes on income we receive, which will ultimately include social security and RMDs from IRA accounts. We also pay Medicare premiums based on our income (commonly known as IRMAA). Once one reaches the age where Social Security is received, one is typically taxed on 85% of the income they receive, so this can also push an individual or couple into a different marginal tax bracket (especially when both spouses are receiving SS income), in addition to potentially pushing one into a higher IRMAA Medicare bracket. This is one of the reasons I like moving money to Roths, when given the opportunity. By converting or investing in Roths, money is taken out of IRAs (which is taxable when income is distributed) and put into an account that will never be taxed again, regardless of whether one takes Roth distributions. This gives me the option to take distributions some years for clients out of their IRA and some years out of their Roth IRA, depending on the overall tax/Medicare ramifications. Additionally, it is always best to move money into Roth IRAs after big corrections, as tax-free returns are much more likely after a significant correction.

Also, this gives one flexibility, because once we turn 72 we have to take (RMDs) required minimum distributions out of our IRAs, which automatically adds taxable income. This is not the case with Roth IRAs. The above discipline is one more illustration of how Life Planning is so interconnected.

Excellent Opportunity to lower overall Cost Averaging: Whether you give to a 401K/403B, give to your investment account, give to a grand child’s 529, etc. now is not the time to back off of this discipline, if you have even a 2-year time horizon. Bottoms are impossible to pick consistently, but one can be sure that when we have corrections of 20% or more, 2 years down the road we are always in a better place. Look back at Covid, 2008/09, 2000, 1987, 1974. It always turns out to be a great opportunity to lower overall cost basis, even if the markets go down another 10%. Don’t think this time is going to be unique, because it very likely won’t be. I assure you I will be adding to all of my grand children’s 529s before the year is out.

I know this has been a very trying time and can cause tremendous anxiety as you plan out your future. Just remember this happens every 3-6.3 years on average, and there is always opportunity that comes out of these times, if we don’t let “recency bias” affect our future decisions to heavily. Still a lot of uncertainty, but also beginning to be a lot of opportunity in certain areas.

Have a good weekend,

Hunter Hardy CFP®

InvestmentHunter Wealth Services

Sorry, comments are closed for this post.