Dear Clients,

In a year of slippery markets, the tape has shown itself to be surprisingly sticky as of late. The indexes did have the worst week since September last week, with the S&P 500 skidding 3.4 percent from almost exactly the perch that technicians would have bet, a level just above 4000 that marked the invisible but so far impenetrable downtrend line from the Jan. 3 market peak. The S&P has hung around the 3,900-4,000 mark the past month, as it waits to see if 1) Inflation is cooling and how fast; 2) Hear if the Fed is also looking at a recession as much as inflation; 3) See if earnings are going to have to be stated downward as much as many experts think. The S&P is basically at the same level where it settled Nov. 10, the day stocks rallied on a softer-than-forecast consumer price index release. Just waiting for the next report which came yesterday…

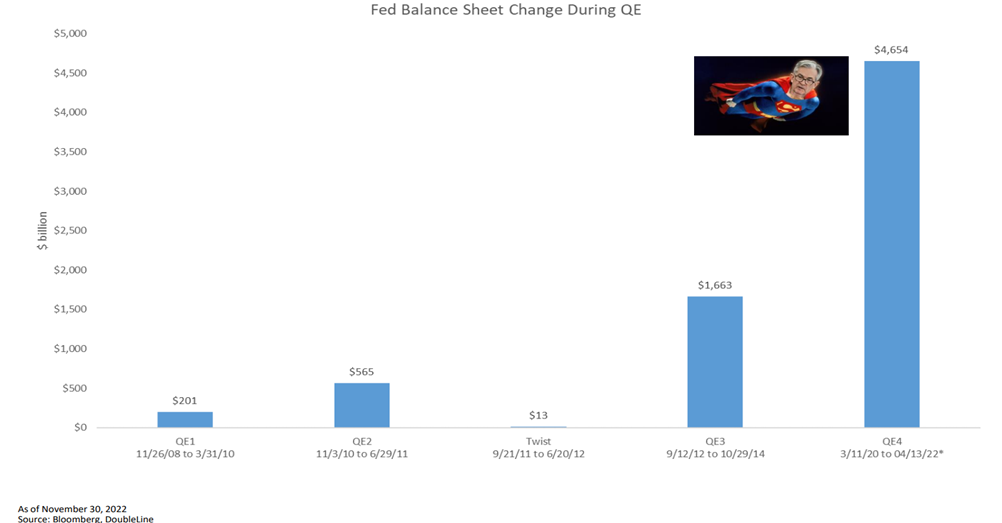

The S&P is at almost exactly the same place it was about seven months ago. Sideways for seven months, during which the Federal Reserve has lifted rates another three full percentage points, S&P 500 earnings forecasts for 2023 have fallen 8%, the Fed balance sheet has shrunk by $400 billion as many growth companies, IPOs, SPACs, and bitcoin collapsed. Easy to forget that over $7 trillion was added to the balance sheet in a very short time period.

So, are the markets being resilient or complacent? I actually feel like the equity markets have more work to do in 1H23, but believe other assets such as fixed income will have a very good year. So, before I take off on this narrative, let’s look at the positives and negatives and then go into some detail. First, there has been a good deal of excess that has been wrung out of the equity markets. As I just wrote, I also haven’t seen this kind of fixed income opportunities in about 15 years. So “there is an alternative this year” and TINA (there is not alternative), is a thing of the past for stocks. Stocks will have competition this year and I actually believe fixed income will do better than stocks in 2023. Especially if a portfolio is put together correctly. I have spoken to many of you about many fixed income opportunities that are much lower risk than stocks that offer 7-9% with maturities of less than 5 years in many cases. This is where I have been investing a lot in the past quarter and will continue to do so well into 2023. Another checking of the box is the projected S&P P/E ratio has moved from 22 to 18 as of this morning (at least if you believe estimated earnings for 2023). But I just don’t believe in the numbers yet. I actually believe 2023 estimates will come down to about $215, as rate increases continue to slow down many areas of the economy. And if you take today’s S&P and divide by my estimate, the S&P is currently at around 18.8, which is just too high in my opinion, especially in a market that has to cool off after all the rate increases take effect.

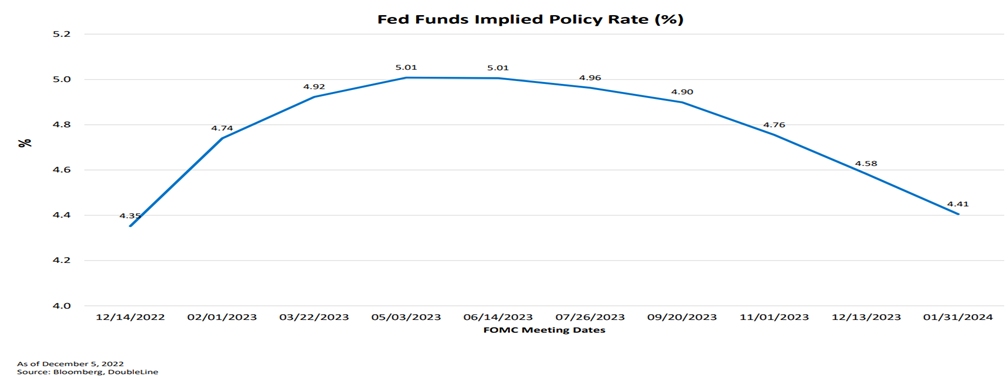

It appears the terminal fed funds rate has topped out, but is inflation dropping at a much faster rate than earnings are deteriorating? That is the big question and again why I think fixed income, significant dividends, covered calls, and active management will all be keys to success in 2023, especially the first half as markets give more clarity on Inflation/Fed/Earnings. As you see from below the Fed Dot Plot has a terminal Fed Funds rate of just over 5%, then the Dot Plot expects that the Fed will have to lower rates as we get further into 2023.

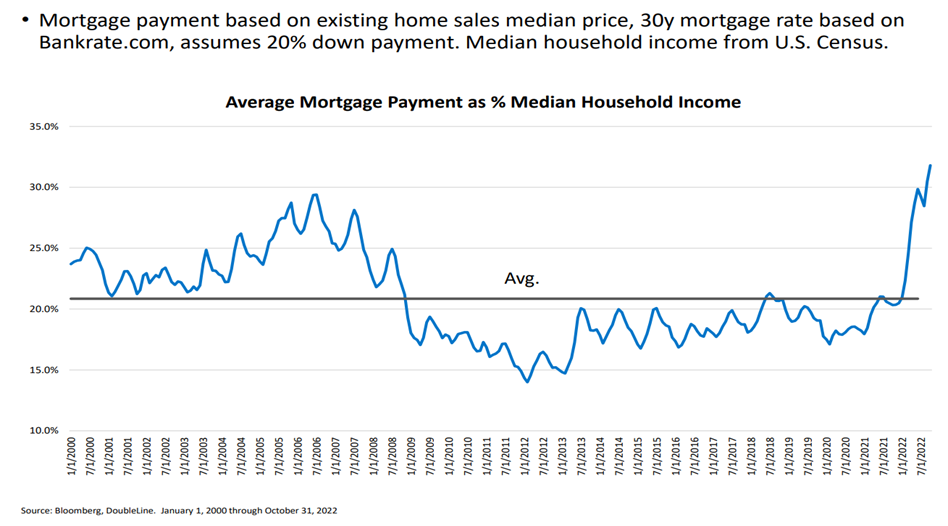

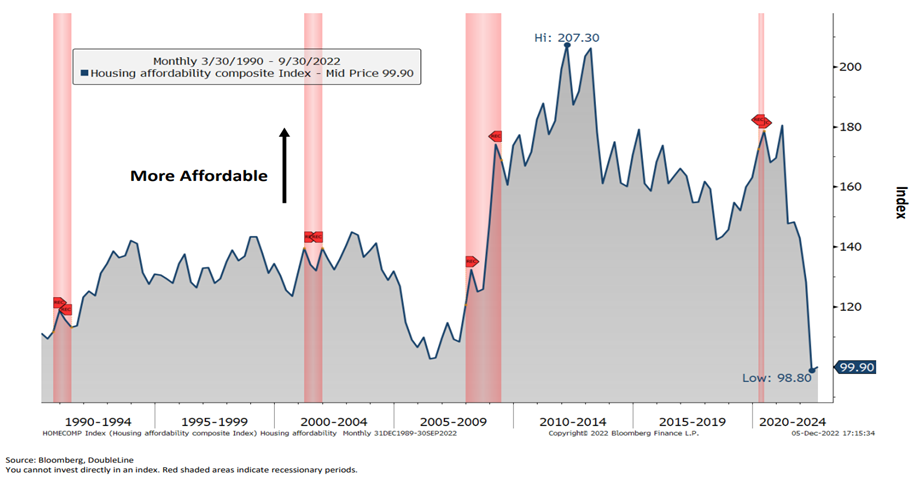

I do agree, that I think the Fed will have to back off as I think many inflationary components are falling very fast like metals, woods, containers, energy, etc., as depicted by the latest CPI report yesterday. I am also seeing a significant slowdown in housing, as appreciated values coupled with the incredible move in mortgage rates has pushed many buyers out of the market. I advise clients to always keep mortgage payments/utilities to 25% or less of overall expenses, so seeing this chart shows the incredible stress mortgage payments are putting on home owners who don’t have a fixed mortgage.

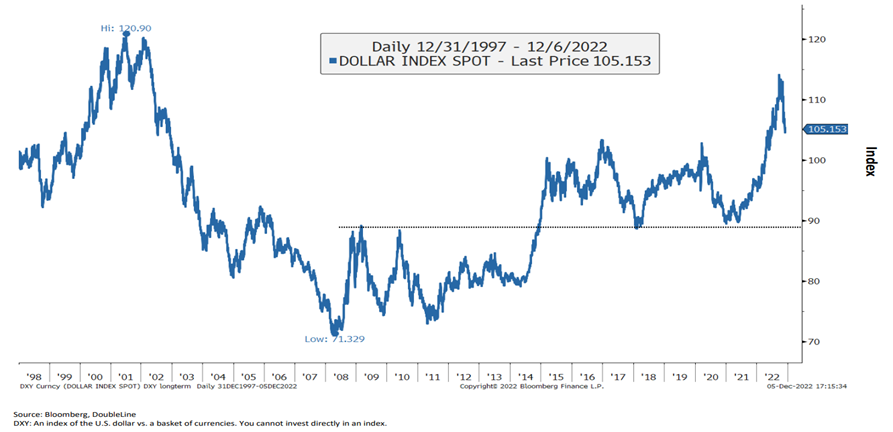

I will admit there are many things about the markets that will ultimately help the stock markets, such as supply chain issues improving significantly, the dollar has weakened after an incredible runup (which is hard on international companies), and a strong “services consumer” that is still very eager to get “out and about”.

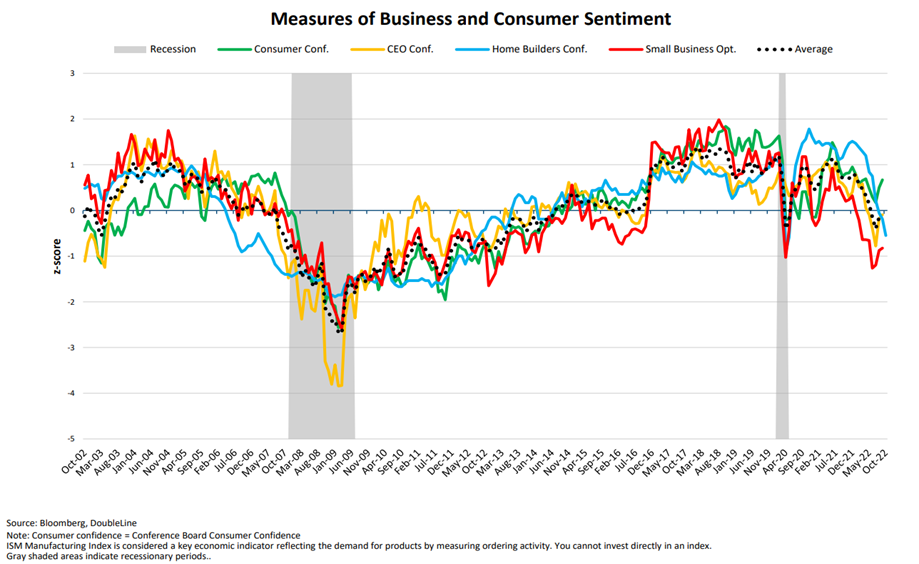

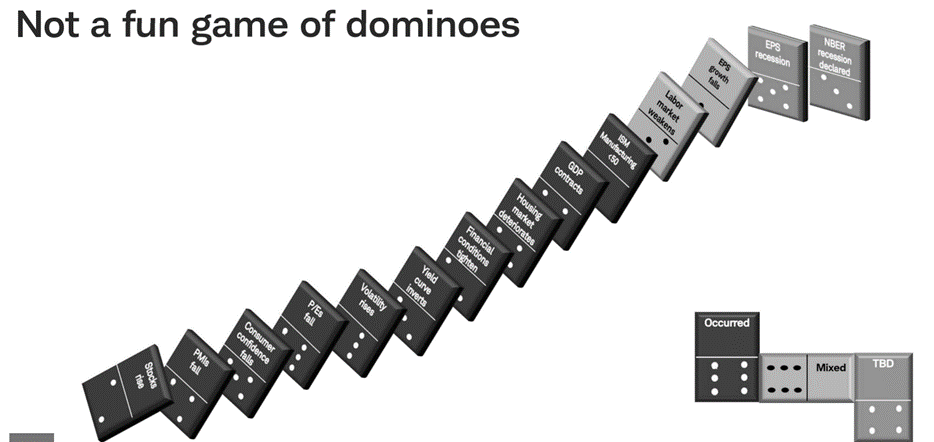

With that said, I don’t see how there won’t continue to be a slowdown and likely at least a mild recession which I don’t believe is priced into the equity markets. Let me give you additional data that almost always occurs prior to a recession, which always leads to a reduction in earnings estimates.

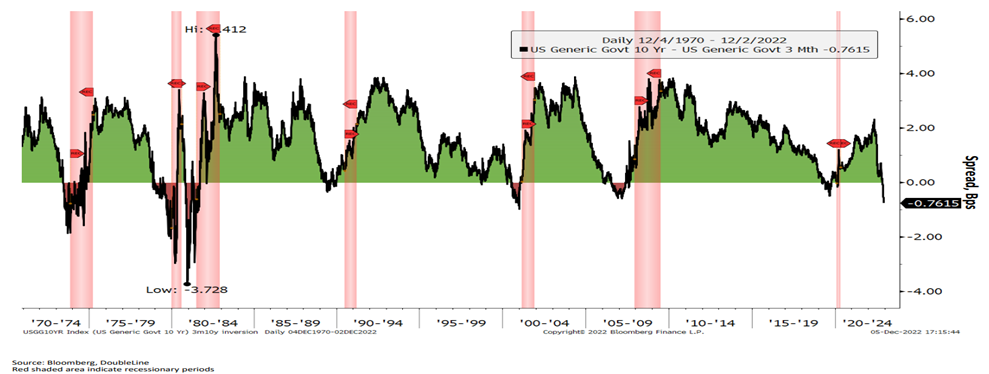

First, virtually all parts of the interest rate curve have inverted, with both the much following 3 mo/10 yr and 2yr/10 yr very inverted by almost 80 basis points. As you can see going back to the 70s, we have never been inverted this far without at least a mild recession to follow, even if short in duration.

The indecisiveness of the markets mirrors the mixed macro messages swirling around. Longer-term Treasury yields are down hard in the past month, the 10-year sinking from 4.2% to a low last week under 3.5%, as at least the bond traders have all but moved beyond the inflation scare, taking a strong monthly wage-growth number and an upside surprise to producer price inflation in stride, moving economic-growth outlook to the status of top worry.

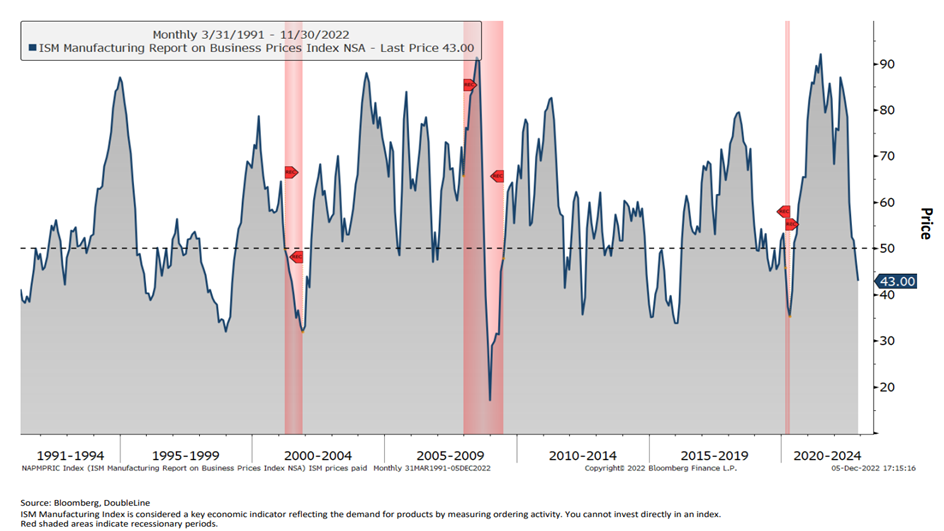

When you couple what the bond markets are telling us with the inverted yield curve and couple that with manufacturing data, it is very hard to doubt we are not in a slowdown as we speak. This is illustrated by the manufacturing data below and is often, but not always a precursor to a recession:

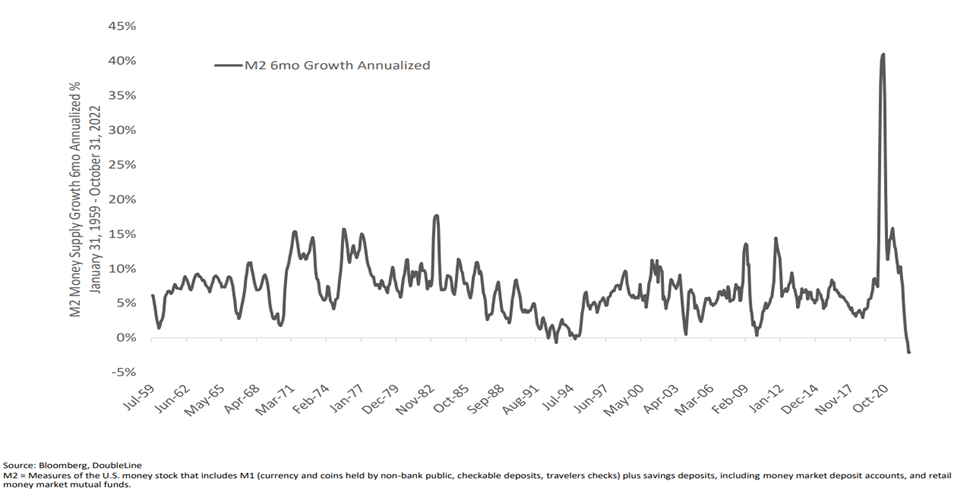

As the interplay described here suggests, the path to a positive outcome is pretty delicate, with multiple variables having to cooperate in a timely way. Certainly plausible, at least relative to how equity markets are priced, which is very fully in my opinion. Add in the fact that M2 growth has “fallen off a cliff”, as the Fed continues to tighten, and the bearish stock market narrative remains strong for 1H23.

This sums to a picture of a broadly slowing economy, and yet the starting point is at such a high level of activity: goods demand, consumer savings, corporate profitability, employment, so that we have more buffer for conditions to worsen without getting truly bad for some time.

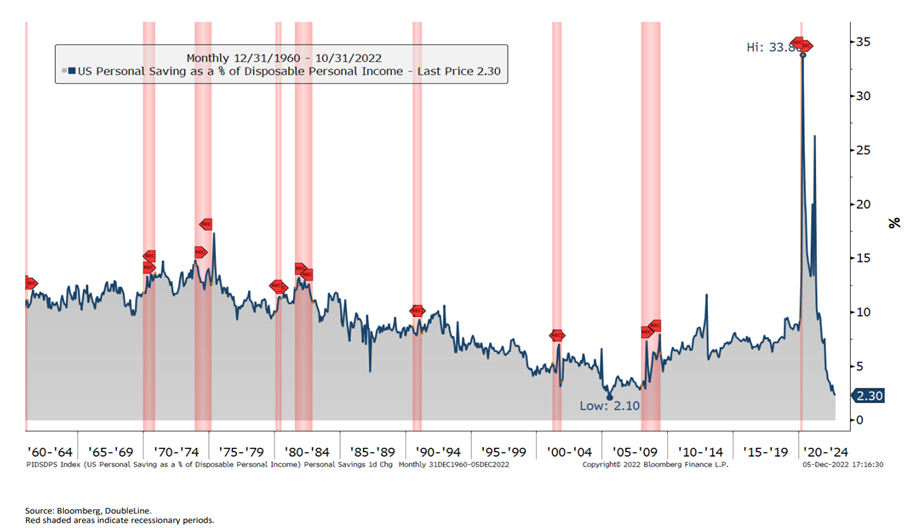

As just one example, Bank of America customer data show that while credit-card usage has picked up quite a bit this year, borrowers are still utilizing a significantly smaller percentage of their credit limits than they were before the Covid economic crisis and while the savings rate is slowing it has not been used up yet, but we are getting close.

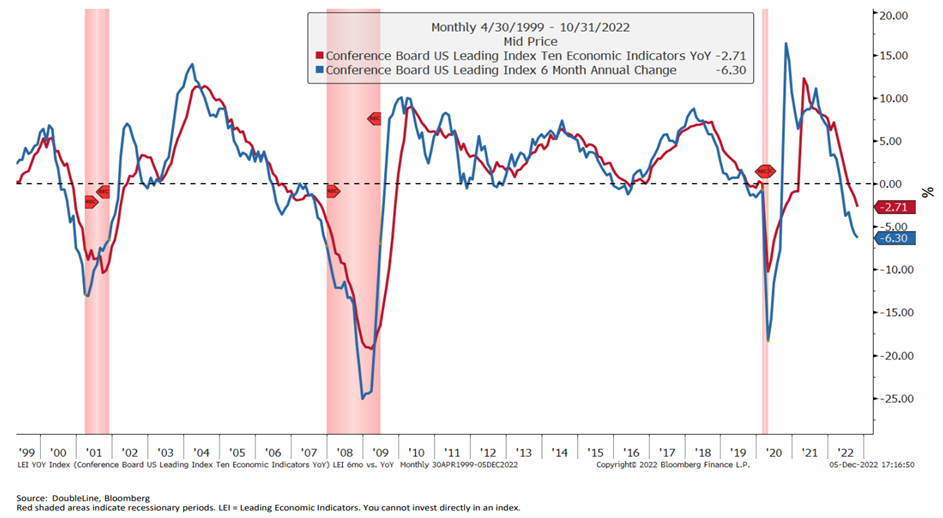

This matches up with a variety of other metrics, from continuing jobless claims (a new cycle high last week but lower than almost any time between 1973 and 2020) to the broad ratio of household equity that has softened after a huge run, to slowing leading indicators, which are still hanging in there in some areas. Things are tougher than they were at their easiest last year, but not all that hard in aggregate compared to normal times.

So, what is priced in is the real question? That is what the markets are struggling with, as the S&P 500 first rose to its current level of about 4000: March 2021, some 21 months ago. While much of the excess value has been wrung out of the equity markets, to the extent it’s still in the market, it resides in the very largest stocks atop the Nasdaq and S&P. The Nasdaq still has a P/E that is about 25% over the overall market and growth stocks are very challenged in a rising rate market like this. With that said, I think growth stocks will be one of the first to rise, as every rally we have seen this year has shown the Nasdaq leading the charge, as many of these stocks have been beaten down in a big way.

There’s a way to write the story of 2022 on Wall Street as one long reset and payback year: several years’ worth of deferred interest-rate normalization imposed over 10 months, valuation excesses in speculative tech, IPOs, SPACs and crypto purged, supply chains healing, pulled-forward demand for hard goods reverting to the mean.

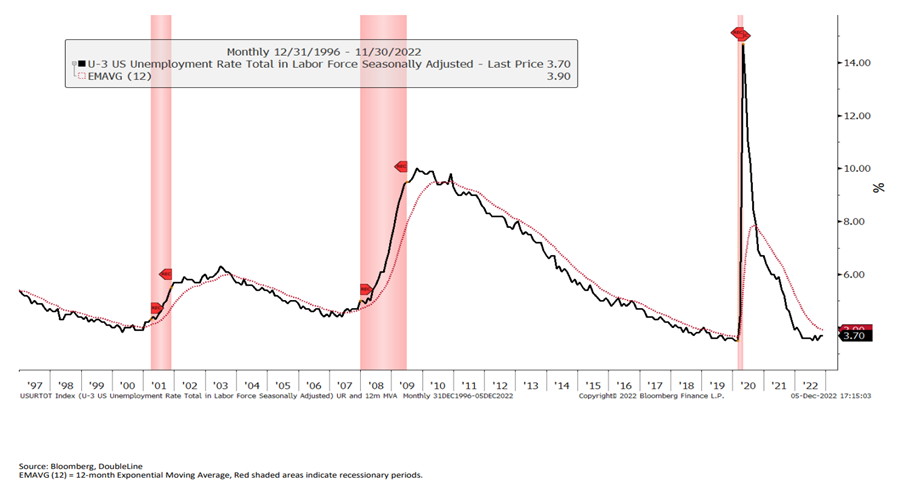

Yet, I cannot use the narrative above to deploy this argument as a reason to herald brighter times in the first half of 2023, at least in the stock market (like I said, there are all kinds of fixed income opportunities). A pretty tight consensus has developed among strategists that the S&P 500 will see little to no upside, with a nasty first few months in 2023 before a recovery once a recession is underway, the Fed turns friendly, and earnings get normalized, or all three. I agree with this narrative for the most part, even though I don’t like being with consensus, but the data is just too strong to go against the grain, though I don’t agree with many who think this will be a long recession. Employment is just too strong in my opinion, for things to remain contracted for very long.

Just because this recession view is popular doesn’t mean it’s not plausible. In fact, it’s popular because it’s plausible. But if nothing else it suggests that for all the challenges facing this so-far resilient market, a dangerous complacency doesn’t seem to be among them as the negative sentiment is even worse than the covid period and is as negative as we were coming out of 2008/09.

With all that said, I do not think a “hard landing” is in the cards. I often get asked, “what is a soft landing or a softer recession?” Most economists define a recession as two consecutive quarters of contracting GDP across multiple segments. So, while I believe that is likely to happen, I just don’t believe it will be severe or long-lasting, as we have never had a recession with employment so healthy and the job market looking this strong (even though it has softened somewhat). With that being the backdrop, I fell like we will bounce back from this slowdown by late 2023.

So, there is my narrative. While I do feel like we will likely have a mild recession in 2023, markets look ahead and I feel the second half of the year will be much better for stocks. As I previously stated, I also feel like there will be good money to be made in fixed income (especially duration around 2-5 years in low end investment grade or high-end non-investment grade). I also thing the covered call strategy, dividends, and active management will be the way to play these markets, especially in 1H23. In fact, I think diversification will again be very beneficial and important after years of getting virtually no yield from fixed income.

Life Planning tip on the importance of making adjustments when relying on investments income

As I have brought up recently, Sequencing can affect the power of compounding significantly and can be critical when living off of retirement capital. It is very important for people to make adjustments during times like these where inflation is high and markets are challenged. Let me give you an example of how this can make a huge difference down the road if adjustments are not made:

Example 1: Life Planning for someone who normally uses 5% of retirement capital to cover expenses.

This person uses 7% yearly of initial starting capital every year during higher inflation years. Also loses 10% in year 1 on investments during downturn, breaks even on investments in year 2, and makes 12% coming out of recession in year 3. Here is how their retirement investments do: 100%-17% in year 1= 83%; 83%-8.5% in year 2=74.5%; 74.5%-+1.9% in year 3= 76.4% of original 100%.

Example 2 Life Planning for someone who normally uses 5% of retirement capital to cover expenses.

This person makes adjustments and uses 4% during challenging time instead of 5% of initial starting capital every year. Also loses 10% in year 1 on investments during downturn, breaks even on investments in year 2, and makes 12% coming out of recession in year 3. Here is how their retirement investments do: 100%-14% in year 1= 86%; 86%-4.6% in year 2=81.6%; 81.6%+7.1% in year 3= 88.8%.

As you can see, while there is just a 3% difference in retirement needs per year, the difference is over 12% coming out the other side in the above illustration. And the person in example 1 will have a much smaller base to work from as the markets rebound coming out of the slowdown. Sequencing analysis, is very good at showing how Life Plan deferments of gratification during challenging times, really pays off. Strong markets are the time to take care of “wants”, but during challenging markets one, focuses only on “needs”. Even if the second investor now receives all the “wants” that he deferred, he would be in much better shape than the first investor who deferred nothing in challenging times.

Bottom Line

So, while I believe this will be a tough first half of the year for the stock market, I do feel there will be other opportunities to make good money through fixed income, covered call strategies, dividend strategies, and active management. But too many dominoes have fallen for our economy to escape at least slower growth in my opinion. And with S&P still at a P/E of 18 based on todays $225 S&P projection, adjustments will still have to be made for the stock market.

So, this year will be a year where risk does not = reward in my opinion and many conservative/steady investments will be the way to go, at least for the first half of the year. There will be ways to make money that we haven’t seen in over a decade, but fixed income will lead the way.

I will be working with many of you on year-end tax planning, as this year is a good year to harvest losses against gains if possible. Hoping each of you has a very, Merry Christmas.

Warmest Regards,

Hunter Hardy

Sorry, comments are closed for this post.