Dear Clients,

I hope all of you celebrated a joyous Christmas and New Year’s day. What great weather many of us got this Christmas. While you will see in my writing today where I think the overall stock market has gotten a little ahead of itself and has too many positives priced in, I do think there are many new types of investments I will continue to add too and focus on I will discuss later in this newsletter.

But as far as 2024 goes, it was another excellent year for many of us. With that said, the Santa Claus rally (last 5 days of the year and first 2 days of the New Year) hasn’t worked this year, at least with 2 days left to go in this seasonal period. But after seeing a year in which the S&P is up about 23% and the DIA is up about 12.9%, positioning as we go into next year should be somewhat expected. I think this is even more true after the 2023 we just followed in 2024. But let’s talk about how this sets us up for 2025.

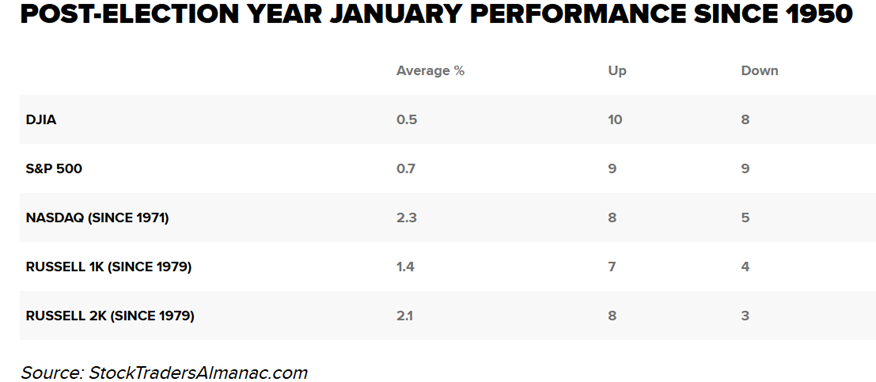

Doubts are surfacing on how long this rally can last, however. The recent weakness has raised alarm bells among some analysts, with a few predicting a correction in 2025 given the market’s run-up this year. January’s performance becomes even more important if the market fails to uphold the Santa Claus rally this year. According to the Almanac, the first five days of January serve as an “early warning system.” This indicator has shown that in the last 18 post-election years, 14 of those full trading years ended up following the direction of the first five days. And the Almanac’s well-known “January Barometer” — which indicates that the S&P 500′s performance in the first full month of the year can predict its results for the remainder of the year — has the same record in post-election years. So, if the S&P 500 rises between Jan. 1 and Jan. 31, stocks should see positive returns for the rest of the year, and vice versa. This full-month barometer has only had 12 major errors since 1950, making for an 83.3% accuracy rate.

While history can certainly be wrong, at these valuations with this much optimism baked in, I will be watching this trend very closely, as there is a lot of positives baked in the overall stock markets right now. I don’t even know what the event might spark a selloff, but at these levels it could be any low probability, high impact event, that few expect. Some possibilities might be higher rates for longer, a geopolitical event (there are certainly many possibilities), repercussions from a tariff war, uncertain fiscal policy or a slowing economy.

With that said, I do believe there are many stock sectors and areas that make a lot of sense with much less risk than the overall markets, which I will get into toward the end of this newsletter.

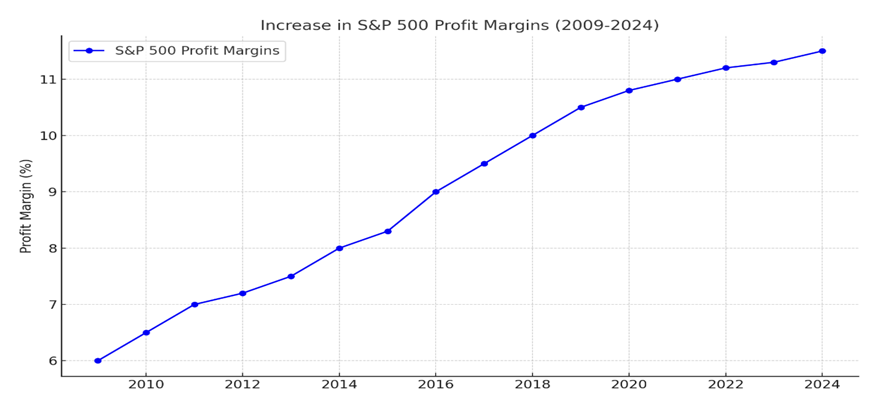

Before I do so, I have argued this year that it might be unfair to compare to the historical average because the indexes are more efficient than ever. Wells Fargo has pointed out that profit margins of S&P 500 companies have nearly doubled over the past 15 years, while net debt to earnings have halved during the same timeframe. That is an incredible amount of efficiency and has been driven a lot by big tech and big financials as we came out of the Great Recession of 2008/09 and moved into some incredible secular trends that have created significant growth opportunities.

Source: Wells Fargo

With that said, 55% of the S&P returns this year have been from the magnificent 7, according to Sam Stovall. Believe it or not, Apple is now almost as big as the rest of the small and mid-caps in the S&P, according to CNBC. The S&P 500 has climbed around 23% YTD. Magnificent 7 stocks were the key to the S&P ROI and we almost had a replay of 2023. If you weren’t in the Mag 7 or 8, you missed out on some excellent returns. While there were points at which smaller stocks broke out, it never lasted very long, as the other 493 stocks had gains on average of about 10%, well underperforming the S&P’s overall returns of 23% and the DIA’s returns of about 12.9%.

The Mag 7 stocks are generating significant growth in terms of revenue and earnings power. These companies are massive monopoly businesses with strong fundamental tail winds. I have no reason to believe that the Mag 7 names won’t continue to lead the S&P (along with financials and industrials) in 2025. Where tech and financials go in the 2025, the rest of the equity markets will follow, in my opinion.

Only 20% of the stocks performed as well as the S&P in 2024, so 80% of stocks actually performed below the S&P, which shows the weakness in many areas outside of the big tech, big financials, and industrials.

Another interesting data point, is 95% of the returns from the S&P 500, have come from the Magnificent 7 since the election. There is no doubt this is where the growth is coming from and what people fall back on, when not sure where to invest their money. These growth goliaths have become defensive plays for some. Value has not outperformed growth since 2016 (READ THAT STAT AGAIN), so I am still a skeptic until I see something different happen. I have been hearing repeatedly over the past few years that many analysts are leading with small cap and international, and I just don’t buy into that narrative yet… Why would you try to guess when they are going to finally revert to the mean, when the trend has been against it for years and the growth remains much better in the U.S. and in certain blue chip sectors? With deregulations coming, IPOs coming, interest rates remaining higher for longer, and trends such as AI, Security, and power in the early innings in my opinion, there are certain investments in these areas that still make a lot of sense.

With that said, Growth at a Reasonable Value (GARP), is where I think most of the returns will continue to come. Just look at the financial sector this year… Too much time is spent on categorizing stocks, as financials had a great year, and many categorize this sector as value, but financials had excellent growth because of the environment this year, so understanding the value versus the growth of each investment, along with the momentum is very important.

The Magnificent 7 grew 25% in 4Q24 (and well over 30% for the year) and is expected to slow to 18% in 4Q25, but continue to grow at 20%+ for 2025. The other 493 grew 4% in 4Q24 and are expected to increase growth to 14-15% in 4Q25, according to CNBC. While 20% growth is nothing to sneeze at, the slowing growth is the reason there have been multiple attempts to move the positive movement to other areas outside of the Magnificent 7. I just think this may be premature for the most part.

Yields, will also be very important in 2025, especially when you compare the growth in U.S.A. to other countries across the world. It will also be very important for our debt and small caps, as the 10-year, has again risen to 4.6%+, though the curve is no longer inverted, as the 2/10 spread is the widest it has been in 2 ½ years, at around 30 basis points.

Bond vigilantes, a Trump congressional mistake like a Tariff war, geopolitics, and lofty valuations, are the big threats to next year.

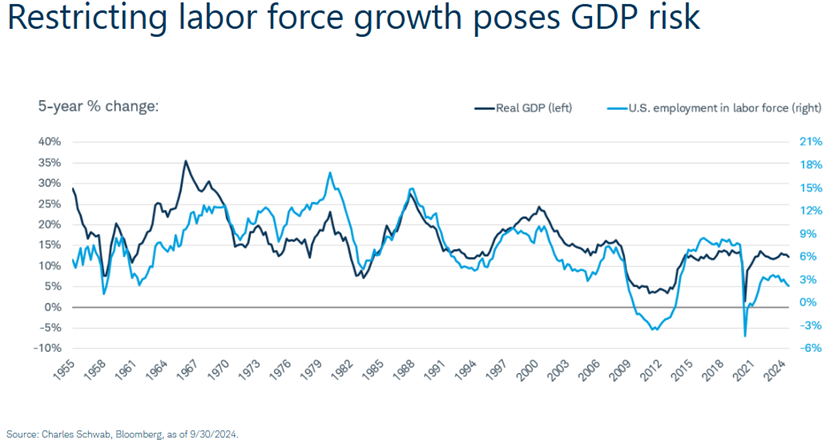

Growth expectations of a GDP of 3% or better, double digit earnings expectations in 2025 (in ’24 the growth expectations were 11% at start of the year and we are ending the year up over 10%), and growth trends in AI/Power/Security, and reduced regulations, are tailwinds for the markets. With that said, I think the first quarter of this year could be very challenging as the markets are looking for clarity in many areas with the changes in congress. First, immigration and labor laws could have a significant effect on growth in 2025.

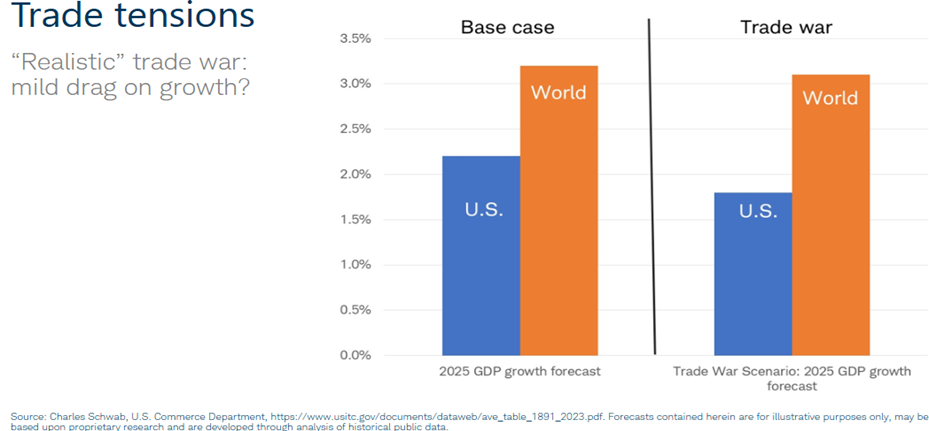

And a Trade War could also have an effect, though I think the effect would likely be muted somewhat as none of the world’s economies are expected to have a recession in 2025. Over 75% of the world’s economies are expected to have increased GDP growth in 2025. But a trade war would obviously have some effect as Schwab depicted in their analysis below:

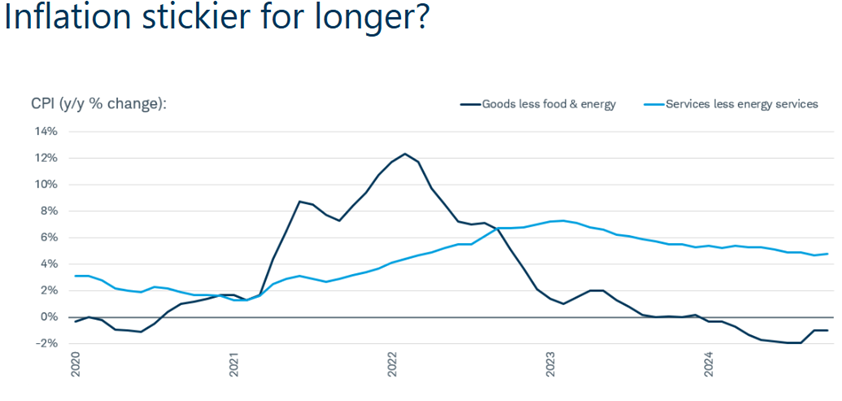

Many of the programs likely being put in place by the Trump could make the Fed’s job of getting inflation down to 2%, much more challenging in the next few quarters. Though the Fed has made good progress, tariffs, tighter borders, deregulations, and lower taxes, could each make inflation more stubborn.

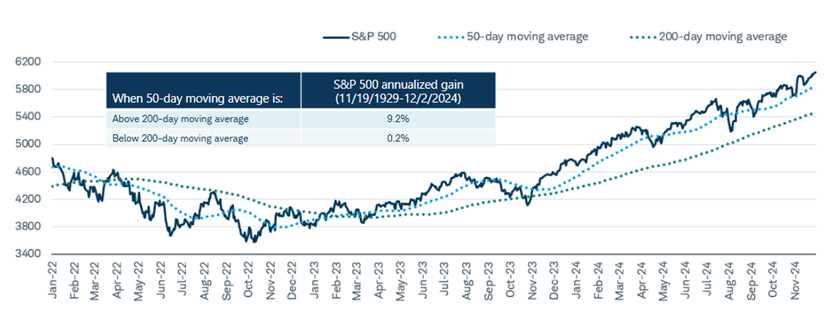

I will also be watching technicals very closely as we enter the new year, as these have proven to be very valuable the past couple of years. After the mini-selloff toward the end of the year, the gap between the 50-200 day averages have narrowed significantly. As long as 50 Day is above the 200 Day, typically get a nice return, even at these valuations, though January will be a good test.

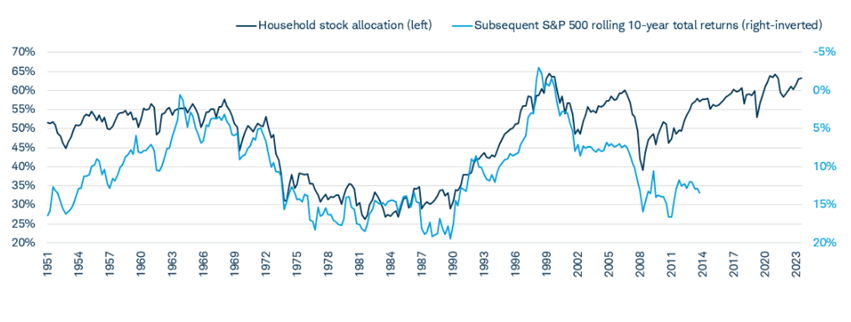

Additionally, before I move from the overall stock markets, I would mention that sentiment has gotten too bullish for me at these levels, especially at the retail level. This is depicted by the chart below, which shows very muted returns after similar stock ownership in the late 90s and in 2007. I have also just sensed too much complacency in these markets.

There is a lot of uncertainty, as even though the Republican congress is very intact now, the margins are slim and this will make critical legislation very challenging to get through congress. I have outlined some of the key issues below:

Deregulation will be interesting to watch, as this could give markets a real boost, though will take time to implement.

As we move into the new Year:

As I wrote above, I will follow January very closely this year, as I think it could be a good indicator for many months to come. Additionally, I will likely run risk lower than most risk tolerances as we move into the year and I am now able to take some gains without effecting client’s 2024 taxes. The markets never had a true correction in 2024, which is unique, though we got close to a full correction of 10% with the 8.5% August drawdown. I do think there is a decent chance of a correction for the overall markets in the first half of the year, until Congress has some clarity on many of the key issues. As I wrote above, there are many new types of investments that I like a lot, that “keep one in the game, while reducing risk.” These include “Buffer ETFs, Enhanced Income Funds, individual mid-duration bonds with 2-6 year maturities, stocks with covered calls, and several income plays that take advantage of higher rates. Additionally, I continue to really like sectors such as technology, financials, and industrials, because of the secular trends I see in the early innings. These trends include generative AI (though I think companies are going to have to depict how this is paying off in 2025), Security (becoming a place that companies have to spend more), and power (the huge consumption of energy needed by data centers across America). I also think certain healthcare areas and defense will be critical areas to put capital to work.

So, I do think there will be places to make money, but I think fundamental analysis against each investment will be more important than ever. Especially with markets at current levels. This will be a year to watch risk/reward very closely and to continue to build on the capital that has been built over the past few years.

I hope each of you had a wonderful New Years and I look forward to a prosperous 2025. Have a great start to your year!

Warmest Regards,

Hunter Hardy

Hunter Hardy CFP®

InvestmentHunter Wealth Services